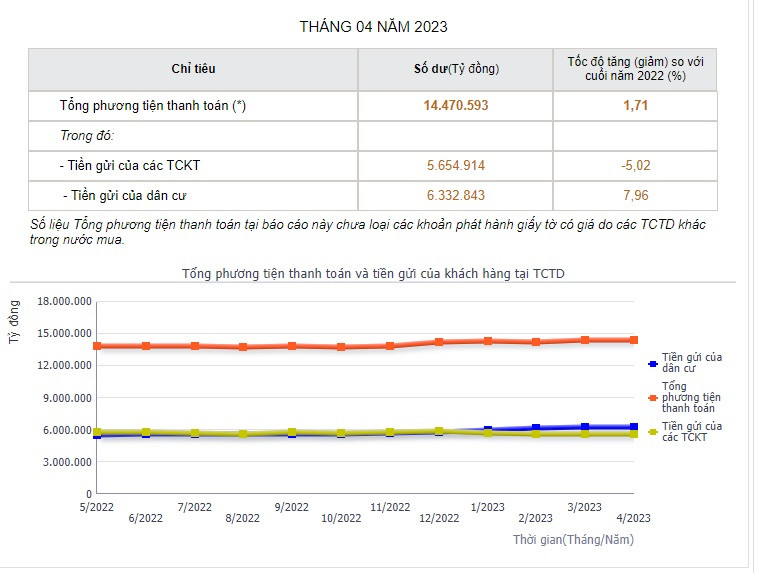

This is the highest level ever. It is also noteworthy that, from the beginning of 2023 until now, the amount of deposits from residents has always been higher than the amount of deposits from economic organizations.

In the same period, deposits of economic organizations reached more than VND 5.65 million billion, down VND 8,833 billion (5.02%) compared to the end of 2022. Meanwhile, compared to the end of March, deposits of residents increased by VND 52,028 billion.

At a recent press conference for the second quarter of 2023, Deputy Governor of the State Bank of Vietnam Dao Minh Tu said that the amount of deposits in the credit institution system is in excess.

This shows that saving money in banks is still the top safe choice for residents in the context that investment channels such as real estate, corporate bonds and stocks are no longer as attractive as before.

Compared to the end of 2022, the average deposit interest rate of commercial banks is about 5.8%/year, down 0.7%/year.

The average lending interest rate is about 8.9%/year, down 1%/year compared to the end of last year.

At the meeting between the Government Standing Committee and the Association of Small and Medium Enterprises on the afternoon of July 6, Governor of the State Bank of Vietnam Nguyen Thi Hong said that since the Covid-19 pandemic broke out, the banking system has provided many support policies for businesses. For example, the policy of reducing interest rates, exempting interest rates, and reducing shared fees with businesses in the recent period has totaled VND60 trillion. In addition, many solutions on interest rates, credit, debt restructuring and maintaining debt groups have been implemented.

Regarding the interest rate issue, the Governor said that in the context of central banks of countries still maintaining high interest rates and continuing to increase interest rates, the State Bank has adjusted down the operating interest rates four times, bringing the operating interest rates back to the level before the Covid-19 pandemic.

The Governor also emphasized that the State Bank of Vietnam is one of the very few central banks in the world that has reduced interest rates. Credit institutions are also actively reducing interest rates, with the average interest rate decreasing by about 1% compared to the end of 2022. Due to the delay in policy, credit institutions may continue to reduce interest rates in the coming time.

The Governor also said that lowering interest rates is an effort of the State Bank because when lowering interest rates, the State Bank must steer and coordinate policy tools in order to stabilize not only the monetary market but also the foreign exchange market, ensuring the safety of banking operations.

According to the latest data from the State Bank, by the end of June 2023, the economic debt balance reached 12,423 trillion VND, an increase of 4.73% compared to 2022. The debt balance for enterprises was about 6.3 trillion VND (an increase of 4.66% compared to 2022, accounting for 51% of the economic debt balance). The debt balance for small and medium enterprises reached nearly 2.3 trillion VND, an increase of nearly 4% compared to the end of 2022, accounting for about 18.5% of the economic debt balance.

Source

![[Photo] Sea turtle midwives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/19/9547200fdcea40bca323e59652c1d07e)

![[Photo] Spreading Vietnamese culture to Russian children](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/19/0c3a3a23fc544b9c9b67f4e243f1e165)

![[Photo] Secret Garden will appear in Nhan Dan Newspaper's Good Morning Vietnam 2025 project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/19/cec307f0cfdd4836b1b36954efe35a79)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with Speaker of the Malaysian House of Representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/19/5cb954e3276c4c1587968acb4999262e)

Comment (0)