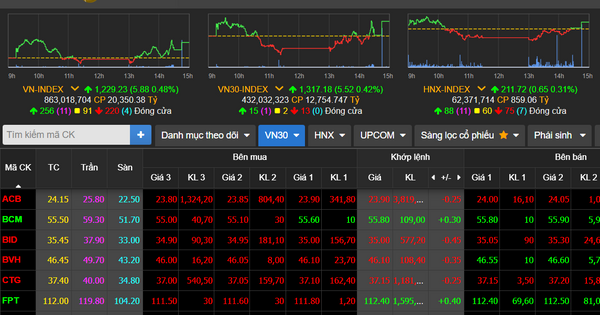

Dominant buying pressure helped the MXV-Index increase 0.3% to 2,298 points.

According to the Vietnam Commodity Exchange (MXV), at the end of last trading week, buying power dominated the energy market.

Commodity market prices of energy group covered in green. Source: MXV

At the end of the week, Brent oil price increased to 73.63 USD/barrel, equivalent to an increase of 2.04%; WTI oil price also increased by 1.58% this week; closing at 69.36 USD/barrel. At the end of the fifth trading session (March 27), the price of two crude oil products reached the highest level since the beginning of March.

Concerns about global oil supply shortages and the risk of increasing global trade tensions have impacted gasoline and oil prices.

Commodity market prices of industrial raw materials are mixed green - red. Source: MXV

Meanwhile, selling pressure dominates the industrial raw materials market.

Closing, Arabica coffee price decreased by 2.93% to 8,376 USD/ton, while Robusta price also decreased by 3.23% to 5,337 USD/ton.

Thus, compared to the record high price set in the middle week of February, Arabica coffee prices have lost more than 1,000 USD/ton; Robusta prices have also decreased by about 450 USD/ton.

In the domestic market, last week, the price of green coffee beans in the Central Highlands region fluctuated from 132,300 VND/kg to 135,400 VND/kg.

Recorded this morning (March 31), coffee prices ranged from 131,200 - 132,300 VND/kg, stable compared to yesterday but down 1,700 VND/kg compared to the beginning of last week.

Another notable development in the industrial raw materials market was the May raw sugar futures contract on the New York Stock Exchange, which fell 3.85% last week.

In contrast, cocoa prices ended the trading week with a strong increase of 3.57%, up to 8,042 USD/ton.

Source: https://hanoimoi.vn/thi-truong-hang-hoa-gia-dau-tang-tuan-thu-3-lien-tiep-ca-phe-dan-xa-moc-ky-luc-697394.html

![[Photo] Japanese Prime Minister's wife visits Vietnamese Women's Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/8160b8d7c7ba40eeb086553d8d4a8152)

![[Photo] General Secretary To Lam receives Chairman of the Liberal Democratic Party, Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/63661d34e8234f578db06ab90b8b017e)

![[Photo] Foreign tourists impressed by the way history is conveyed through interactive exhibitions at Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/6bc84323f2984379957a974c99c11dd0)

![[Photo] Living witnesses of the country's liberation day present at the interactive exhibition of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/b3cf6665ebe74183860512925b0b5519)

![[Photo] General Secretary To Lam's wife and Japanese Prime Minister's wife make traditional green rice cakes together](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/7bcfbf97dd374eb0b888e9e234698a3b)

![[Podcast]. Loving my old mother...](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/9469ccef275047fea3cad33463d1250e)

Comment (0)