|

Banking and real estate still account for the majority of transaction value

The "Corporate Bond Focus March" newsletter released by FiinRatings on March 28 said that compared to the beginning of the year, the market recorded 77 more problem corporate bond lots (calculated including the value of bond lots with delayed interest/principal payments and corporate bonds with delayed payment terms compared to the original maturity date, calculated cumulatively up to February 28, 2025), worth VND5.54 trillion. However, the added value has reached the lowest level since the peak of problem corporate bonds in February 2023. Of which, 63.4% of the value comes from the real estate group. These businesses have had a series of previously delayed corporate bond lots and still have large debt obligations due in the next 12 months, signaling continued delays/delays in 2025 for the above group.

In addition, in February, some other industries such as manufacturing and trade services still had more problematic corporate bonds. However, FiinRatings believes that the decrease in the rate of problematic corporate bonds is still a positive sign showing that the corporate bond market has passed the screening stage and is starting to recover.

Regarding the primary market, in the first two months of the year, the total issuance value reached 5.5 trillion VND with 4 issuances, down 44.1% compared to the same period last year. In particular, February recorded no new issuances in both the private and public markets due to the Lunar New Year holiday.

|

Most of the newly issued corporate bonds came from credit institutions to supplement Tier 2 capital, accounting for 94.6% of the total issuance value.

“Banks will continue to boost bond issuance in 2025 to meet capital needs for credit growth and the requirement to reduce savings interest rates will widen the gap between credit growth and deposit growth,” FiinRatings assessed.

On the other hand, the early stage of the year lacked the participation of non-financial enterprises. In the coming time, the draft amendment to Decree 155, which imposes stricter regulations on debt ratios for issuing enterprises, may have some impact on public issuance activities.

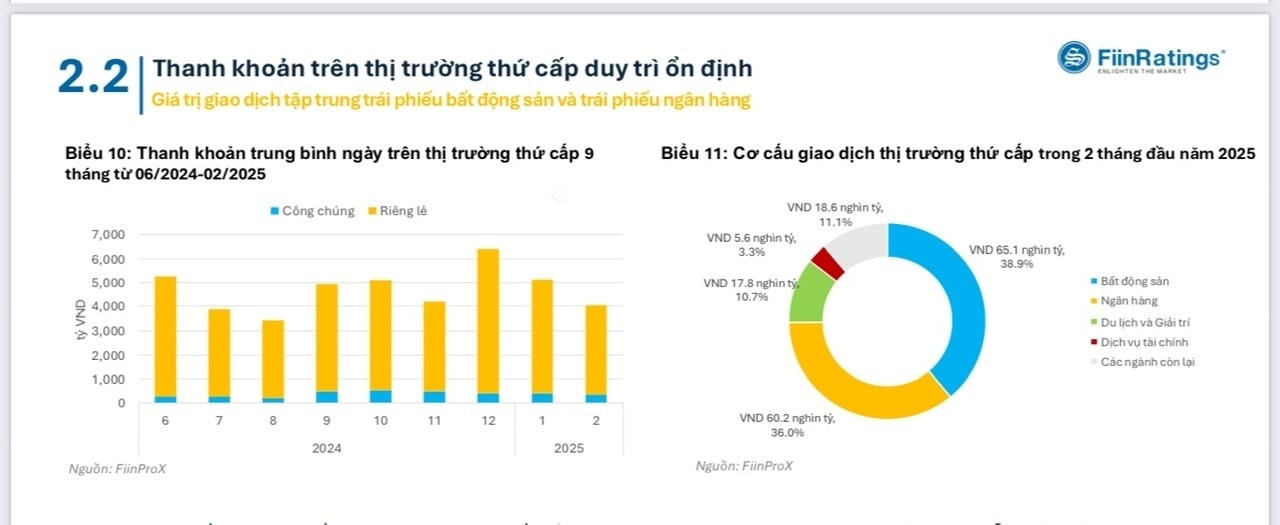

Overall, in the first two months of 2025, the total value of bond transactions (both public and private bonds) reached VND167.2 trillion, up 19% compared to the peak in December 2024. Transactions in the first two months of the year were mainly concentrated in January, although there were only a few days of trading due to the holidays, liquidity in February was still high compared to some times of the previous year.

The banking and real estate sectors still accounted for the majority of transaction value in the first two months of the year, with proportions reaching 36% and 38.9%, respectively, equivalent to an increase of 35.6% (reaching VND 60.2 trillion) and 7% (reaching VND 65.1 trillion).

The cumulative corporate bond repurchase activity in the first two months of 2025 reached over VND17.2 trillion, up 22.0% over the same period last year. However, the repurchase value in February only reached VND3.85 trillion, down 71.2% compared to January, at the lowest level in the past 3 years.

FiinRatings believes that the decline in repurchase demand from real estate issuers is the main cause of the above situation, reflected in the industry's repurchase value in February decreasing by 95% compared to the previous month.

Banks remain the main buyers of corporate bonds

In the second quarter of 2025, FiinRatings estimates that VND40.6 trillion of individual corporate bonds will mature. Specifically, VND16.5 trillion of maturity (40.7% of total value) belongs to the real estate group, VND11.9 trillion (29.2% of total value) belongs to other sectors, and VND8.2 trillion (20.2% of total value) belongs to the credit institution group.

|

Accordingly, some issuers with large maturity values include Vietinbank (VND 4,950 billion), Wincommerce (VND 3,000 billion), TNR holdings (VND 2,923 billion) and TNL Asset Leasing (VND 2,862 billion).

Forecasting the corporate bond market in 2025, FiinRatings believes that the outstanding value of the corporate bond market will increase by 15-20%. In particular, banks must continue to increase the issuance of Tier 2 capital, which is corporate bonds, to meet credit growth requirements as directed by the Government while the mobilization interest rate is controlled to not increase. This will put pressure on meeting current capital safety indicators such as regulations on loan-to-deposit ratio (LDR) and using short-term capital for medium and long-term loans. Many banks have plans to increase Tier 1 capital (equity capital), but it takes a long time and depends on the context of the stock market to be able to implement and complete.

Experts said that new regulations on private bond issuance and public offering are expected to be applied in the second half of 2025 as a basis for improving the quality of bond products and attracting investors to participate in this investment channel in the context of low savings interest rates.

“Banks are still the main buyers of corporate bonds thanks to high credit growth targets, which will be the basis for banks to increase their investment proportion or credit structure in the form of corporate bonds,” FiinRatings commented.

The announced corporate bond issuance plans mostly belong to credit institutions with a growing need for medium and long-term capital to serve the target of increasing credit growth. In addition, real estate enterprises are likely to have more corporate bond issuance plans this year as the business environment improves.

Source: https://thoibaonganhang.vn/thi-truong-trai-phieu-doanh-nghiep-co-the-tang-15-20-trong-nam-2025-162009.html

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

Comment (0)