The Ministry of Home Affairs has just issued Circular 002/2025 amending and supplementing a number of articles of Circular 01/2025 on guidelines for implementing policies and regimes for cadres, civil servants, public employees and workers in the implementation of organizational restructuring of the political system.

Specifically, the circular guides how to determine the time and monthly salary to calculate policies and regimes; how to calculate policies for people who retire early; cadres, civil servants and commune-level cadres and civil servants; public employees and workers.

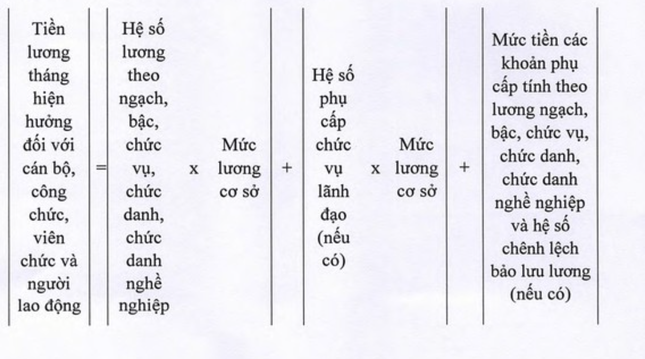

How to calculate current monthly salary for cadres, civil servants and public employees.

For those receiving salaries according to the salary table prescribed by the State, the circular clearly states that the current monthly salary includes: Salary level according to rank, level, position and salary allowances and salary reservation difference coefficient (if any) according to the provisions of the law on salary.

Regarding the calculation of policies for people retiring early, for cadres, civil servants, public employees and workers who meet the conditions and are decided by competent authorities to retire early compared to the retirement age, they will immediately receive pension according to the provisions of the law on social insurance without having their pension rate deducted. This subject is also entitled to a one-time pension; a subsidy based on the number of years of early retirement and a subsidy based on the working time with compulsory social insurance contributions.

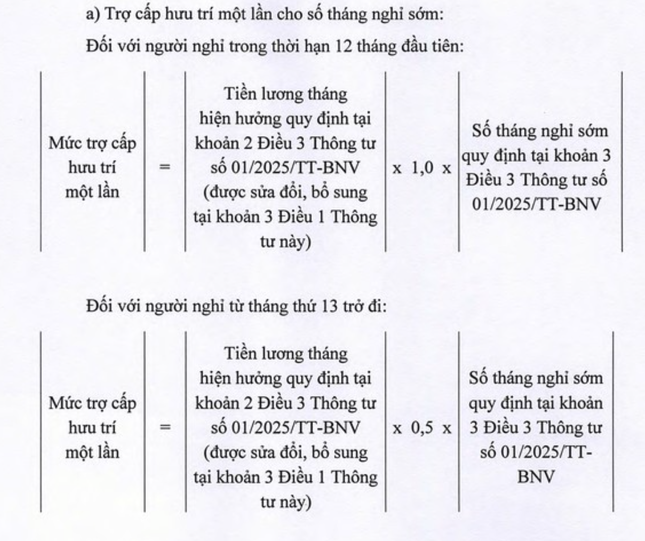

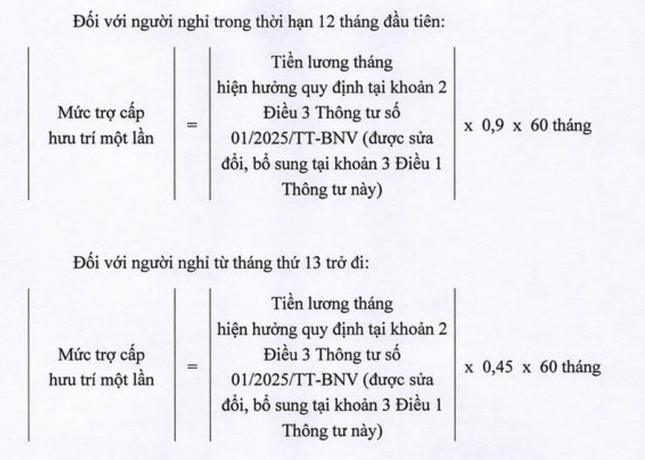

How to calculate one-time pension benefits.

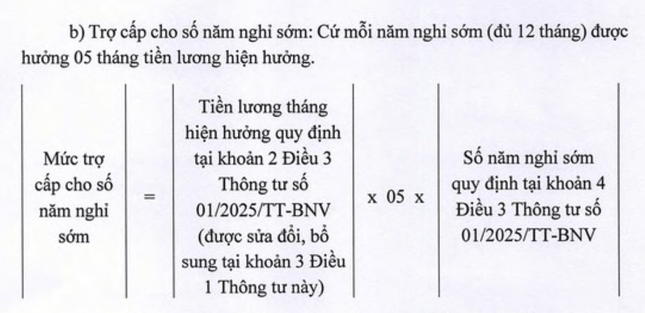

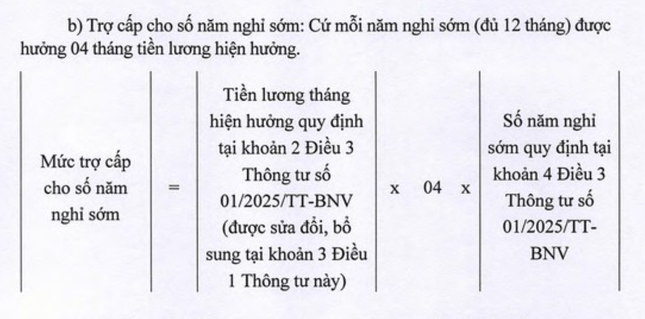

According to this new circular, in case of having 2 to 5 years left until retirement age, they will receive 3 allowances, including: One-time pension allowance for the number of months of early retirement; allowance for the number of years of early retirement - for each year of early retirement (12 months), they will receive 5 months of current salary; allowance based on working time with compulsory social insurance.

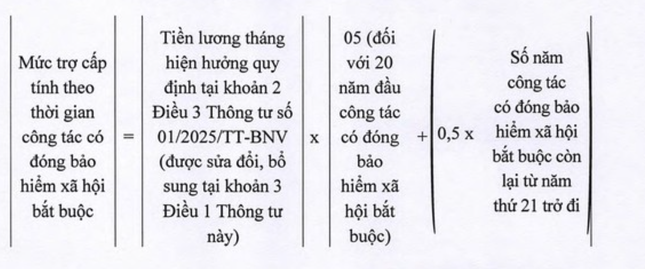

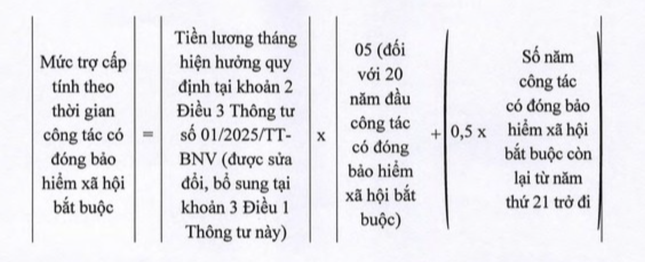

For those who retire before the effective date of the Social Insurance Law 2024 (except for female cadres and civil servants at the commune level), the subsidy level is calculated as follows: The first 20 years of work with compulsory social insurance contributions will receive a subsidy of 5 months of current salary; for the remaining years (from the 21st year onwards), each year will receive a subsidy equal to 0.5 months of current salary.

For female commune-level cadres and civil servants retiring from January 1, 2025 onwards and those retiring from the effective date of the Social Insurance Law 2024, the allowance is calculated as follows: The first 15 years of work with compulsory social insurance contributions will be subsidized with 4 months of current salary; for the remaining years (from the 16th year onwards), each year will be subsidized with 0.5 months of current salary.

Calculation method for cases with remaining life expectancy of more than 5 years but 10 years to retirement age.

For those who have more than 5 years left until 10 years of retirement age, they will receive 3 allowances, including: One-time pension allowance for the number of months of early retirement; allowance for the number of years of early retirement; allowance based on working time with compulsory social insurance.

The Circular takes effect from the date of signing and promulgation, April 4, 2025.

Source TPO

Source: https://baotayninh.vn/thong-tin-moi-ve-cach-tinh-che-do-voi-can-bo-nghi-huu-truoc-tuoi-a188566.html

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

Comment (0)