| Agricultural market last week: Agricultural futures prices moved in opposite directions. ASEAN's plant-based agricultural market has the potential to reach 290 billion USD. |

The main driver of this downward trend is the global supply outlook, and two important upcoming reports on U.S. agricultural markets could shed some light on the rest of the picture.

The US Department of Agriculture (USDA) will release its 2024 Prospective Plantings report and its quarterly Grain Stocks report at 11 p.m. on March 28. These figures will reflect the situation and prospects of US agricultural crops such as corn, wheat, and soybeans.

Countries, including Vietnam, that rely heavily on imported feed ingredients will pay special attention to the adjustments in the two reports to assess the impact on global agricultural prices. This will help businesses develop more flexible purchasing strategies, thereby avoiding unexpected fluctuations in the market.

|

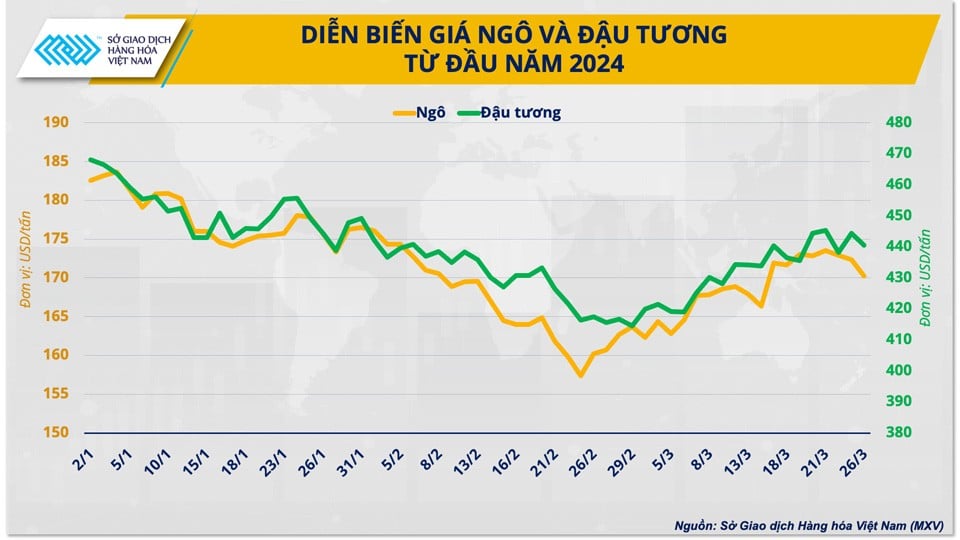

| Corn and soybean price developments from the beginning of 2024 |

Impact from new crop supply will be limited

The second quarter will mark a shift in the focus of agricultural markets from the South American harvest to the new U.S. crop season. Before the official figures are released tomorrow evening, USDA provided its first overview and acreage expectations at the World Agricultural Forum 2024 in February.

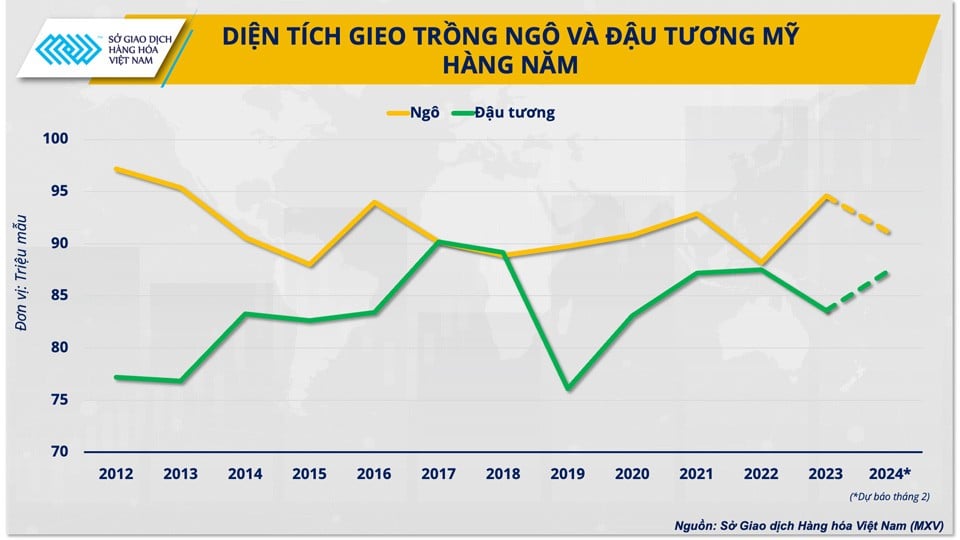

Accordingly, US farmers are forecast to plant 91 million acres of corn, down significantly from 94.6 million acres in 2023. In contrast, the USDA forecasts soybean acreage at 87.5 million acres, up from 83.6 million acres last year. The shift in equivalent acreage between corn and soybeans is evident.

|

| US corn and soybean planting area |

Global agricultural prices have been high in recent years, but have fallen sharply in the past few months. Profits from agricultural production in the US have fallen as global supplies recover after two years of tightening. For a commodity that requires high production costs such as corn, it is not surprising that acreage is forecast to shrink this year.

Soybeans are a more attractive commodity in the current climate. Soybean crushers in the U.S. are expanding to meet the growing demand for renewable fuels. Consumption continues to outpace production, which will be one of the key factors in deciding where to plant this year’s soybean crop.

|

| Mr. Pham Quang Anh, Director of Vietnam Commodity News Center |

Assessing the impact of the 2024 Crop Outlook report, Mr. Pham Quang Anh, Director of the Vietnam Commodity News Center, said: “Although the market has mixed expectations about supply, prices of agricultural products will generally not be affected too much after this report. Past adjustments to data show that the planting area will be based on the market context and price fluctuations in the first quarter of each year. Thus, the element of surprise compared to the USDA's forecasts from February will be unlikely.”

US exports gradually recover

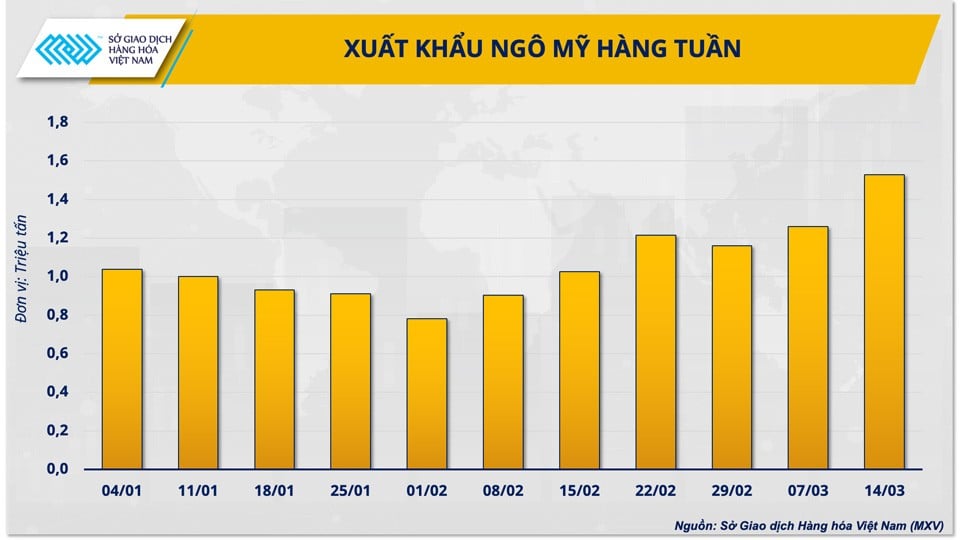

On the demand side, corn remains the most promising export commodity among the three major US agricultural commodities, largely due to increased sales to traditional customers such as Mexico, Japan and Colombia.

According to the Export Sales report, US corn sales for the 2023/24 crop year remained high last week at 1.19 million tonnes. Demand in Mexico - the top importer of US corn - is still increasing as drought has significantly affected domestic production in the current crop year.

|

| US Weekly Corn Exports |

Along with the forecast for the new crop situation, the USDA will also release inventory data for US agricultural products as of March 1, 2024. Currently, most analysts are predicting that supplies will increase compared to the same period last year due to record corn production in the previous harvest. However, based on the positive export situation in the first 3 months of the year in the US, agricultural product inventories may be tighter than market expectations, Mr. Pham Quang Anh commented.

What scenario will the livestock industry face?

The two upcoming key USDA reports are unlikely to cause a dramatic reversal in feed ingredient prices, but they should provide a clearer picture of U.S. agricultural supply and demand after a period when the market has been largely driven by seasonal activity in Brazil.

This could be one of the quieter periods as prices await further news on Brazil’s main corn crop and upcoming U.S. production conditions. Earlier this month, the Crop Supply Agency (CONAB) lowered its forecast for Brazil’s total corn production to 112.7 million tons, well below the USDA’s 124 million tons. As of this week, the second corn crop, which accounts for about three-quarters of the country’s total output, has completed planting. However, frost risk and weather uncertainties during development and harvest could still pose a potential for new price increases.

For the US, if the acreage factor is clarified after tomorrow night's report, the 2024/25 corn yield is a big question mark for the market. The hottest period of the year in the US occurred at the end of the second quarter, which could create market concerns about the possibility of lost production. This also explains the price increases and peaks of corn and soybeans that have historically been recorded in May and June.

Assessing the impact and situation of domestic purchases, Mr. Pham Quang Anh said: “Most of our livestock enterprises have taken advantage of the recent sharp decline to purchase goods until the first half of this year. However, the unpredictable fluctuations in agricultural product prices over the past 3 years have made the market more sensitive, especially before important reports. With the risk scenario from weather that could negatively affect the world's two leading agricultural producing countries, the current price range will be an opportunity for enterprises to continue to add new shipments for the third quarter of 2024, before new increases form in the next few months.”

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)