VN-Index decreased slightly

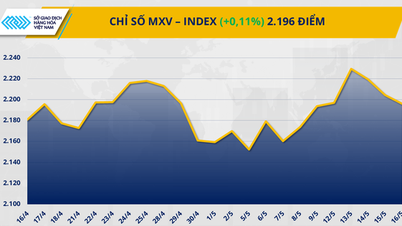

The impact of the tariff news eased, helping the domestic stock market start the new week quite positively. However, selling pressure quickly appeared in the next 2 sessions, causing the VN-Index to return to the psychological support zone of 1,200 points. At this zone, demand tended to increase, helping the VN-Index recover quite well, but large-cap stocks such as VIC and VHM fell sharply in the last session of the week, losing a large part of the general market's efforts to increase points. Closing the trading week from April 14 to April 18 with 3 sessions of increase and 2 sessions of decrease, the VN-Index stopped at 1,219.12 points, down 3.34 points (-0.27%).

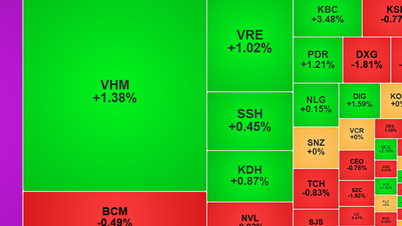

The market traded in balance with 11 sectors gaining points compared to 10 sectors losing points. However, the large fluctuations of each sector showed a clear differentiation after the market searched for a new status. The fertilizer sector increased by 5.86%, seaports by 4.98% and retail by 4.47% recorded the best growth. On the contrary, industrial park real estate, telecommunications technology and seafood were the three sectors with the sharpest declines.

Average liquidity on the Ho Chi Minh City Stock Exchange reached VND22,190.53 billion, down 13.06%. Foreign investors increased their net selling with a total net selling value of VND4,809 billion on this exchange.

Experts from Vietnam Construction Securities Joint Stock Company said that the VN-Index closed the week with a slight decrease after approaching the 1,245-point mark, showing that profit-taking pressure is increasing and cannot rule out the possibility that it will continue in the sessions of next week.

“Profit-taking pressure may cause the VN-Index to adjust to the support zone of 1,180 points before continuing to return to the recovery trend, towards the strong resistance level of 1,270 - 1,300 points - the equilibrium point before the information about the 46% US reciprocal tax on Vietnamese goods is announced. Therefore, new buying positions as well as increasing the proportion of stocks need to patiently wait for the VN-Index to test the support zone of 1,180 points to be activated,” this business expert predicted.

Business results information supports investor sentiment

Expert Phan Tan Nhat, Head of Analysis, Saigon - Hanoi Securities Joint Stock Company (SHS), said that information about the business results of the first quarter of 2025 that have been and will continue to be announced is supporting investors' sentiment more positively. In addition, the expectation that there will be information about negotiations between the US and China also supports market sentiment. Many stocks are still relatively attractive compared to the internal factors of the business and long-term growth prospects. Therefore, it is currently suitable to accumulate low-weight positions, or consider short-term buying to reduce investment capital; prioritize risk management in the current new context for high-weight cases, not timely restructuring the portfolio when the market declines sharply.

Sharing the same view, experts from VNDirect Securities Corporation believe that the market will shift its attention to the picture of business results in the first quarter of 2025. In the context that the market has returned to the "cheap valuation" zone, positive information about business results can be a catalyst to help improve investor sentiment as well as the stock valuation level. Enterprises expected to have positive results will attract cash flow from the market. With recent positive credit growth figures and the cooling trend of input interest rates, the banking industry is expected to record positive growth in the first quarter of this year.

In addition, the growth of the consumer - retail sector is expected to begin to accelerate as domestic purchasing power shows clear signs of improvement thanks to improved incomes and benefits from the Government 's stimulus policy. Other sectors expected to have positive business results include livestock, aquaculture and electricity.

Regarding trading strategies, investors can take advantage of the market's accumulation phase to restructure their investment portfolio, consider increasing the proportion of stocks during market corrections to the support zone around 1,200 points, and prioritize basic stocks in industries with positive first-quarter business results prospects such as banking, retail, livestock, aquaculture, and electricity.

Meanwhile, experts from Asean Securities Corporation expressed their opinion that market momentum is showing less positive signs. Two scenarios are presented in the coming time. In the positive scenario, the market may continue to recover and surpass the resistance level of 1,240 points when many stocks have fallen into attractive valuations. In the neutral scenario, the market will continue to move in balance and sideways around the range of 1,180 points - 1,240 points.

Source: https://hanoimoi.vn/thong-tin-ket-qua-kinh-doanh-giup-cai-thien-tam-ly-nha-dau-tu-chung-khoan-699676.html

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/d7e02f242af84752902b22a7208674ac)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)