The event took place on April 15 and 16 in Hanoi.

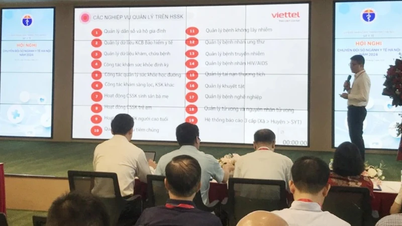

Speaking at the opening ceremony, Dr. Nguyen Quoc Hung, Vice Chairman and General Secretary of the Vietnam Banks Association, said that in Vietnam, the Government has issued the "National Digital Transformation Program to 2025, with a vision to 2030", in which the State Bank of Vietnam has issued the Digital Transformation Plan for the banking industry to 2025, with a vision to 2030. Therefore, most commercial banks have built a digital transformation strategy and developed application services in the electronic environment, increasing the experience of banking products and services to consumers, contributing significantly to the achievements of national digital transformation in general and the banking industry in particular.

To date, the proportion of adults with payment accounts has reached 87%, exceeding the target of 80% by 2025, with an average annual growth rate of non-cash payments reaching more than 50%.

Non-cash payment transactions reached 7.83 billion transactions, with a value of 134.9 million billion VND (up 58.23% in quantity and 35.01% in value), of which: via the Internet channel increased by 51.15% in quantity and 33.94% in value; via mobile phone channel increased by 55.54% in quantity and 34.91% in value, transactions via QR Code increased by 106.91% in quantity and 109.67% in value...

Banks have also stepped up the exploitation and development of online public services, effectively integrating them into the National Public Service Portal. To date, more than 90% of work records have been processed and stored online, with nearly 14.6 million accounts and 46.2 million records submitted via the National Public Service Portal, carrying out nearly 26.8 million online payment transactions, totaling more than VND 12.9 trillion.

|

Dr. Nguyen Quoc Hung, Vice Chairman and General Secretary of Vietnam Banks Association spoke at the event. |

At the Conference, Mr. Le Anh Dung, Deputy Director of the Payment Department (State Bank) said that Vietnam is entering a new stage of development, with the aspiration to become a developed country by 2045, as directed in Resolution 57-NQ/TW of the Politburo on breakthroughs in science, technology, innovation and national digital transformation.

In this era, digital transformation is not only an inevitable trend but also a core driving force to promote sustainable economic growth, enhance national competitiveness and improve people's quality of life.

"As the lifeblood of the economy, the banking industry plays a pioneering role in the digital transformation journey, not only meeting the increasing needs of customers but also contributing to the national digital transformation goal," Mr. Le Anh Dung affirmed.

By early 2025, at many credit institutions, more than 90% of financial transactions will be conducted through digital channels, reflecting the great efforts and success of the entire industry in the motto of focusing on customers, providing superior experiences and providing practical benefits to service users.

Most banks have connected and effectively exploited the National Population Database, implementing customer identification via chip-embedded citizen identification cards. The number of personal payment accounts reached more than 200 million, with transaction growth via the Internet, mobile devices and QR codes reaching 35%, 33% and 66% respectively compared to the same period in 2024.

Many banks have reduced their cost-to-income ratio (CIR) below the 30% threshold, demonstrating efficiency through comprehensive digital transformation, approaching leading financial institutions in the region.

These figures not only demonstrate the speed of digital transformation but also demonstrate financial inclusion, helping tens of millions of people, especially in rural and remote areas, access convenient and modern financial services.

|

Mr. Le Anh Dung, Deputy Director of Payment Department, State Bank of Vietnam, spoke at the conference. |

According to Mr. Le Anh Dung, along with achievements in the digital transformation process, the Vietnamese banking industry is also facing many challenges.

To overcome challenges and continue to promote digital banking transformation in the direction of innovation and strong application of technology, the State Bank has been implementing many important policies and strategies. The digital transformation plan for the banking sector according to Decision 810/QD-NHNN sets a target that by 2025, at least 50% of banking operations will be completely digitalized, while 70% of customer transactions will be conducted on digital channels...

In the coming time, the State Bank will focus on perfecting the legal framework, investing in technology infrastructure, enhancing cybersecurity, developing digital human resources in the banking industry, and promoting financial inclusion.

Source: https://nhandan.vn/thuc-day-manh-me-cong-cuoc-chuyen-doi-so-trong-nganh-tai-chinh-ngan-hang-post872582.html

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

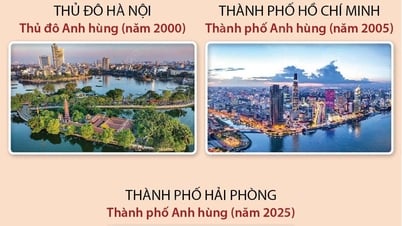

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

![[Video] Developing Physical Education in Primary Schools in Vietnam](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/13/781ea31da6c24eaab2162e89e10ddec1)

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

Comment (0)