Most recently, voters in Dong Nai and An Giang provinces proposed changing the compulsory purchase of insurance for motorbike and scooter owners to a voluntary form.

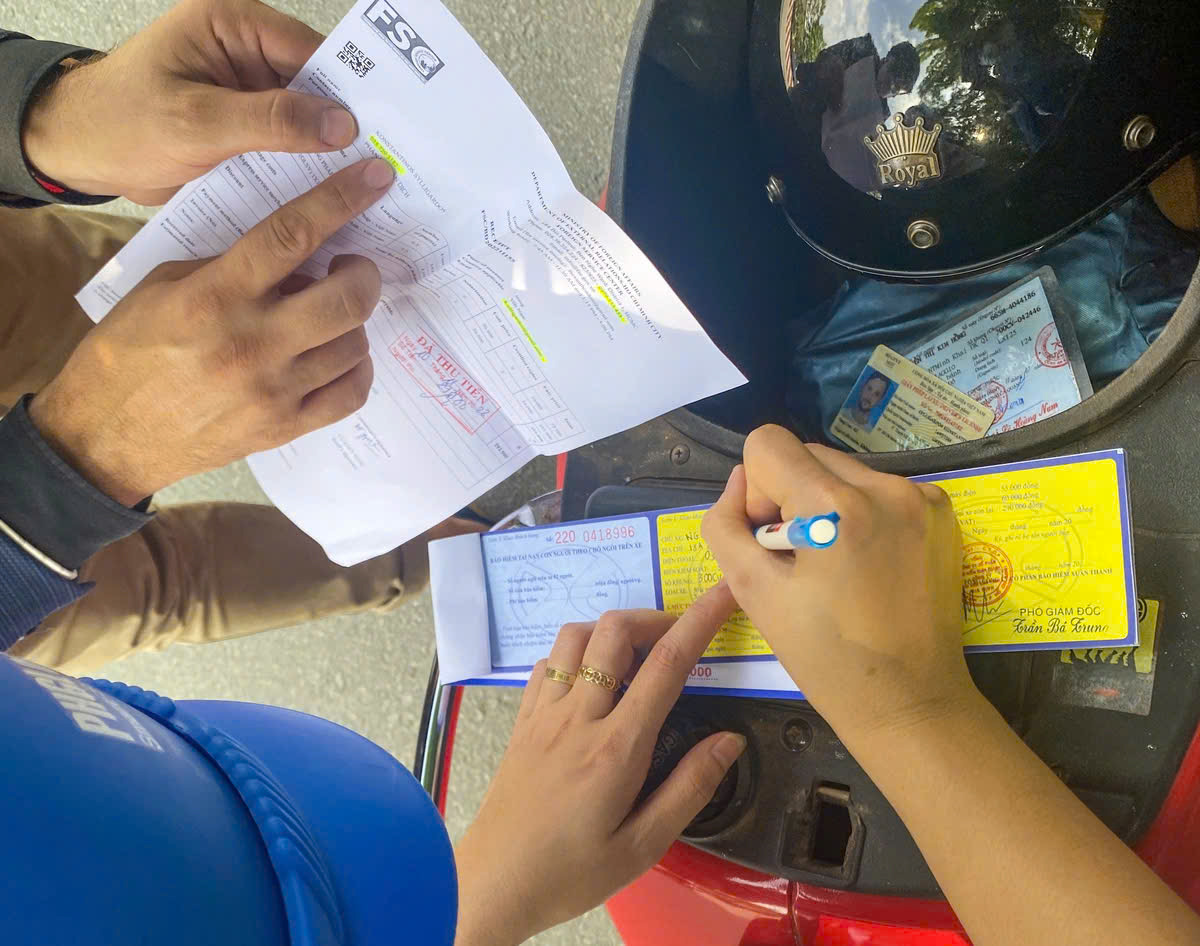

Voters in Dong Nai and An Giang provinces petition not to force motorbike owners to buy insurance - Photo: QUANG DINH

According to the Ministry of Finance , the total number of motorbikes in Vietnam is currently about 72 million, but only about 6.5 million have insurance.

It is recommended that motorcycle insurance is voluntary, not compulsory to buy.

The Ministry of Finance said it has just received a petition from voters in Dong Nai province sent by the Government Office and a petition from voters in An Giang province sent by the People's Aspirations Committee of the National Assembly Standing Committee.

In the document, voters of these two provinces proposed to study changing the compulsory form of insurance for motorbike and scooter owners to a voluntary form, not forcing people to buy this insurance.

In reality, although regulations require motorbike and scooter owners to purchase civil liability insurance, when an accident occurs and insurance payment is requested, the insurance company harasses and causes difficulties.

Furthermore, cumbersome procedures make it difficult for insurance buyers to request insurance payments.

At the same time, voters also recommended reviewing regulations on traffic police fining traffic participants who do not purchase motorcycle insurance.

Previously, voters in Ho Chi Minh City, Quang Tri, Lang Son... also proposed to remove the regulation requiring people to buy insurance for motorbikes and switch to a voluntary form.

Because many people buy this insurance product just to deal with traffic police, instead of caring about their rights.

Ministry of Finance: Compulsory purchase of insurance for motorbikes

Responding to the above proposal, the Ministry of Finance said that in the world today, most countries apply compulsory civil liability insurance for car, motorbike, and scooter owners, and some countries even apply it to electric bicycles.

Even developed countries with low number of motorbikes and scooters such as the US, EU, Japan, Korea or developing countries with large number of motorbikes and scooters participating in traffic such as India, China, ASEAN countries... also have mandatory regulations for civil liability insurance for motor vehicle owners.

In Vietnam, according to the Ministry of Finance, compulsory civil liability insurance for motor vehicle owners (including cars and motorbikes) has been implemented since 1988.

Currently, compulsory civil liability insurance for motor vehicle owners, including motorbike owners, is regulated in the Law on Insurance Business 2022; Law on Road Traffic 2008, Law on Road Traffic Order and Safety 2024...

Many new regulations increase benefits for motor vehicle owners regarding insurance premiums, insurance amounts, simplifying documents and compensation procedures...

Specifically, the insurance premium for motorcycles is 55,000 or 60,000 VND per year. In the unfortunate event of an accident resulting in injury or death to a third party, the insurance company will pay the third party a maximum of 150 million VND per person per accident. For property damage, the insurance company will pay a maximum of 50 million VND per accident.

Currently, motorbikes are still the main means of motor transport and the biggest source of accidents in Vietnam, accounting for 63.48% of causes of accidents.

However, the Ministry of Finance also reported that, according to statistics, the number of motorcycles participating in mandatory civil liability insurance for motor vehicle owners in the first six months of 2024 was only about 6.5 million. Meanwhile, the total number of motorcycles in Vietnam reached approximately 72 million. Thus, the percentage of motorcycles participating in this type of insurance accounts for only about 9% of the total number of vehicles in circulation.

In the coming period, in order to improve the effectiveness of implementing this type of insurance, along with coordinating with relevant parties to promote awareness, the Ministry of Finance said it will strengthen inspection and supervision, and strictly handle cases of violations of regulations on mandatory civil liability for owners of motor vehicles (if any).

At the same time, the Ministry of Finance will coordinate with relevant agencies to continue researching and simplifying insurance compensation procedures and records, and humanitarian aid payments, ensuring that insurance compensation takes place quickly and in accordance with regulations.

Source: https://tuoitre.vn/tiep-tuc-kien-nghi-khong-buoc-chu-xe-may-mua-bao-hiem-20250108154318423.htm

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)