That was the content emphasized at the consultation workshop for the Report "Vietnam Financial Market 2024 and Prospects 2025" co-organized by the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) and the Asian Development Bank (ADB) in Vietnam on April 22, in Hanoi.

Speaking at the opening of the workshop, BIDV Deputy General Director Tran Phuong said: For the past three consecutive years (2022-2024), BIDV has co-organized with ADB to organize an annual workshop on "Vietnam's financial market and prospects", attracting the attention and appreciation of management agencies, experts, domestic and foreign financial institutions, associations, research institutes, and the media.

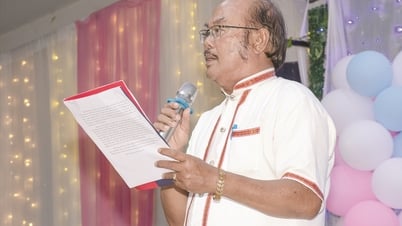

|

BIDV Deputy General Director Tran Phuong delivered the opening speech at the Workshop. |

This year, following the success of the previous 3 reports, BIDV (with the professional support of ADB) continues to implement the Vietnam Financial Market Report 2024 and Outlook 2025. “To date, this is the only Report that comprehensively assesses the Vietnamese financial market, including the banking-securities-insurance sectors.

"This series of Reports has been and will contribute to providing comprehensive, independent, objective and transparent information about the Vietnamese financial market. At the same time, the Report also identifies trends, opportunities and challenges of the market, thereby providing practical solutions and recommendations to promote the development of the Vietnamese financial market in a safe, effective and sustainable manner," Mr. Tran Phuong emphasized.

Financial Market in 2024 and Prospects for 2025

Commenting on the world financial market in 2024, ADB chief economist in Vietnam Nguyen Ba Hung stated: In 2024, the world economy will maintain a fairly good recovery, but it will be uneven, with differentiation between countries, between the service and manufacturing sectors. Global inflation tends to cool down significantly, creating favorable conditions for central banks to lower interest rates, shifting monetary policy from controlling inflation to easing to promote growth. However, the level of interest rate reduction is still cautious, the interest rate level is still high, especially in the context of increasing risks of trade-technology wars, causing prices and inflation to be anchored high.

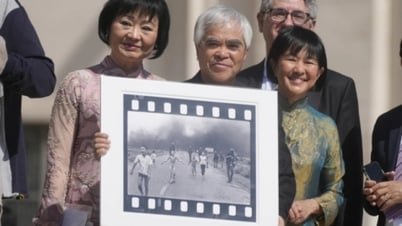

|

ADB Chief Economist in Vietnam Nguyen Quoc Hung said. |

Dr. Can Van Luc, BIDV Chief Economist and Director of BIDV Training and Research Institute, also said that Vietnam's financial market in 2024 is basically quite stable and has achieved some remarkable results. Credit increased by 15.08%, capital mobilization increased by 10.5%. Pre-tax profit of 27 listed commercial banks reached VND 299 trillion, up 17.2%, much higher than the increase in 2023 (3.8%). The stock market grew positively. The corporate bond market continued to recover when the total value of corporate bonds issued reached VND 466.5 trillion, up 27.7% compared to 2023.

The business results of securities companies were positive as after-tax profits increased by 32%, mainly thanks to brokerage and proprietary trading revenues and margin lending. The insurance sector faced more difficulties as confidence had not yet recovered after a number of incidents in the joint investment and compensation sectors due to Typhoon Yagi, insurance premium revenue decreased by 0.25%, etc.

However, the financial market in 2024 still faces many challenges when bad debt increases and pressure still exists, while the bad debt coverage ratio of credit institutions tends to decrease, and the pressure to increase capital is high. The profits of securities companies are unsustainable, the need to increase capital is large while the business results of insurance companies record mixed results due to the impact of Typhoon Yagi and confidence needs time to recover...

The international context in 2025 is forecasted to have more fluctuations after Mr. Donald Trump was elected President of the United States, especially in the fields of foreign relations, security, economy, trade (especially related to tariff policies) and international investment. Although Vietnam's economy is forecast to grow well, it faces more risks and challenges than opportunities, especially from the international context. Accordingly, the growth rate depends largely on the results of reciprocal tariff negotiations between Vietnam and the United States.

With the baseline scenario (60% probability), assuming Vietnam negotiates to reduce the reciprocal tax rate to about 20-25% (from the current expected level of 46%), GDP growth in 2025 could reach about 6.5-7%.

With a positive scenario (20% probability), the tariff rate is only about 10%, GDP growth can reach 7.5-8%.

In the negative scenario (20% probability), the US will still impose a 46% reciprocal tax rate (or only slightly reduce it), GDP growth will be very negatively affected, decreasing by 1.5-2 percentage points, reaching only 5.5-6% in 2025. Inflation for the whole year of 2025 is forecast to increase by about 4-4.5%.

With the international and domestic context as mentioned above, Dr. Can Van Luc commented: The financial market in 2025 is forecasted to face some risks and challenges in addition to advantages.

In the baseline scenario, credit growth is forecast at 14-15%. The State Bank will continue to operate monetary policy proactively, flexibly, promptly, effectively, in close coordination with fiscal policy and other macroeconomic policies, contributing to supporting economic growth, stabilizing the macro economy, controlling inflation, interest rates are expected to continue to be maintained at low levels, lending interest rates are expected to decrease slightly according to the direction of the Government and the State Bank. The USD/VND exchange rate is forecast to be under pressure to increase but will be in a tug-of-war, increasing by about 3-4% throughout the year.

The banking system’s profits in 2025 are expected to grow positively (15-20%), much lower than in 2024. The stock market is expected to benefit from the upgrading of the Vietnamese stock market and positive results of listed companies. The business results of insurance companies are expected to be more positive as the negative impacts of super typhoon Yagi are gradually resolved and confidence is restored.

In terms of institutions, the legal framework for the financial sector is expected to have many positive changes to meet new requirements. The policy on digital asset and digital currency management is expected to be issued soon. The Law on Credit Institutions 2024 is amended to fill the legal gap in handling bad debt when Resolution No. 42/2017/QH14 of the National Assembly has expired.

The stock market is expected to be upgraded in 2025, creating excitement and increasing confidence for domestic and foreign investors, and also an opportunity to attract investment capital and promote reform. In addition, the trend of green transformation and ESG practices at financial institutions and domestic and international enterprises will continue to take place in a more substantial and systematic direction.

Developing the corporate bond market

However, the research team's report also pointed out that the financial market in 2025 still has many issues that need to be controlled, such as: unexpected and unpredictable fluctuations in the international market (especially the US tariff issue), strongly affecting the open economy and the global financial market and Vietnam, including FDI and indirect investment (FII) capital flows; the pressure on corporate bonds maturing is still quite large and falls heavily on the real estate business group (accounting for nearly 56% of the total); bad debt is under increasing pressure, requiring the early legalization of Resolution 42/2017/QH14 of the National Assembly for more fundamental handling; the risk of interconnection between the real estate market and the financial market is still latent.

|

Dr. Can Van Luc spoke at the workshop. |

According to Dr. Can Van Luc, the corporate bond market is playing an increasingly important role in the financial system as well as the Vietnamese economy. In particular, in the period of 2019-2021, the market has developed very rapidly, the issuance volume has increased by more than 50% per year, the total issuance volume is 1.04 million billion VND, bringing the total outstanding bond debt to about 14.75% of GDP. However, the overheating development along with the incomplete legal corridor has led to many problems, such as violations in the market, large volume of maturing bonds, increasing risk bond ratio, declining investor confidence, etc.

Therefore, since mid-2022, the Government and the Ministry of Finance have applied a new framework to regulate the corporate bond market and have initially achieved positive results, with issuance volume and liquidity recovering quite well in 2023-2024. However, the Vietnamese corporate bond market still needs to improve many issues.

In the short term, there is pressure from a large amount of maturing bonds, and in the long term, there are structural issues, such as the structure or form of issuance; the basis, structure and quality of investors are still inadequate; or the over-reliance on individual issuance, which is risky and not close to international practice; credit rating regulations still lack grouping, while the requirements for professional investors are strict and not specifically grouped, which can limit the investor base.

In the coming time, the corporate bond market is expected to develop more strongly thanks to many positive supporting factors, such as high economic growth prospects, low interest rates, increasingly improved market infrastructure and legal corridors... Fundamentally resolving the above barriers and challenges will also contribute significantly to the development process of this market.

At the workshop, speakers and experts also made a number of policy recommendations, solutions to stabilize and develop the financial market, and solutions to develop the bond market in Vietnam.

Accordingly, experts recommend developing a more balanced financial market, reducing the burden of medium- and long-term capital supply on the banking system; promoting the development and early upgrading of the stock market; increasing the economy's ability to supply and absorb capital...

Source: https://nhandan.vn/thuc-day-xu-huong-dich-chuyen-kenh-cung-ung-von-post874344.html

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the victory over fascism in Kazakhstan](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/dff91c3c47f74a2da459e316831988ad)

![[Photo] Prime Minister Pham Minh Chinh receives delegation from the US-China Economic and Security Review Commission of the US Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/ff6eff0ccbbd4b1796724cb05110feb0)

![[Photo] Sparkling lanterns to celebrate Vesak 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/a6c8ff3bef964a2f90c6fab80ae197c3)

Comment (0)