|

| Photo: Nguyen Linh |

On April 22, 2025, in Hanoi, the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) in collaboration with the Asian Development Bank (ADB) organized a workshop to announce the report "Vietnam Financial Market 2024 and Prospects 2025". The report provided a comprehensive, transparent and objective picture, helping policymakers, investors and the financial community gain a deeper insight into the developments and development trends of the market in a volatile context.

|

| Mr. Tran Phuong - Deputy General Director of BIDV - Photo: Nguyen Linh |

Signs of recovery, but challenges remain

2024 will see a global economic recovery, but uneven. While global inflation is likely to cool, creating conditions for central banks to ease monetary policy, the geopolitical environment and trade and technology competition pose many potential risks. In that context, Vietnam continues to pursue a proactive, flexible and adaptive monetary policy to promote growth, control inflation and maintain macroeconomic stability.

|

| Mr. Nguyen Ba Hung, Chief Economist of ADB in Vietnam, speaking at the Workshop - Photo: Nguyen Linh |

With GDP growth of 7.09%, inflation controlled at 3.63%, credit growth of 15.08%, capital mobilization increasing by 10.5% and exchange rate maintained under control despite strong pressure on the USD appreciation, Vietnam's financial market in 2024 achieved relative stability and some positive results. In the banking sector, pre-tax profits of 27 listed commercial banks reached about VND299 trillion, up 17.2% compared to 2023 - a significant growth in the context of increasing bad debt pressure and the need to increase equity capital.

The stock market also had a positive recovery when the VN-Index increased by 12.11%, capitalization value increased by 14.3% and market liquidity improved significantly. Notably, the corporate bond market recorded a clear recovery with a total issuance value of VND466.5 trillion, up 27.7% compared to the previous year.

However, risks and shortcomings in the financial system still exist. The trend of bad debt is increasing, the bad debt coverage ratio of credit institutions tends to decrease, the pressure to increase capital of credit institutions is increasing...

The insurance sector is facing difficulties as market confidence has not recovered after incidents related to joint investment and the impact of natural disasters (compensation for damage caused by Typhoon Yagi).

Along with that, the legal framework and pilot mechanism (sandbox) for digital assets, digital finance and digital currency are still slow to be issued...

Positive outlook but with many potential external risks

In 2025, the international context is expected to be more volatile, especially after Donald Trump was elected President of the United States. New policies on trade, tariffs, international investment and foreign relations from the new administration can have a strong impact on the global economy, including Vietnam. In particular, the issue of reciprocal tariffs between Vietnam and the US is considered a key factor affecting economic growth in 2025.

|

| Dr. Can Van Luc, Chief Economist of BIDV - Photo: Nguyen Linh |

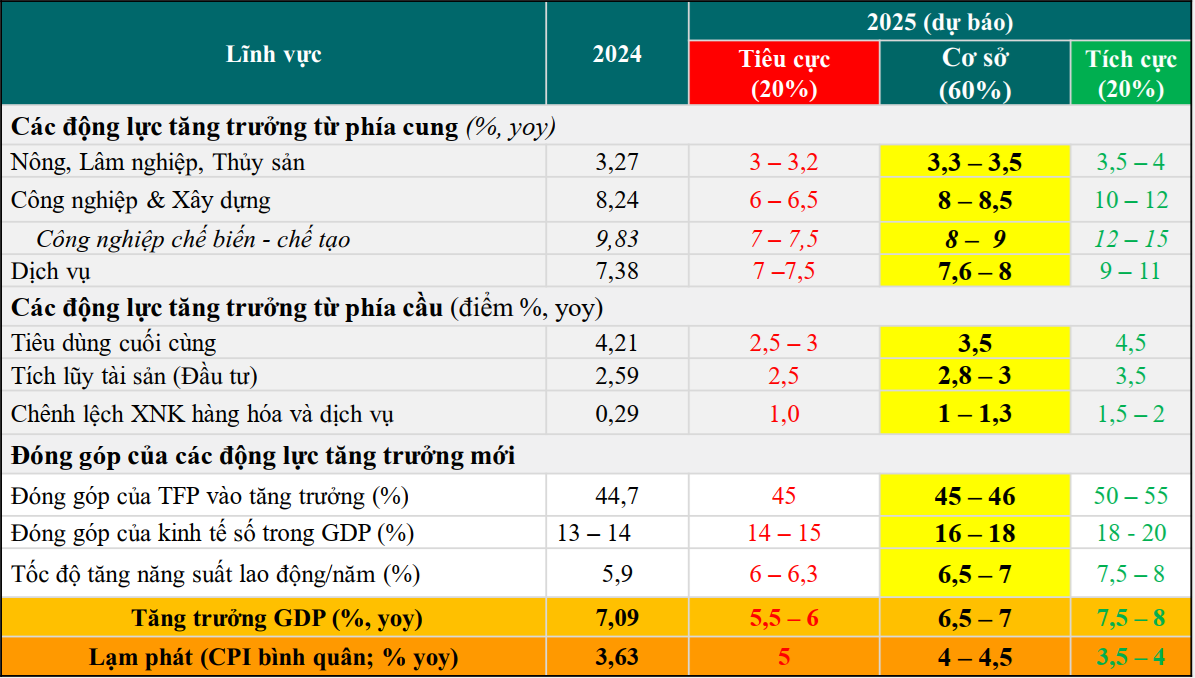

Presenting the Report, Dr. Can Van Luc - Chief Economist of BIDV said that with the baseline scenario (probability 60%) - assuming the possibility of successful negotiations to reduce the corresponding tax rate to 20-25%, GDP growth in 2025 could reach 6.5-7%.

In the positive scenario (20% probability), the tariff rate is only about 10%, GDP growth can reach 7.5-8%. In the negative scenario (20% probability), the US will still impose a 46% reciprocal tariff (or only slightly reduce it), GDP growth will be very negatively affected, decreasing by 1.5-2 percentage points, reaching only 5.5-6% in 2025.

|

| GDP growth and inflation in 2024; forecast for 2025 (Source: TCTCK; Forecast and calculation research group) |

In the baseline scenario, inflation in 2025 is forecast at 4-4.5%, while credit growth is estimated to increase by about 14-15% (due to weak demand and capital absorption in some sectors, slow recovery of the real estate market with high real estate prices, beyond the affordability of many people).

The State Bank of Vietnam is expected to continue to operate monetary policy proactively, flexibly, promptly, effectively, in close coordination with fiscal policy and other macroeconomic policies, contributing to supporting economic growth, stabilizing the macro economy, and controlling inflation. Interest rates are expected to remain low, lending interest rates will decrease slightly according to the direction of the Government and the State Bank of Vietnam. The USD/VND exchange rate is forecast to be under increasing pressure but will be in a tug-of-war, increasing by about 3-4% throughout the year.

However, the financial market in 2025 still has many issues that need to be controlled, such as: Unexpected and unpredictable fluctuations in the international market (especially the US tariff issue) and their impacts; the pressure on corporate bonds maturing is still quite large and falls heavily on real estate businesses; bad debt is under increasing pressure, requiring early legalization of Resolution 42/2017 of the National Assembly for more fundamental handling; the risk of interconnection between the real estate market and the financial market is still latent.

Regarding the corporate bond market, after a prolonged period of stagnation since 2022, the corporate bond market in 2024 has shown clear signs of recovery in both issuance scale and investor sentiment. However, the Report states that this recovery is still unsustainable and many issues need to be improved. In the short term, there is pressure from a large number of maturing bonds, and in the long term, there are structural issues, such as the structure or form of issuance; the basis, structure and quality of investors, etc.

Some key policy recommendations

In order to promote stable and sustainable development of the financial market in 2025 and the following years, the Report has made a number of specific policy recommendations: (i) develop a more balanced financial market, reduce the burden of medium- and long-term capital supply on the banking system; (ii) promote the development and early upgrading of the stock market; (iii) increase the economy's capacity to supply and absorb capital; (iv) promote sustainable development, green finance; enhance the application of science and technology, digital transformation, and data management in the spirit of Resolution 57/2024/NQ-TW; (v) strengthen the mechanism and effectiveness of coordination between management agencies in controlling risks to the financial system and sustainable development.

|

In addition, to develop the corporate bond market, both short-term and long-term solutions are needed. In the short term, the urgent issue is to properly resolve the situation of late payment and maturity of corporate bonds, regaining investor confidence; as well as promptly reforming procedures and conditions, shortening the time for granting licenses to issue bonds to the public to encourage businesses to issue more. In addition, it is necessary to supplement policies to encourage and disclose credit rating information for businesses in general (not only for issuing corporate bonds), with a group of criteria requiring credit rating.

In the long term, the Research Team proposed five main groups of solutions, including: (i) Continuing to improve legal regulations related to bond issuance, including the government bond market to create a benchmark for interest rates; (ii) Completing infrastructure for the corporate bond market such as a centralized secondary market, information and data base on bonds and collateral; (iii) Completing the market management and supervision mechanism; (iv) Diversifying and improving the quality of both primary and secondary investors; (v) The management and development orientation of this market need to be closely linked to the management and supervision of risks in the financial system.

Speaking at the workshop, BIDV Deputy General Director Tran Phuong said that for the past three consecutive years (2022-2024), BIDV has cooperated with ADB to organize annual workshops on Vietnam's financial market and prospects. The workshops have attracted the attention and appreciation of management agencies, experts, domestic and foreign financial institutions, associations, research institutes, and the media. This year, following the success of the previous three reports, BIDV - with the professional support of ADB - continues to implement the Report: "Vietnam's financial market 2024 and prospects 2025". To date, this is the only report that comprehensively assesses the Vietnamese financial market, including the fields of Banking - Securities - Insurance. “We believe that this series of reports has been and will contribute to providing comprehensive, independent, objective and transparent information about the Vietnamese financial market. At the same time, the report also identifies trends, opportunities and challenges of the market, thereby providing practical solutions and recommendations to promote the development of the Vietnamese financial market in a safe, effective and sustainable manner,” said Mr. Tran Phuong. |

Source: https://thoibaonganhang.vn/thi-truong-tai-chinh-viet-on-dinh-giua-the-gioi-bat-dinh-163167.html

![[Photo] The moment Harry Kane lifted the Bundesliga trophy for the first time](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/68e4a433c079457b9e84dd4b9fa694fe)

![[Photo] Prime Minister Pham Minh Chinh chairs the fourth meeting of the Steering Committee for Eliminating Temporary and Dilapidated Houses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/e64c18fd03984747ba213053c9bf5c5a)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

![[Photo] National Assembly Chairman works with leaders of Can Tho city, Hau Giang and Soc Trang provinces](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c40b0aead4bd43c8ba1f48d2de40720e)

Comment (0)