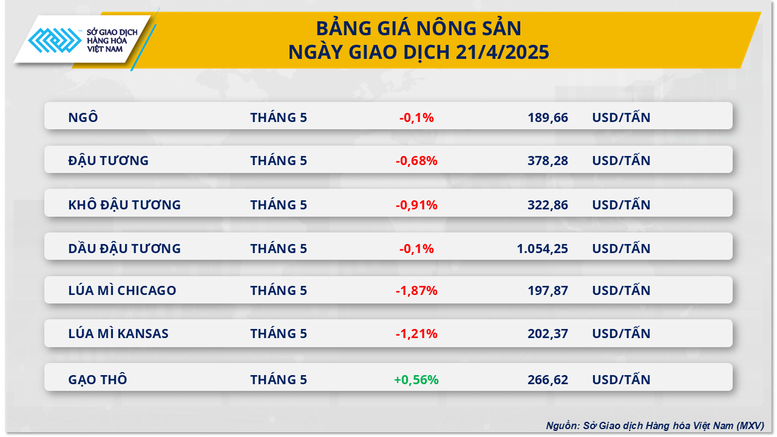

With 6/7 commodities simultaneously decreasing in price, the agricultural market attracted attention in yesterday's trading session. In addition, the metal group was clearly differentiated in the context of supply and demand going in opposite directions.

Soybean prices closed in reverse

According to MXV, soybean prices recorded a slight decrease of 0.68% to 378 USD/ton in the first trading session of the week. The market could not maintain its upward momentum in the early session, as prices quickly turned to weaken following the general trend of agricultural products.

Weather in the US has had little impact on the market. Heavy rains over the weekend in Texas, Oklahoma and Missouri have improved soil moisture in dry areas, supporting planting progress in the Midwest. While some areas may experience delays due to rain, the market is still viewing this as a short-term risk and not a concern at this time.

China imported 2.44 million tonnes of US soybeans in March, up 12% year-on-year and bringing total first-quarter imports to 11.6 million tonnes, 62% higher than a year earlier, according to data from the General Administration of Customs.

However, experts predict that Brazilian soybeans will dominate the market in the coming months as the country’s harvest season peaks. In addition, China’s domestic soybean production is expected to increase by 2.5% this year, indicating a long-term trend of decreasing dependence on imports. This factor has contributed to the downward pressure on prices.

Meanwhile, some positive trade news has emerged but not enough to turn the market around. These include the US and India reaching a bilateral trade agreement and the proposal to levy a fee on Chinese ships under Section 301, which has been amended to exclude agricultural products, reducing risks to soybean exports. Japan is also said to be considering increasing soybean imports from the US, but no specific details have been provided.

Similar to soybeans, the two finished products, soybean meal and soybean oil, both weakened. Soybean oil prices decreased slightly by 0.1%, indicating that sellers have returned to the market after five consecutive sessions of increase. The lack of clarity on the US biofuel support policy continued to weaken the expectation of the country's soybean oil consumption, putting pressure on prices.

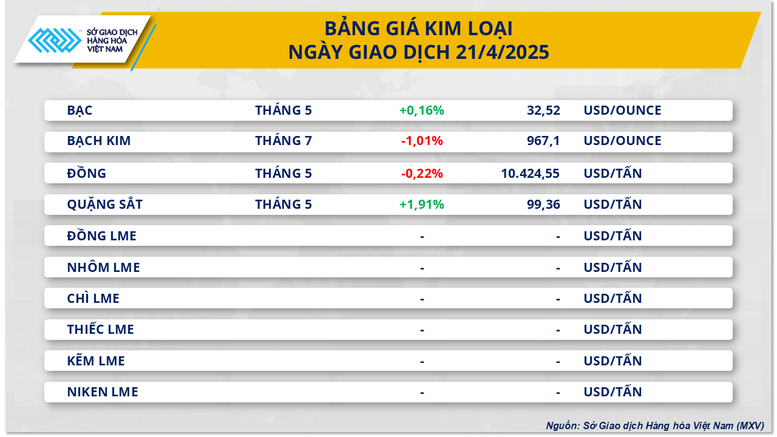

Metal market moves in opposite directions

The first trading session of the week witnessed a clear divergence in the metal market. In the precious metals market, silver prices closed up slightly by 0.16% to $32.52/ounce. Meanwhile, platinum prices turned to weaken by 1.01% to $967.1/ounce. The need for financial protection from investors has drawn money into the precious metals market, including silver, in yesterday's trading session.

On the other hand, platinum prices are under pressure as the outlook for auto consumption in the US becomes less positive, which could reduce demand for platinum in the production of auto catalytic converters. According to Cloud Theory, an organization that tracks car prices in the US, new car prices here have increased beyond the $50,000 mark and are expected to continue to increase. The sharp increase in car prices has made consumers more cautious in their purchasing decisions. Meanwhile, since February, many car manufacturers and dealers have proactively cut incentives and promotions, weakening purchasing power in the auto market.

For the base metals group, COMEX copper prices reversed and decreased by 0.22%, falling back to 10,424 USD/ton. Meanwhile, iron ore continued to increase by 1.91%, reaching 99.36 USD/ton.

Copper prices are under pressure as supply in China increased sharply in March. Elsewhere, iron ore extended its gains thanks to positive steel export data in China.

Source: https://baochinhphu.vn/thi-truong-hang-hoa-dien-bien-giang-co-phien-dau-tuan-102250422093753565.htm

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)