The circular will take effect 45 days after signing and is the basis for FTSE Russell's positive assessment at the market classification announcement on October 8.

|

| Foreign institutional investors can trade stocks without requiring sufficient funds. |

The Ministry of Finance has just officially issued Circular 68/2024/TT-BTC amending and supplementing a number of articles of circulars regulating securities transactions on the securities trading system; clearing and settlement of securities transactions; activities of securities companies and information disclosure on the stock market.

This is a circular that has been expected for many months because it directly removes the bottleneck related to the ability of foreign institutional investors to purchase shares without requiring sufficient funds (Non Pre-funding solution - NPS) and officially provides a roadmap for information disclosure in English. The changes in the Circular are considered a very important step to remove the "bottleneck" to meet the standards for upgrading the stock market from frontier to secondary emerging according to FTSE Russell's criteria.

The Circular will take effect on November 2, 2024.

According to regulations, securities companies must determine the limit for receiving purchase orders for shares that do not require sufficient funds from foreign institutional investors at the beginning of the trading day and keep documents and information determining this limit.

The limit for accepting stock purchase orders is calculated by the total amount that can be converted into cash but does not exceed the difference between 2 times the equity of the securities company and the outstanding loan balance for securities margin trading. In case the prescribed investment limit is exceeded, the securities company is not allowed to continue performing the above business until the investment limit is met. At the same time, the securities company must also apply necessary measures within a maximum period of 1 year to comply with the investment limit.

Regarding the provisions on information disclosure, similar to the previous Draft, Circular 68 stipulates that listed organizations and large-scale public companies will periodically disclose information simultaneously in English from January 1, 2025. Next, listed organizations and large-scale public companies will additionally disclose extraordinary information, information upon request, and disclose information on other activities of the public company simultaneously in English from January 1, 2026.

Public companies not subject to the provisions of Points a and b of this Clause shall periodically disclose information in English from January 1, 2027. Public companies shall disclose extraordinary information, disclose information upon request, and disclose information on other activities of the public company in English from January 1, 2028.

In a recent report, SSI Research maintained the scenario that Vietnam will be upgraded in the September 2025 review. According to this unit, the Vietnam Securities Depository and Clearing Corporation (VSDC), securities companies, custodian banks and investors are working to complete the paperwork process.

According to SSI Research's calculations, with the upgrade to emerging market status, according to preliminary estimates, capital flows from ETFs could reach up to 1.7 billion USD, not including capital flows from active funds. FTSE Russell estimates that total assets from active funds are 5 times higher than those from ETFs.

As planned, on October 8, FTSE Russell will announce the market classification table. With the revised Circular officially issued in September and soon implemented in the fourth quarter, this will be the basis for FTSE Russell to give a positive assessment of the Vietnamese stock market in this ranking period.

|

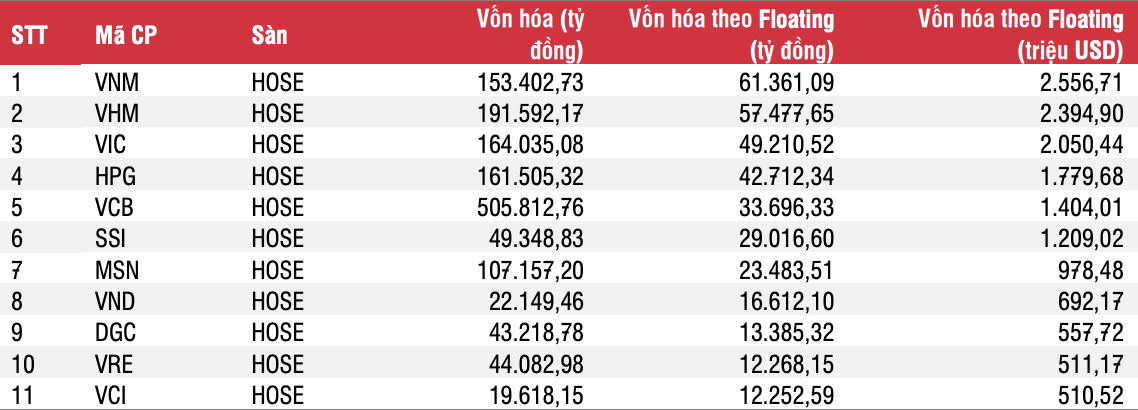

| Stocks could attract cash flow as Vietnam is upgraded to emerging market status. Source: SSI Research |

Identifying stocks that can attract cash flow when Vietnam is upgraded to an emerging market, SSI Research points out stocks of many large-cap companies such as Vinamilk, Vinhomes, Vingroup, Hoa Phat... These are all companies with a capitalization of billions of US dollars and are focusing on governance quality. New regulations related to information disclosure in English will also soon be implemented in many large listed companies in Vietnam.

Source: https://baodautu.vn/thong-tu-go-vuong-pre-funding-co-hieu-luc-ngay-tu-2112024-d225250.html

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

Comment (0)