|

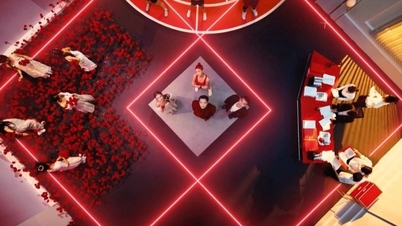

| Overview of the Workshop on providing comments on the draft Law on Special Consumption Tax (amended). (Source: MPI) |

(PLVN) - There is no basis to believe that imposing special consumption tax (SCT) on sugary soft drinks (SBD) will achieve the goal of limiting consumption; however, this policy is considered to have "more disadvantages than benefits", and requires a full assessment of its impact.

Can protect people's health?

At the Workshop on providing comments on the draft Law on Special Consumption Tax (amended) organized by the Association of Foreign Invested Enterprises (VAFIE) in coordination with the People's Representative Newspaper on the morning of September 20, former Director of the Large Enterprise Tax Department (General Department of Taxation) Nguyen Van Phung reiterated the four objectives of imposing special consumption tax on imported goods, in which the first objective is to implement the Party and State's policy on protecting people's health and limiting consumption of certain goods that are harmful to the health of the community and children.

However, Mr. Phung said that the figures provided by the Drafting Committee were not convincing. “Is imposing special consumption tax on NGKCĐ effective in the context of many other foods containing sugar and high in calories that also exist on the market? If special consumption tax is imposed on NGKCĐ only, will consumers still be able to switch to other alternative foods, and these alternative foods can also be the cause of non-communicable diseases?” - Mr. Phung wondered.

At the same time, it was affirmed: "Tax tools in this case are difficult to change consumer behavior, and can even create conditions for smuggled goods, street foods that are not quality controlled, and are difficult to manage tax collection...".

Associate Professor, Dr. Nguyen Thi Lam, former Deputy Director of the Vietnam Institute of Nutrition, also said that there are many causes of overweight and obesity. Therefore, only reducing the consumption of NGKCĐ will not solve the problem of overweight, obesity and non-communicable diseases.

Business "health" is being threatened

The latest research results of the Central Institute for Economic Management (CIEM) show that adding a 10% special consumption tax on alcoholic beverages over 5g/ml as drafted will negatively impact 9 beverage industries and 24 related industries in the value chain, causing a loss of nearly VND 28 trillion (equivalent to 0.5% of GDP in 2022), reducing indirect taxes by VND 5.4 trillion/year and reducing direct taxes by VND 3.2 trillion/year due to the decreasing consumption and production of alcoholic beverages.

According to Dr. Can Van Luc and the expert group of BIDV Training and Research Institute, these are very remarkable numbers. “NGKCĐ is only 1 of 9 causes of obesity, while the taxation has ensured fairness, implementation and efficiency? The drafting committee needs to carefully consider adding special consumption tax on NGKCĐ over 5g/ml…”, the expert suggested.

Dr. Nguyen Anh Tuan, Permanent Vice President of VAFIE, is concerned that while the purpose of imposing special consumption tax on imported goods is to protect people's health, it is not convincing enough, the threat to businesses' health is real.

VAFIE Chairman, Dr. Nguyen Mai affirmed: “Increasing special consumption tax at the present time will increase the burden on businesses, forcing businesses to narrow down production and business activities, indirectly affecting the state budget revenue as well as the budget balance of localities...

Mr. Luong Xuan Dung, Chief of Office of the Vietnam Beer Alcohol and Beverage Association (VBA), said that since the COVID-19 pandemic, the industry's profits have decreased by 67%, with the most severe decline in small and medium-sized enterprises, many of which are facing the risk of bankruptcy.

The imposition of special consumption tax on imported raw materials has significantly affected the recovery of enterprises in the industry, especially in the context of increasing raw material prices and consumers tightening spending. Enterprises are also under a lot of pressure from arising financial obligations and external impacts such as the recent YAGI storm.

“Imposing special consumption tax on alcoholic beverages certainly does not bring in large revenues for the budget, but it can have a big impact on businesses, especially small and medium-sized businesses that do not have abundant financial resources. Therefore, if we take into account the time needed for businesses to prepare, there should be a roadmap, for example, Vietnam will not impose special consumption tax on these soft drinks until 2030…” - former Director of the Large Enterprise Tax Department Nguyen Van Phung suggested.

“In the process of collecting opinions from businesses, VCCI found that the business community strongly supports the policies of the Party and the State and expects that the special consumption tax will contribute to ensuring a stable, fair, favorable business environment, harmonizing the interests of the State, people and businesses (including workers).

To achieve these expectations, new regulations need to have a legal basis, a practical and scientific basis, demonstrating the best harmony of interests of all parties, based on thorough research and impact assessment, with a full analysis of the advantages and disadvantages of each option, with learning and analysis, selecting good international experiences to apply appropriately to Vietnam. New policies issued need to be based on a thorough impact assessment of the effectiveness and costs of each solution on the economy, society, business environment and the existence and development of related industries.

The addition of new taxable subjects will have a huge and very serious impact on the development of businesses in this industry. VCCI believes that this policy needs to be considered very carefully..." - Ms. Phan Minh Thuy - Head of the Legal Department of VCCI.

Source: https://baophapluat.vn/thue-tieu-thu-dac-biet-doi-voi-nuoc-giai-khat-co-duong-can-danh-gia-day-du-tac-dong-chinh-sach-post526094.html

![[Photo] National Assembly Chairman Tran Thanh Man receives First Vice Chairman of the Federation Council of the Federal Assembly of the Russian Federation](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764648408509_ndo_br_bnd-8452-jpg.webp&w=3840&q=75)

Comment (0)