On June 15, 2021, the Ministry of Industry and Trade issued Decision No. 1578/QD-BCT on the application of anti-dumping duties and countervailing duties officially on certain cane sugar products originating from the Kingdom of Thailand (case code AD13.AS01).

Pursuant to Article 62 of Decree 10/2018/ND-CP dated January 15, 2018, detailing certain provisions of the Law on Foreign Trade Management regarding trade defense measures (hereinafter referred to as Decree No. 10/2018/ND-CP), the investigating authority shall, at least 12 months before the expiration date of the decision to apply anti-dumping and countervailing measures, notify the receipt of the application for a final review of the application of anti-dumping and countervailing measures. The content of the final review is specified in detail in Clause 2, Article 82 and Clause 2, Article 90 of the Law on Foreign Trade Management and Article 63 of Decree No. 10/2018/ND-CP.

The Trade Remedies Department officially announces the acceptance of applications for a final review of the case. According to Clause 2, Article 62 of Decree No. 10/2018/ND-CP, within 30 days from the date of this notification by the investigating authority, domestic producers have the right to submit an application for a final review of the application of anti-dumping and countervailing measures. The deadline for the Trade Remedies Department to receive applications is April 21, 2025.

The application must be submitted directly to the Trade Remedies Department within the aforementioned deadline at the following address:

3rd Floor, Damage Investigation and Safeguards Division, Trade Remedies Department, Ministry of Industry and Trade, 54 Hai Ba Trung Street, Hoan Kiem District, Hanoi .

Contact person: Nguyen Duc Trong; Tel: 0969966066; Email: trongnd@moit.gov.vn

Source: https://moit.gov.vn/tin-tuc/thong-bao/thong-bao-tiep-nhan-ho-so-ra-soat-cuoi-ky-viec-ap-dung-bien-phap-chong-ban-pha-gia-va-thue-chong-tro-cap-chinh-thuc-doi-.html

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

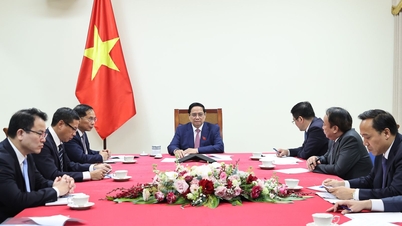

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)