According to information from ACB Bank's leaders, in the first quarter of 2025, the bank achieved a profit of VND 23,000 billion, equal to 20% of the yearly plan. Credit is estimated to increase by more than 3%, capital mobilization increased by more than 2%. The bank's bad debt ratio decreased by 1.34%, helping to increase operational efficiency. With a positive first quarter, ACB has the basis to complete the set goals.

In the first quarter, Nam A Bank also had positive business results, with pre-tax profit reaching VND1,214 billion, up 21.52% over the same period last year. As of March 31, the bank's total assets reached nearly VND263,000 billion, up more than 7% compared to the beginning of 2025.

Outstanding credit reached nearly VND 178,000 billion, up 6% compared to the beginning of the year. Capital mobilization reached nearly VND 204,000 billion, up nearly 14% compared to the beginning of 2024. In terms of asset quality, the bad debt ratio (group 3-5) was at 2.23%; the bad debt coverage ratio was nearly 54%.

Nam A Bank's 2025 profit target was approved by the shareholders' meeting at the recent annual meeting at VND5,000 billion before tax, an increase of 10% compared to the previous year. However, the Board of Directors' target is about VND5,500 billion.

VIB Bank has also just announced that its pre-tax profit in the first quarter of 2025 is estimated to reach about 20 - 22% of the total profit target of more than VND 11,000 billion for the whole year of 2025. This bank expects that the profit will be higher in the coming quarters, especially the last quarter of the year, which can be 30 - 40% higher than the first quarter of the year. Therefore, VIB has the basis to complete the profit target set for the year.

TPBank also reported pre-tax profit of nearly VND1,430 billion in the first two months of the year and is expected to earn VND2,100 billion in the first quarter of 2025, up nearly 15% over the same period last year. Accordingly, the Bank's total operating income reached more than VND2,800 billion in the two months and is estimated to reach VND4,300 billion by the end of the first quarter of 2025.

Analysts at MB Securities Joint Stock Company (MBS) forecast that in 2025, TPBank's net interest margin will increase to 3.54%; pre-tax profit will reach VND9,116 billion, up 20% compared to the level achieved in 2024.

At NCB Bank, in the first quarter of 2025, pre-tax profit is estimated to reach more than VND 125 billion; mobilized capital, including customer deposits and issuance of valuable papers, is more than VND 107,000 billion, up 6.8% compared to the end of 2024; customer loans are more than VND 78,000 billion, up 9.6% compared to the end of 2024; net interest income is nearly VND 510 billion, the highest in the last 9 quarters. Other business activities such as services, foreign exchange and gold trading, buying and selling investment securities... are all profitable.

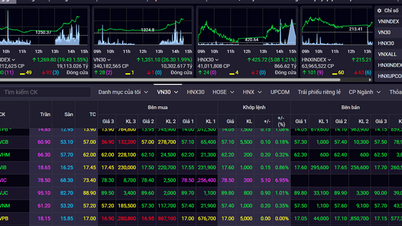

According to the results of the State Bank's business trend survey recently announced, the majority of surveyed credit institutions (74 - 76%) expect the overall business situation and pre-tax profit in the first quarter of 2025 to improve compared to the fourth quarter of 2024, and are expected to continue the improvement trend in the second quarter of 2025.

Bank profits increased in the first quarter of this year largely due to improved credit. According to the State Bank of Vietnam, as of March 25, credit in the entire economy increased by 2.5% compared to the beginning of the year. Experts forecast that credit this year could grow by 15-17%.

A report by Vietcombank Securities Joint Stock Company (VCBS) shows that all banks on the watch list (mainly listed banks) are forecast to have pre-tax profits growing in the first quarter of 2025. Notably, Sacombank and Techcombank are expected to increase their profits by 25%, expected to reach VND3,326 billion and VND9,752 billion, respectively, in the first quarter.

Some other banks are expected to have strong profit growth such as MB up 22%, VietinBank up 20%, MSB up 17%, BIDV up 16%, HDBank and VIB up 15%. The profit growth of VPBank, ACB and TPBank is forecasted to be 10%, 8% and 5% respectively.

Source: https://hanoimoi.vn/tin-dung-cai-thien-loi-nhuan-ngan-hang-tang-trong-quy-i-699172.html

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary To Lam receives leaders of typical Azerbaijani businesses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/998af6f177a044b4be0bfbc4858c7fd9)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)