Leaving banks, where will the money flow?

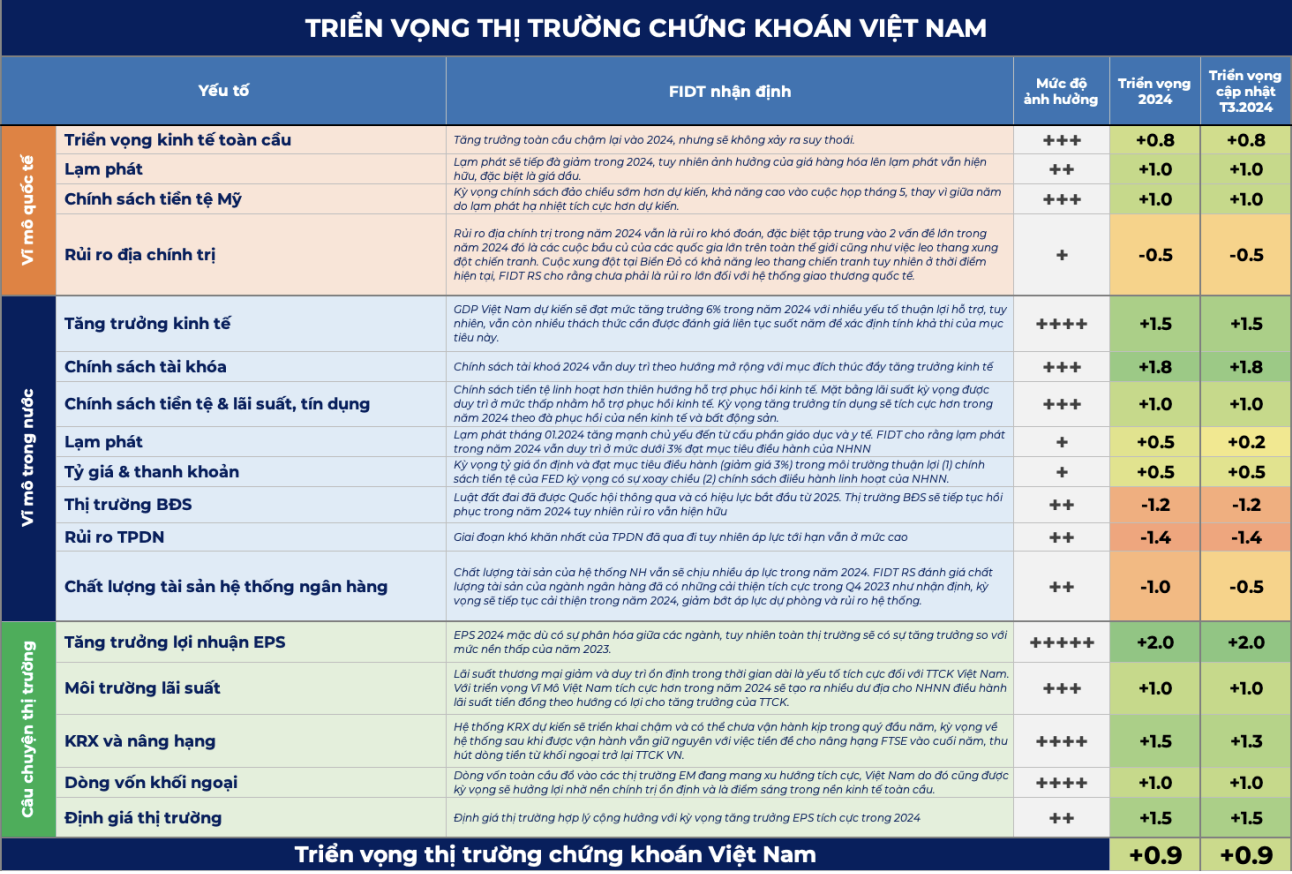

According to the research and analysis team from FIDT JSC, the stock market in March still has a positive outlook. However, the market's growth momentum will be affected because large-cap industries such as banking, residential real estate, industrial real estate, etc. are forecast to decline.

"Cash flow will shift from the banking sector to real estate in the coming time. Although interest rates have shown signs of increasing recently, they are still at a low level. It is expected that good interest rates will help capital penetrate into the real estate sector, especially residential real estate. From there, the outlook for the steel industry will become brighter.

In addition, the securities industry is also in a relatively cheap valuation state. Cash flow in the circulating state is expected to shift to the securities industry. The effect of KRX and securities upgrading is still there, creating a positive sentiment for investors, making the securities industry more attractive" - FIDT said.

According to FIDT, the market in March will face more skepticism. Firstly, the economic picture is still not really clear and the recovery prospect is really confirmed in the upcoming first quarter GDP results, which is still something investors need to monitor.

Second, the market has increased for quite a long time and needs a short-term adjustment. Through that, money can circulate to other sectors after the market-pushing force from the banking group has gradually cooled down.

Sell hot stocks to find new opportunities

Forecasting this month, FIDT said that the market is likely to experience a technical correction. Reacting to the corrections is a good opportunity for investors to accumulate more potential stocks to wait for the next increase of VN-Index.

"Cash flow in the coming period will rotate to industries and stocks with stories of recovery in business results such as export groups, real estate, retail..." - FIDT forecasted.

Accordingly, for investors with a high proportion of stocks (greater than 70%), the current time is an opportunity to restructure the portfolio, gradually reducing the proportion of stocks that have increased rapidly in the recent period. At the same time, increase stocks with recovery stories that are still in the price range or have not increased too much to ensure a safe position.

In addition, investors with a low stock ratio (less than 70%) can confidently buy stocks with recovery stories that are still in the price range or have not increased too much. At the same time, boldly increase the ratio during general market corrections.

For swing trading, investors can trade short-term within the fluctuation range and should not chase buying during strong index increases. Besides, they can bravely open buy when the market adjusts to the lower range. Avoid using strong margin when short-term volatility conditions are very high and difficult to predict.

Source

![[Photo] President Luong Cuong attends the National Ceremony to honor Uncle Ho's Good Children](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/9defa1e6e3e743f59a79f667b0b6b3db)

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

![[Photo] In May, lotus flowers bloom in President Ho Chi Minh's hometown](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/aed19c8fa5ef410ea0099d9ecf34d2ad)

Comment (0)