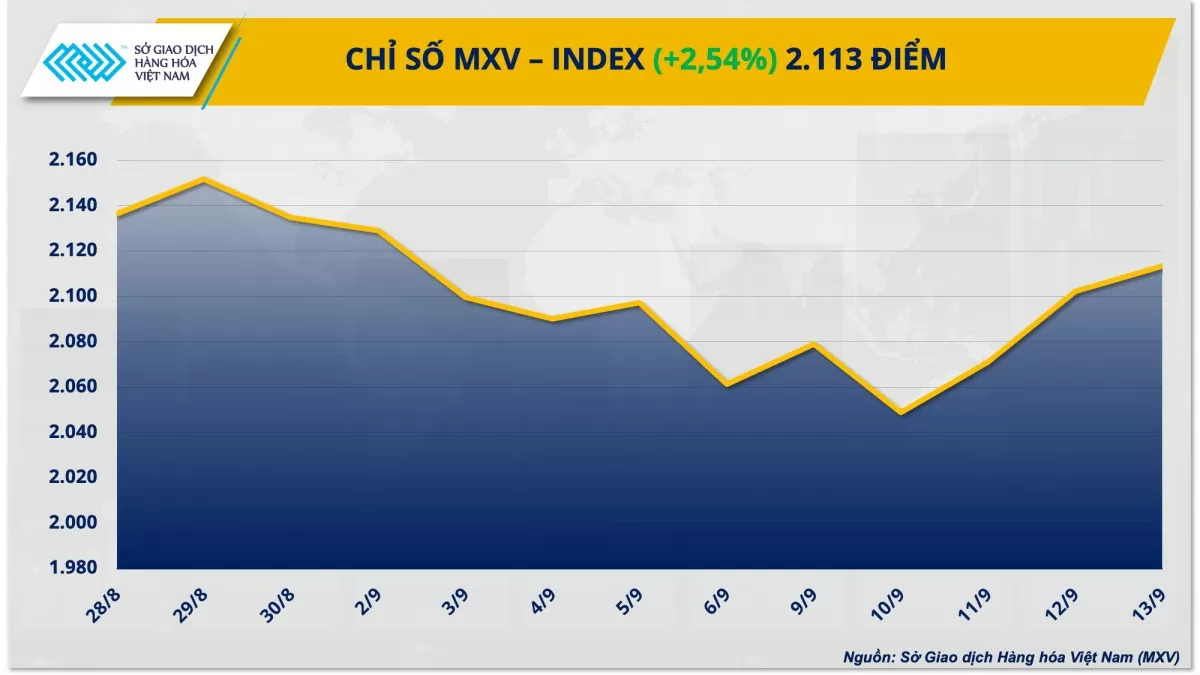

| Commodity market today, September 12: Strong buying power returns to the market, pulling the MXV-Index back Commodity market today, September 13: Strong investment cash flow into the energy and metal markets |

Prices of many commodities have skyrocketed thanks to support from macro factors and supply and demand. Notably, in the precious metals market, silver prices jumped more than 10% to a peak in nearly two months, while platinum prices also hit their highest level since July this year. The industrial raw materials market, especially coffee, attracted special attention from investors as it continued to set records. At the end of the week, the MXV-Index increased by 2.54% to 2,113 points.

|

| MXV-Index |

Strong cash flow into precious metals market

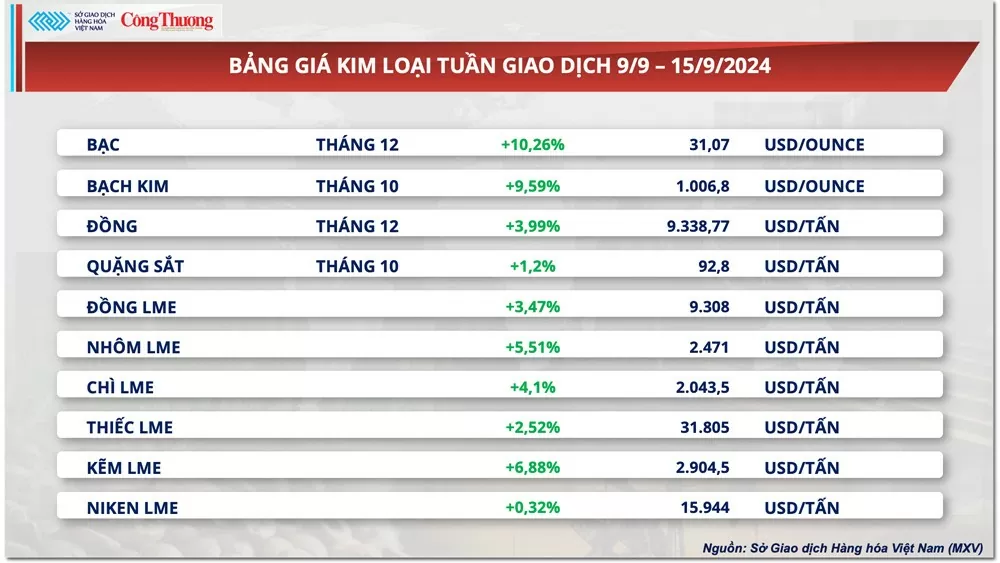

At the end of the trading week, all metals recovered after the previous red week. For precious metals, silver jumped 10.26% to $31.07/ounce, the highest level in nearly two months. This was also the biggest weekly increase of silver prices since early April this year. Platinum reclaimed the $1,000/ounce mark thanks to a 9.59% increase, closing the week at $1,006.8/ounce, the highest level since mid-July.

|

| Metal price list |

The strong cash flow into precious metals last week was mainly due to clearer signals about the US Federal Reserve’s interest rate cut scenario. Besides the safe haven investment channel of precious metals, green also covered the US stock market, reflecting the general optimistic sentiment in the world financial market.

Specifically, according to data from the US Bureau of Labor Statistics, in August, the country's producer price index (PPI) increased 1.7% compared to the same period last year, a deceleration from the 2.1% increase in July and 0.1 percentage points lower than forecast. The consumer price index (CPI) also cooled to 2.5% in August, in line with market forecasts.

These data continue to confirm that inflation in the US is still on track to cool down to the Fed's 2% target, thereby strengthening the belief that the Fed will cut interest rates at the meeting on September 17-18. The FedWatch interest rate tracking tool shows that investors are currently betting on a 55% chance of a 25 basis point cut and a 45% chance of a 50 basis point cut.

For base metals, thanks to the support of macro factors, COMEX copper prices also recovered and increased nearly 4% to 9,338 USD/ton. In addition, expectations of increased copper consumption in China as the country enters its peak consumption season also helped pull copper buying power back into the market.

Data showed copper inventories in China continued to fall to 185,520 tonnes in the week ended September 9, the lowest since February 2024 and marking the 14th consecutive week of decline, reflecting increased demand for copper withdrawals from storage.

Adding to the support, concerns about tight copper supplies in major copper supplier Peru also helped underpin the rally. Data showed copper production in the country fell 3.2% year-on-year to nearly 222,390 tonnes in July.

Prices of some other goods

|

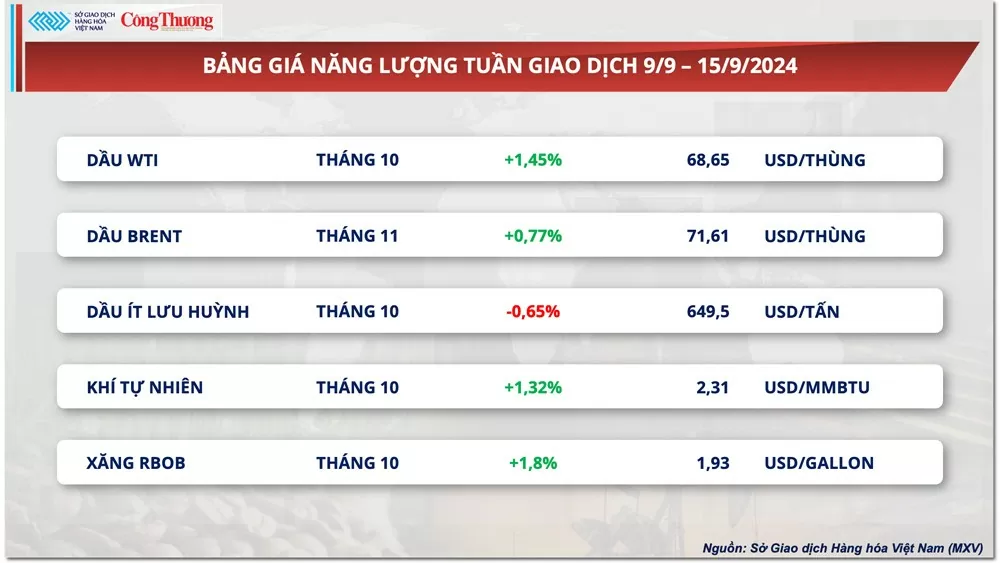

| Energy price list |

|

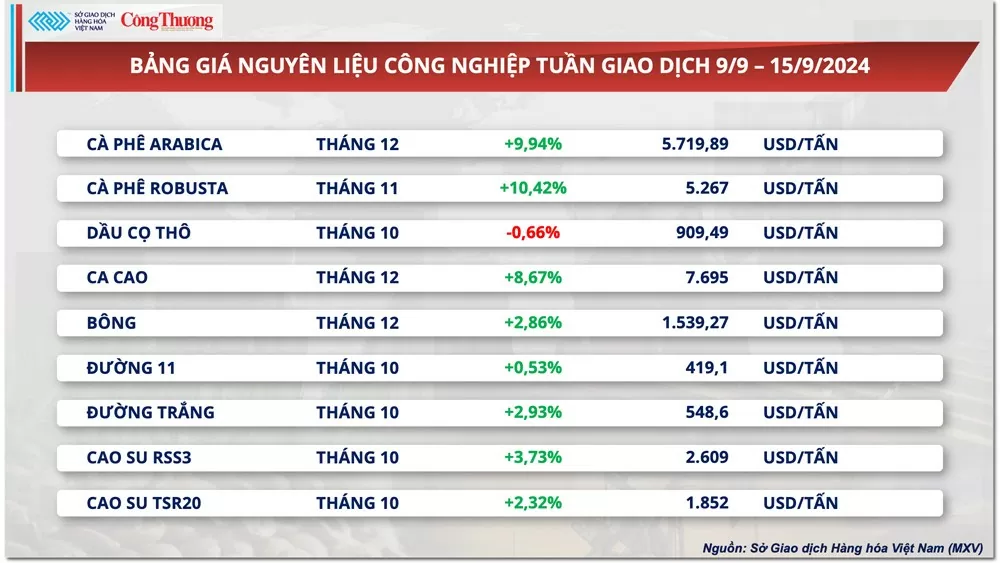

| Industrial raw material price list |

|

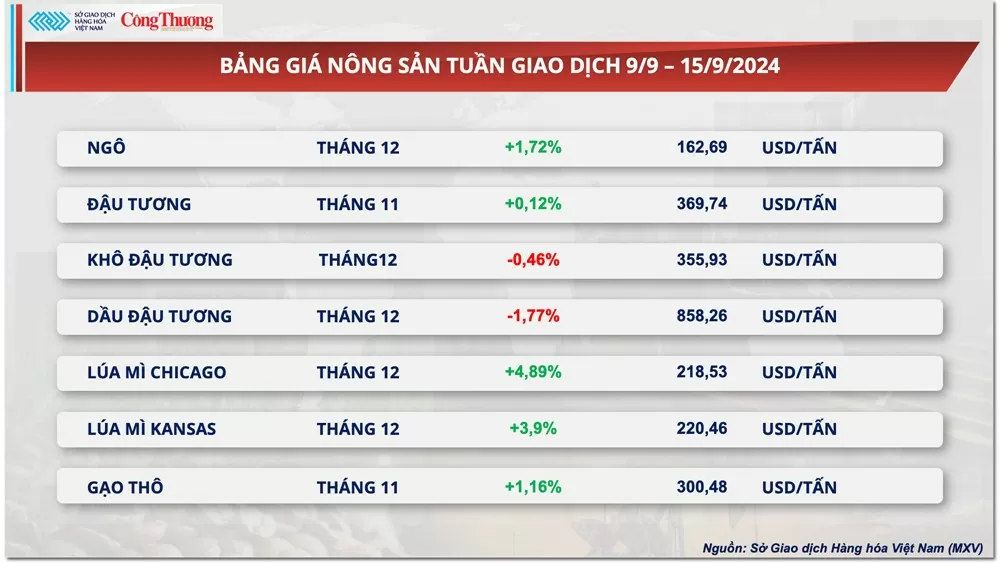

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-169-thi-truong-hang-hoa-the-gioi-trai-qua-tuan-giao-dich-soi-dong-346151.html

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)