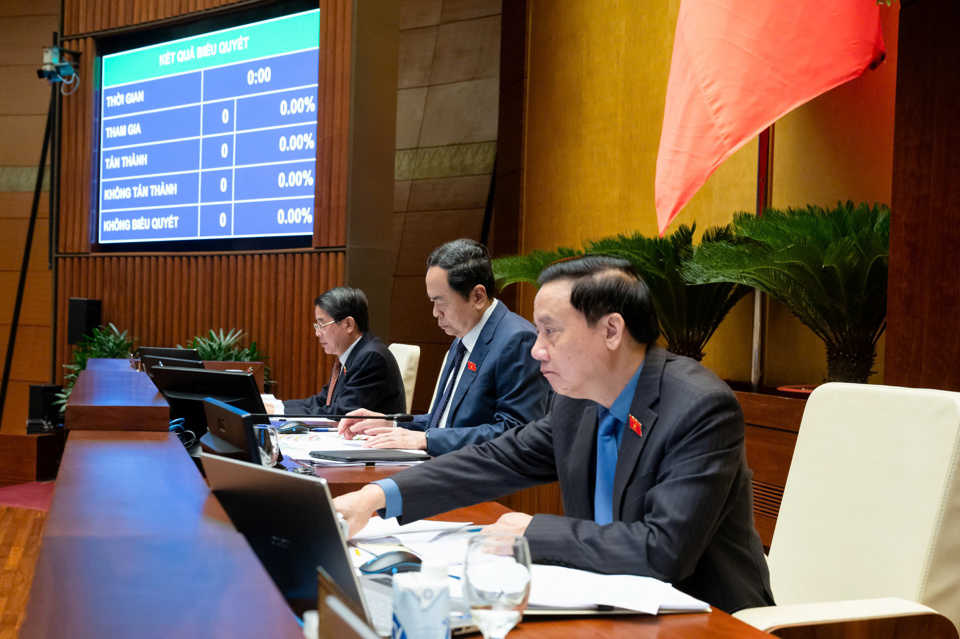

Kinhtedothi - On the morning of November 13, at the 8th Session, the National Assembly voted to pass the Resolution on the State budget estimate for 2025 with a series of important targets. In particular, the Resolution clearly stated that public sector salaries, pensions, social insurance benefits, monthly allowances, etc. have not yet increased.

The Resolution on the State budget estimate for 2025 was passed by the National Assembly with a series of important targets. Accordingly, the National Assembly resolved that the State budget revenue for 2025 would be 1,966,839 billion VND.

Using 60,000 billion VND of the accumulated fund for salary reform of the central budget and 50,619 billion VND of the remaining fund for salary reform of the local budget by the end of 2024 to transfer to the 2025 budget arrangement of the ministries, central agencies and localities to implement the basic salary level of 2.34 million VND/month. Total state budget expenditure in 2025 is: 2,548,958 billion VND.

The State budget deficit is 471,500 billion VND, equivalent to 3.8% of the gross domestic product (GDP). The total State budget loan is 835,965 billion VND.

Regarding the 2025 budget revenue, some opinions suggested considering and calculating the import-export balance revenue estimate and crude oil revenue at a higher level.

In the report on explanation and acceptance, the National Assembly Standing Committee stated that revenue from crude oil and balance revenue from export and import activities are 100% of the central budget revenue, while this revenue source is greatly affected by fluctuations in the world economic and political situation when the country's economy has participated deeply, widely and comprehensively in the global economic value chain.

Therefore, the high estimate of these revenues is likely to affect the central budget revenue in case the estimate is not met, affecting the ability to balance and implement expenditure tasks according to the plan. Therefore, the National Assembly Standing Committee proposed that the National Assembly allow keeping the plan as the Government submitted. At the same time, it is recommended that the Government, during the operation process, closely monitor the fluctuations of the world economy to have appropriate revenue management solutions, ensuring the highest increase in State budget revenue.

The Resolution also resolves, on the management of the State budget in 2024, to allow the transfer of VND 56,136,146 billion of the remaining unallocated central budget revenue increase in 2022 to arrange the estimate and plan for public investment of central budget capital in 2025 for tasks and projects permitted by the National Assembly to use the general reserve of the medium-term public investment plan for the period 2021-2025 in Resolution No. 112/2024/QH15.

At the same time, it is allowed to extend the implementation time and disburse a maximum of VND 579,306 billion of the capital plan from the increased central budget revenue source in 2022 that has not been fully disbursed to resolve compensation for site clearance (including the delayed payment) of the National Highway 1 expansion projects through Nghe An province under the central budget tasks arising after these projects have been finalized in 2025.

Allowing the transfer of the remaining unallocated VND 18,220 billion of the central budget revenue increase in 2023 to arrange the central budget public investment plan and estimate in 2025 for tasks and projects permitted by the National Assembly to use the general reserve of the medium-term public investment plan for the 2021-2025 period in Resolution No. 142/2024/QH15...

The Resolution also allows the use of the source of 5% reduction and savings in regular expenditure in 2024 of the central budget and local budgets to support the elimination of temporary and dilapidated houses for poor and near-poor households and support other localities to carry out this task in case the locality does not use up all the source; carry out the transfer of unused funds to 2025.

Regarding the implementation of wage policies and a number of social policies, the Resolution clearly states that public sector wages, pensions, social insurance benefits, monthly allowances, and preferential allowances for meritorious people will not be increased in 2025. Ministries, central agencies, and localities continue to implement solutions to create sources for reforming wage policies according to regulations.

Along with that, from July 1, 2024, the scope of using accumulated resources for salary reform of the Central budget is allowed to be expanded to adjust pensions, social insurance benefits, monthly allowances, preferential allowances for meritorious people and streamlining of payroll...

Allow localities to use the remaining salary reform funds to invest in regional and national connection projects, and key national projects implemented locally in cases where the locality has a large surplus, commits to ensuring funding for salary reform and implementing social security policies issued by the Central Government for the entire roadmap until 2030 and does not request support from the Central budget.

Source: https://kinhtedothi.vn/thong-qua-du-toan-ngan-sach-nha-nuoc-nam-2025-chua-tang-luong-khu-vuc-cong.html

![[Photo] Fall Fair 2025 and impressive records](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/03/1762180761230_ndo_br_tk-hcmt-15-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh receives the Chairman of the Japan-Vietnam Friendship Association in the Kansai region](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/03/1762176259003_ndo_br_dsc-9224-jpg.webp)

![[Photo] General Secretary To Lam receives Singaporean Ambassador Jaya Ratnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/03/1762171461424_a1-bnd-5309-9100-jpg.webp)

![[Photo] Lam Dong: Close-up of illegal lake with broken wall](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/03/1762166057849_a5018a8dcbd5478b1ec4-jpg.webp)

Comment (0)