With a breakthrough mindset, Resolution 57-NQ/TW dated December 22, 2024 of the Politburo has set out the requirement to strongly promote science, technology, innovation and digital transformation activities. Especially in the agricultural sector, Resolution 57 also emphasizes the need to promote smart production in agriculture - this is considered a key factor for sustainable growth of the agricultural sector.

As a unit directly providing loans for the agricultural sector applying high technology and clean technology, the entire Agribank system in general and Agribank Ha Tinh branch in particular always identify agricultural and rural lending as the focus, in which high technology agriculture and clean agriculture are the priority areas and offer many incentives to loan customers.

Realize your dream

The story of the Director of Nga Hai Cooperative (Nghi Xuan, Ha Tinh ) Le Van Binh took us back to 1993, when the cooperative had not yet been formed but was just a model of livestock and fruit tree farming.

When visiting the modern, high-tech farm model today, few people can imagine that in the beginning this place was just a wild swamp, without even roads or electricity. Except for the parents of both families, anyone who heard of farmer Le Van Binh's intention to establish a farm on this barren land shook their heads, or even discouraged him.

However, Mr. Binh was still determined to set up the project, and became the first farmer household and also famous in Ha Tinh province at that time for being able to borrow a loan of up to 100 million VND from Agribank Nghi Xuan district branch.

Director of Nga Hai Cooperative (Nghi Xuan, Ha Tinh) Le Van Binh. |

“At that time, when people only dared to borrow a few million dong at most, the bank dared to “break the barrier” and lend me hundreds of millions of dong. I remember that at that time, I carried exactly two sacks of money from the bank home by bicycle, put them under the bed, and then gradually used that money to level the ground, build a house, drill wells, dig ponds and build goat pens. But investing in agriculture, you get rich in a short time but you get poor very quickly. Many times I thought I would collapse, standing on the brink of losing everything because of storms and floods, but fortunately, my family and Agribank were always with me, so we have the foundation we have today,” Mr. Binh confided.

Like many other households and businesses, each step of change on Mr. Binh's economic journey cannot be without the "leverage" of credit capital from the bank. Mr. Binh's farm model continued to operate until 2013, when the locality had a policy of building new rural areas, requiring the need to link business and produce goods.

In time, Mr. Binh and many people in the area joined together to establish a cooperative. Up to now, there are 30 members who directly produce and sign contracts to consume products.

Currently, Nga Hai Cooperative has a scale of 100 hectares of agricultural production in the direction of high-tech agriculture with a total investment of 30 billion VND; each year, it earns more than 1 billion VND. With a system of barns built according to European standards, the Cooperative is cooperating with businesses to raise pigs and chickens for sale. In particular, the Cooperative is also a pioneer in growing melons in greenhouses in Ha Tinh province when it hired Israeli agricultural experts to directly transfer technology. The Cooperative currently has four closed greenhouses growing melons with a total area of 5,000 m2. And most recently, the Cooperative is also investing in another 4,000 m2 of greenhouses to grow grapes.

“After more than 30 years of being a customer of Agribank with a current outstanding debt of 7 billion VND, I realize that the bank is truly a midwife of the private economy, especially agricultural cooperatives, when it understands farmers better,” said Cooperative Director Le Van Binh.

Launch pad for agricultural breakthrough

In fact, over the past time, the entire Agribank system has continuously made efforts to improve processes, apply technology, shorten project appraisal time, and loan plans; reduce costs to reduce loan interest rates and expand credit capital for the agricultural sector, helping customers access loans quickly.

According to Deputy Director of Agribank Ha Tinh branch Tran Van Tai, joining the digital transformation atmosphere as well as actively implementing the Party's guidelines and policies, Resolution 57 of the Politburo on digital transformation and science and technology development, Agribank Ha Tinh branch also continuously innovates technology in management as well as in transactions with customers.

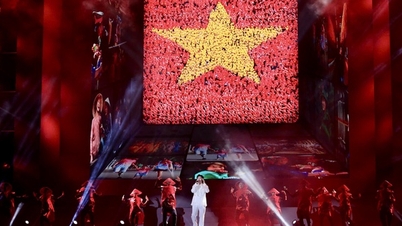

Agribank proactively and actively invests in developing clean agriculture and high-tech agriculture. |

In addition, Agribank also strengthens close coordination with local authorities and ministries to implement Project 06 as well as high-tech agricultural development projects, clean agriculture, and at the same time, removes difficulties and obstacles for customers related to issues such as: access to capital, mortgaged assets, etc. right from the project's formation.

Thanks to that, up to this point, Agribank Ha Tinh branch has achieved many positive results. Specifically, as of March 17, the total capital of the branch reached 24,100 billion VND, an increase of 800 billion VND compared to the beginning of the year, equivalent to an increase of 3.5% and reaching 56% of the plan assigned by the Central Government in 2025. Outstanding loans reached nearly 17,500 billion VND, an increase of 920 billion VND compared to the beginning of the year, equivalent to an increase of 5.5% and reaching 46% of the target assigned by the Central Government.

“Thus, it can be seen that the access to capital of the people as well as businesses to Agribank has been greatly improved and is very easy to access. Hopefully, these positive signals can contribute to the economic development of the locality as well as contribute to the overall economic development of the country in accordance with the goals set by the Party and the State in the coming time,” Deputy Director Tran Van Tai expressed.

It can be said that from Agribank's capital, many clean agricultural and high-tech agricultural areas have been developed. In the system of credit institutions, Agribank is also the pioneer bank to allocate 50,000 billion VND to implement a loan program to encourage the development of high-tech agriculture and clean agriculture.

Accordingly, Agribank reduces lending interest rates from 0.5%/year to 1.5%/year for customers participating in the clean agricultural production chain. In addition, customers borrowing capital under the Agribank's high-tech agricultural development program and clean agriculture are exempted from money transfer fees within the Agribank system, and receive a 50% reduction according to Agribank's current regulated fee for money transfers outside the Agribank system...

Up to now, the loan turnover since the program was launched by Agribank has reached more than 25,000 billion VND with more than 40,000 customers borrowing capital (of which, more than 98% of customers are individuals, households, farm owners,...).

Customers transact at Agribank Ha Tinh branch. |

Agribank Deputy General Director Phung Thi Binh said that in 2025, Agribank was assigned a credit growth target of 13%, equivalent to about 230,000 billion VND supplied to the economy. In 2024, Agribank proactively reduced lending interest rates 4 times, bringing the average lending interest rate at the end of the year down nearly 2% compared to the beginning of the year, and among the lowest in the market. Also in this year, Agribank launched 20 preferential credit programs for customers.

To further support customers, in the first two months of 2025, Agribank continued to reduce the floor interest rate for short-term loans by 0.2% - 0.5%, to promote credit growth. At the same time, 9 preferential credit programs with a scale of more than 350,000 billion VND were deployed to all subjects, focusing on groups: import-export enterprises, production and business enterprises, small and medium enterprises, individuals borrowing for consumption, business loans, etc.

“These subjects are the growth drivers of the economy, contributing to the minimum growth target of 8% as set by the Party and the State,” Ms. Phung Thi Binh affirmed. And 9 preferential interest rate programs are currently applying interest rates 1-2% lower than the normal interest rate. In particular, for customers with preferential import-export or value chain loans, Agribank has a program to reduce interest rates up to 3% compared to the normal lending interest rate.

Source: https://nhandan.vn/tien-phong-rot-von-xay-dung-nen-nong-nghiep-thong-minh-post867368.html

Comment (0)