The Vietnam Commodity Exchange (MXV) said that at the close of yesterday's trading session (April 10), dominant buying power helped the MXV-Index increase by 0.15% to 2,127 points.

Energy commodity market is "red". Source: MXV

According to MXV, the energy market is in red. In particular, the price of two crude oil products has returned to a strong downward trend.

At the end of the trading session, both Brent and WTI crude oil fell more than 3%. Brent crude oil price recorded a decrease of 3.28%, down to 63.33 USD/barrel; while WTI crude oil price stopped at 60.07 USD/barrel, down 3.66%.

The US announcement to raise tariffs on imported goods from China to 145% escalates trade tensions between the world's two largest economies.

Meanwhile, the US Energy Information Administration (EIA)'s short-term energy outlook report released yesterday forecasts a decline in global oil demand. The EIA also reduced its forecast for future oil prices due to OPEC+'s plan to increase production and concerns about a global economic recession. These factors continue to put great pressure on the energy market.

The metal commodity market is "bright green". Source: MXV

Meanwhile, the metal market witnessed strong gains in all 10 commodities.

Silver prices increased by 1.13% to $30.76/ounce. Meanwhile, platinum prices also increased by 1.46% to $933.3/ounce.

Precious metals continued to be supported as global trade tensions escalated after China also raised retaliatory tariffs on goods imported from the US.

According to the minutes of the US Federal Reserve’s March meeting released on April 9, policymakers agreed to slow down the pace of quantitative tightening (QT). This means the FED will loosen monetary policy, thereby maintaining abundant liquidity in the banking system, helping to promote cash flow into safe-haven assets such as precious metals.

For the base metals group, COMEX copper prices rose 3.43% to $9,560/ton. In addition, iron ore jumped 2.49% to $97.14/ton.

Source: https://hanoimoi.vn/thi-truong-hang-hoa-gia-dau-dot-ngot-lao-doc-698582.html

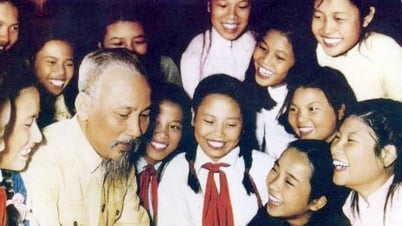

![[Photo] President Luong Cuong attends the National Ceremony to honor Uncle Ho's Good Children](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/9defa1e6e3e743f59a79f667b0b6b3db)

![[Photo] In May, lotus flowers bloom in President Ho Chi Minh's hometown](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/aed19c8fa5ef410ea0099d9ecf34d2ad)

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

![[Photo] Close-up of An Phu underpass, which will open to traffic in June](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/5adb08323ea7482fb64fa1bf55fed112)

Comment (0)