Gold soars again

After several sessions of decline, the price of SJC gold bars has been unruly as before, reaching a peak of 80 million VND/tael on December 26, 2023. Specifically, the price of SJC gold bars increased by 1 million VND/tael at the end of last week, bringing the increase in the past week to 2.5 million VND/tael. Saigon Jewelry Company - SJC bought at 74 million VND, sold at 77 million VND. Doji Group bought at 73.95 million VND, sold at 76.95 million VND. Bao Tin Minh Chau Company bought at 74 million VND, sold at 76.9 million VND... The difference between the buying and selling prices of gold bars increased to 3 million VND/tael instead of 2.5 million VND/tael before.

Interest rates on Vietnamese Dong have fallen sharply.

The price of 4-number 9 gold rings also increased to a near record high, with SJC Company buying at 62.4 million VND and selling at 63.8 million VND; Bao Tin Minh Chau Company buying at 63.42 million VND and selling at 64.52 million VND; Doji Group buying at 62.9 million VND and selling at 64.05 million VND... Gold rings have increased in price from 700,000 VND to 1 million VND per tael in the past week.

Domestic gold prices have increased at a fairly rapid rate compared to world prices. The precious metal on the international market increased by only 5 USD/ounce last week, to 2,049 USD/ounce. This is also the reason why the price of SJC gold bars is 16.1 million VND/tael higher than the world price instead of 14 million VND/tael previously; gold rings alone have a higher price of 2.9 - 3.6 million VND/tael instead of 2.75 million VND/tael.

Thus, in just the past week, the "gap" between domestic and foreign gold prices has continued to widen. Remember, after the statement of the Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu that "the price of SJC gold bars being 20 million VND/tael higher than the world price is unacceptable" at the beginning of the month, the domestic gold price immediately dropped sharply. The gap between domestic and world prices narrowed to 18 - 19 million VND/tael and then around 13 million VND/tael. It was thought that the gold market would gradually decrease, but SJC gold bars continued to increase in "expensiveness" compared to the world price.

It is worth noting that the world's precious metals are expected to increase. According to the latest survey by Kitco News , half of retail investors predict that gold prices will increase next week, while more than two-thirds of market analysts are optimistic about the short-term prospects of gold, supported by the sudden escalation of conflict in the Middle East, which will be a catalyst. This information has caused domestic gold trading companies to push up prices, because of concerns that buying pressure in the market will appear when supply has not improved.

Expert Nguyen Tri Hieu said that the gap between domestic and foreign gold prices has increased as the State Bank has not intervened in the market. Measures must be taken to supply gold to the market to resolve the problem of the price difference between SJC gold bars and the world price.

"The recent surge in gold prices has not affected monetary policy, exchange rates or interest rates. The State Bank should withdraw its monopoly on gold bar production and gold import. Allowing units to participate in importing and supplying gold to the market will solve the problem of reducing this high price. Domestic gold prices being higher than the world price and "a single market" will lead to speculation, causing people to buy gold with the expectation that the price will only go up and not down when the market has no supply," Mr. Hieu suggested.

According to Associate Professor, Dr. Dinh Trong Thinh (Academy of Finance), the State Bank of Vietnam has only announced market intervention but has not yet had a specific solution, which is the reason why domestic gold prices are decreasing and increasing again. From being more expensive than the world by 13-14 million VND/tael to 17 million VND/tael.

"The fundamental problem of the gold market has not been solved, which is the lack of supply. The State Bank of Vietnam is the exclusive producer of SJC gold bars, but for more than 10 years, no new gold has been released to the market. The supply of gold on the market is decreasing, while demand is increasing, leading to an increase in prices. In addition, information that the US and UK have conducted military operations in Yemen targeting the Houthi forces because of attacks on ships in the Red Sea has raised expectations that international gold prices will increase, causing domestic precious metals to also increase," Mr. Thinh explained.

Impatient depositors

The trend of decreasing savings interest rates continues in the first days of January with more than 10 banks cutting deposit interest rates. The lowest deposit interest rate on the market today belongs to Vietcombank with 1.7%/year for a term of 1-2 months, the highest interest rate of this bank is only 4.7%/year. Next is SCB with the lowest deposit interest rate of 1.9%/year, the highest is 4.8%/year. ABBANK has the lowest interest rate of 2.95%/year for a term of 1 month; 6 months is 4.8%/year but from September onwards it is only 4.2%/year. Some banks have a deposit interest rate of 6%/year for a term of 18 months or more. Compared to 1 year ago, the deposit interest rates of banks have decreased by more than half.

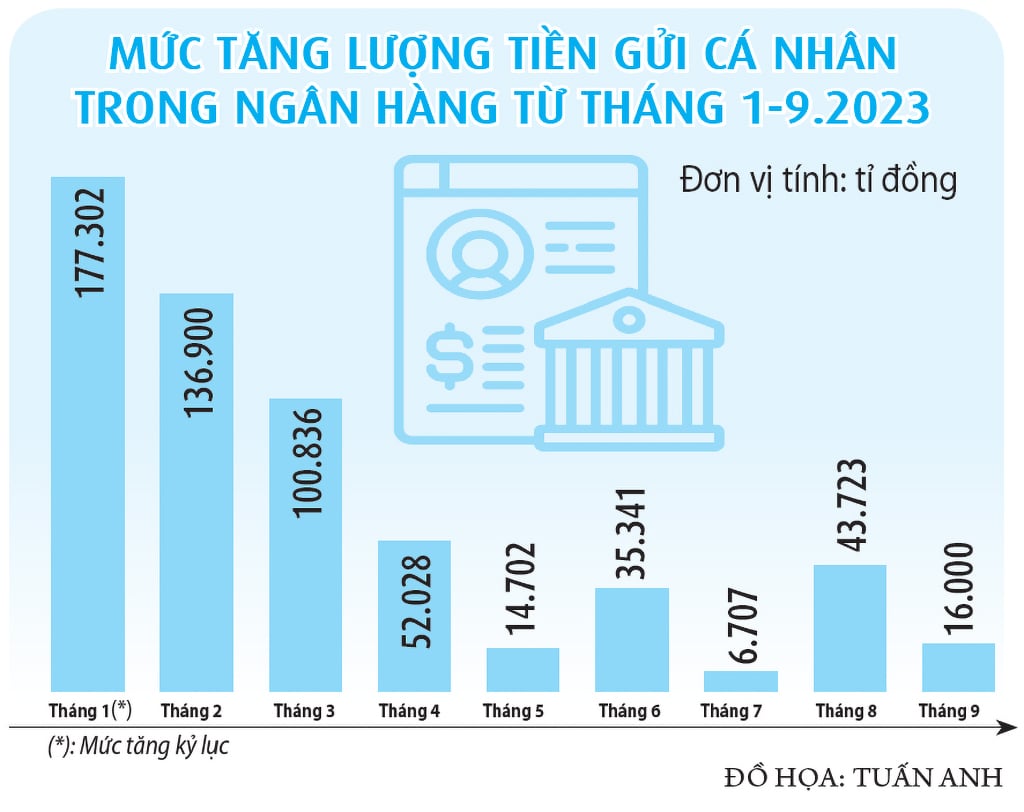

Interest rates have dropped quite sharply, and the amount of personal deposits in banks is increasing more slowly. According to the latest announcement from the State Bank, the amount of personal deposits in October 2023 increased by only 422 billion VND, to 6,449,673 billion VND. This is the month with the lowest increase ever.

Meanwhile, deposits from organizations are in the opposite direction, from a sharp decline in the first months of 2023, to a high increase in the last months of 2023 and tend to exceed personal deposits. By the end of October, economic organizations continued to increase deposits by VND 23,554 billion compared to the previous month, to VND 6,254,115 billion.

Associate Professor, Dr. Dinh Trong Thinh said: "Savings interest rates have decreased due to excess liquidity in banks, especially short-term ones. However, with the lowest interest rates in the past few decades, I do not believe people will switch to buying gold because the risk is currently very high."

According to Mr. Nguyen Tri Hieu, low interest rates often lead to speculation in other channels, including gold. However, in the long term, Vietnam's current interest rates are still positive while gold buyers are cautious at this time because prices fluctuate continuously, so it is full of risks. The current interest rate trend is low and may continue to decrease in the next 1-2 months when banks find it difficult to lend. However, this situation will soon end when credit activities increase again from mid-year onwards when the economy recovers and businesses borrow more money. Interest rates will increase from mid-2024 onwards when the US reduces interest rates.

A survey of many people who deposit money in banks shows that interest rates are too low, but they are no longer actively looking for higher-yielding investment channels. "Seeing my savings dwindle day by day makes me sad, but I still don't see a way out of investing, so I'm still struggling," said Ms. NH, a bank depositor.

This is probably also the mood of many people in the context of economic difficulties, investment channels all have potential risks although there are many opportunities.

Buying gold only makes business people rich

Buying gold at this time only enriches the gold business community, while the people suffer losses. Because the difference between the buying and selling price of gold is up to 3 million VND/tael, buying will immediately result in a loss. Not to mention, the price of SJC gold bars is 17 million VND/tael higher than the world price. In case the State Bank has information or implements market intervention measures, the domestic gold price will plummet, falling deeply like about 10 days ago.

Mr. Dinh Trong Thinh , Academy of Finance

Source link

![[Photo] General Secretary To Lam receives leaders of typical Azerbaijani businesses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/998af6f177a044b4be0bfbc4858c7fd9)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)