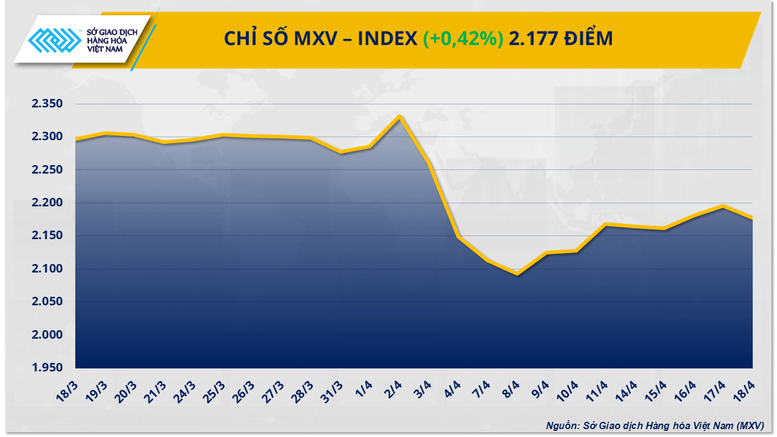

This week, if there are no unexpected developments, the raw material commodity market is expected to continue to recover, with the price index surpassing the 2,200 point mark.

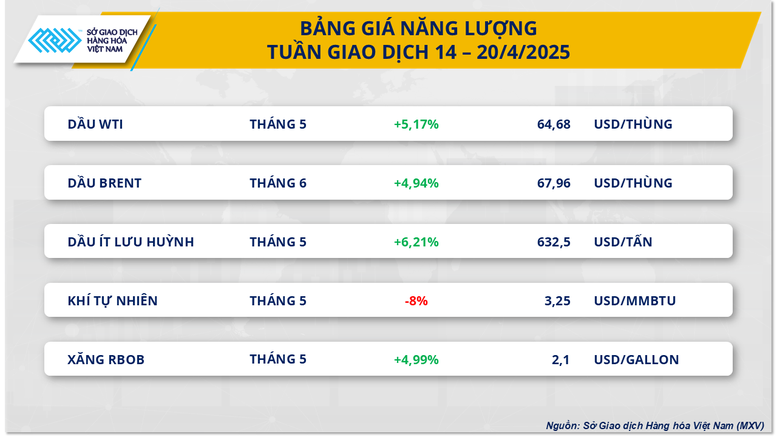

According to MXV, the energy market continued to attract attention as it led the overall market's growth. Prices of 4/5 commodities increased sharply by 4-6% compared to last week. Of which, two crude oil commodities increased by about 5% as the market gradually adapted to the new US tariff policies and supply concerns from the end of March returned.

On Friday, April 18, the NYMEX and ICE EU exchanges were closed for the holiday, so the prices of Brent and WTI crude oil stopped at $67.96/barrel and $64.68/barrel respectively when they closed on Thursday (April 17). This was also the trading session with the strongest price increase of the week after the meeting between US President Donald Trump and Italian Prime Minister Giorgia Meloni at the White House. Optimistic statements from both heads of state about the possibility of reaching a new trade agreement between the US and the European Union (EU) reheated the market.

Meanwhile, concerns about oil supplies have returned as the US tightened sanctions on Iranian and Venezuelan crude oil and OPEC+ announced a plan to cut production.

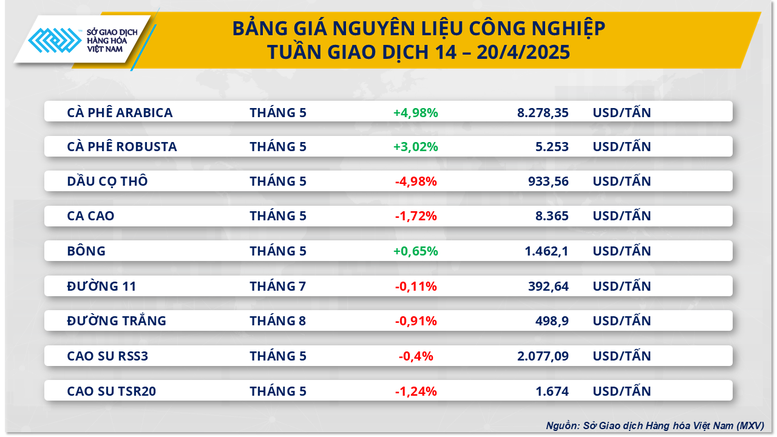

At the end of the last trading week, the prices of two coffee commodities reversed to increase after three consecutive weeks of decline. Closing the session on Thursday, the price of Arabica coffee reached 8,278 USD/ton, up 4.98% compared to the reference price; the price of Robusta coffee increased 3.02% compared to the price of last week, recovering to 5,253 USD/ton. The coffee market was temporarily closed on Friday to prepare for Easter.

According to MXV, after being affected by tariffs, the prices of the two coffee products have recovered significantly due to basic information. According to Cecafe, Conillion (Robusta) coffee exports in March continued to decline since August last year, only 61% compared to February and down more than 5 times compared to the same period last year. During the week, the NCDT report showed that coffee surpassed bottled water to take the number one position, being the most consumed beverage in the US with an average of 3 cups per day. In addition, the Real/USD exchange rate has increased by 6.1% since the beginning of the year, reducing the motivation for Brazilian coffee exports.

MXV believes that the coffee market is currently in a state of backwardation, when the price of the near-term standard futures contract is higher than the price of the far-term standard futures contract. The COT Arabica index on the ICE New York floor shows that the net position of the Managed money group (hedge fund) in the market announced on April 15 continued to decrease by 6,841 lots, at 35,243 lots. Of which, the long position decreased by 8,275 lots compared to last week, continuing to decrease by more than 18%.

The inventory situation recorded on the ICE exchange on April 17 fluctuated slightly, Arabica inventory increased slightly by 1.05% to 795,588 bags, Robusta inventory remained almost unchanged, still at the lowest level since the peak reached on March 25 at 4,414 lots according to the recent 3-month data, recorded on April 17 at 4,272 lots.

In the domestic market, recorded this morning (April 21), the price of green coffee beans in the Central Highlands fluctuated between 129,000-129,700 VND/kg, stable compared to yesterday but down from 3,500-4,000 VND/kg compared to April 17.

Another notable development in the industrial raw material market is that the price of Malaysian palm oil continued to plummet for the third week, losing nearly 5% compared to the previous week.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-the-gioi-dan-thich-nghi-voi-chinh-sach-thue-quan-moi-10225042109215428.htm

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

Comment (0)