Three-month copper on the London Metal Exchange (LME) CMCU3 fell 0.2% to $9,791 a tonne, while the most-traded copper contract for August on the Shanghai Futures Exchange (SHFE) SCFcv1 fell 0.4% to 79,300 yuan ($10,914.90).

Copper inventories in LME-approved warehouses, Comex warehouses, bonded warehouses in China as well as warehouses designated by the Shanghai International Energy Exchange all rose in July, indicating weak demand.

Meanwhile, China's economy grew much slower than expected in the second quarter, painting a picture of weak demand as China accounts for about half of annual copper demand.

Still, the data maintained expectations that Beijing will need to roll out more stimulus.

Speculative interest in copper has also improved, with fund managers holding a net long position of 43,403 contracts in CME copper contracts as of July 8, the first increase since May 20 when copper hit a record high.

Meanwhile, copper demand in China has stabilized in recent weeks, as shown by the metal’s import differential of $3 per tonne, compared with a low of $15 in May.

LME aluminium CMAL3 fell 0.3% to $2,454.50 a tonne, zinc CMZN3 fell 0.3% to $2,946.50, tin CMSN3 fell 0.3% to $33,150, while nickel CMNI3 rose 0.4% to $16,770 and lead CMPB3 rose 0.1% to $2,190.

SHFE aluminium SAFcv1 fell 1.1% to 19,820 yuan/tonne, nickel SNIcv1 fell 0.8% to 133,450 yuan, tin SSNcv1 fell 0.5% to 273,190 yuan, while zinc SZNcv1 rose 0.3% to 24,320 yuan and lead SPBcv1 was up 0.8% at 19,750 yuan.

Source: https://kinhtedothi.vn/gia-kim-loai-dong-ngay-17-7-tiep-tuc-giam-do-nhu-cau-yeu.html

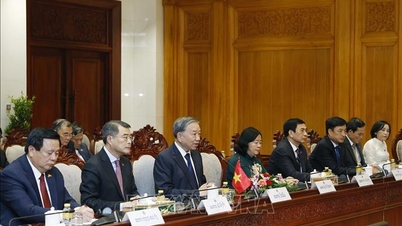

![[Photo] Prime Minister Pham Minh Chinh receives President of Cuba's Latin American News Agency](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F01%2F1764569497815_dsc-2890-jpg.webp&w=3840&q=75)

Comment (0)