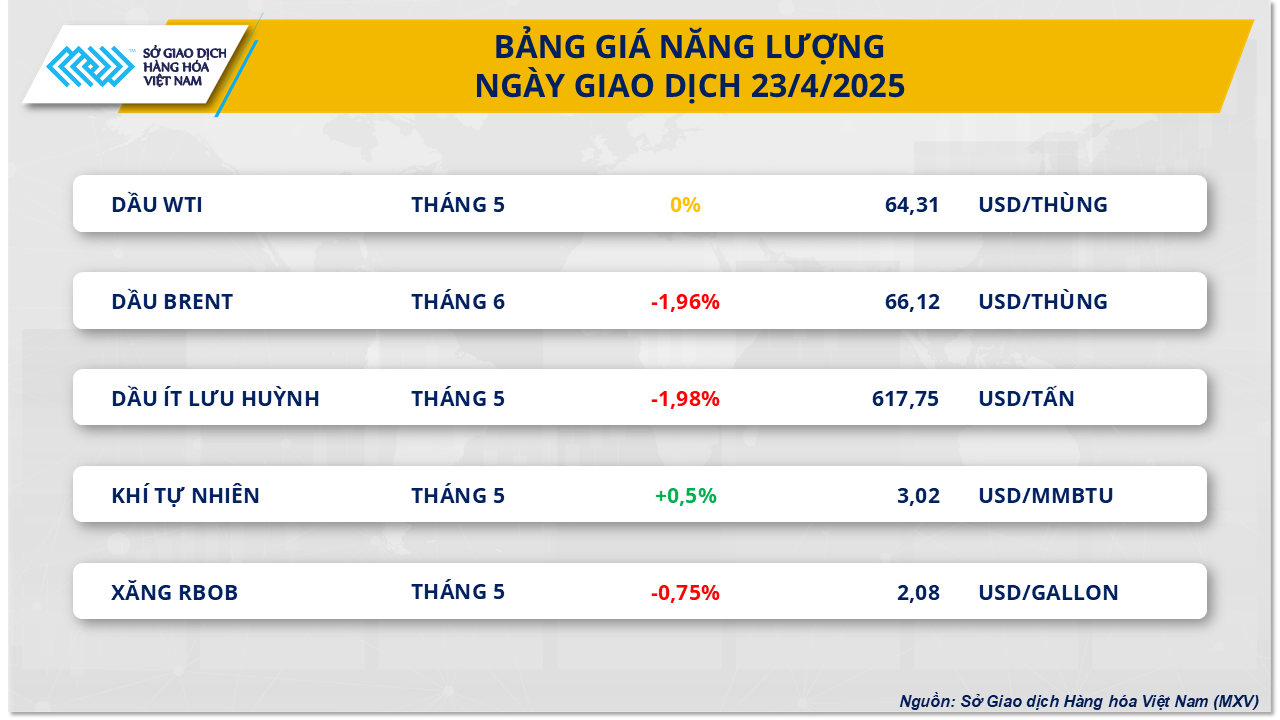

In the energy market, selling pressure dominated the market in yesterday's trading session. In the world crude oil market, information about supply from the OPEC+ group spread, causing great pressure, causing prices to reverse and fall sharply.

At the end of the session, Brent crude oil prices fell 1.96% to $66.12/barrel. Meanwhile, WTI crude oil futures for June delivery also fell 2.2% to $62.27/barrel. Previously, oil prices had recovered nearly 2% after new tensions in US-Iran relations.

The main reason for the decline in yesterday's trading session was market information about the possibility of an unusual increase in production by OPEC+. According to many sources, some member countries have proposed to increase production in June. Previously, in May, OPEC+ "pumped" 411,000 barrels/day, three times the original plan. In April, the group also increased production by 138,000 barrels/day. These developments have raised concerns about excess supply in the market, thereby pushing oil prices down.

In addition, the fact that some OPEC+ member countries have repeatedly exceeded their allocated crude oil production quotas has reinforced investors’ concerns, despite OPEC+ policies requiring cuts to excess production. Iraq and Kazakhstan are the two most prominent violators, although both have pledged to adjust their output as required by OPEC+. Data from Kpler shows that Iraq’s oil exports continued to increase in April, despite a promise to reduce 50,000 barrels per day from 4.2 million barrels per day. Meanwhile, Kazakhstan’s output fell only 3% in the first half of April, remaining at 1.47 million barrels per day – 129,000 barrels above its quota.

“We will try to adjust our actions. If our partners ... are not satisfied with the adjustment of our actions, then we will once again act in our national interests,” Kazakhstan’s Energy Minister Erlan Akkenzhenov said yesterday. The statement reflects the challenge of implementing OPEC+ commitments, with most of the country’s production controlled by multinationals such as Chevron and ExxonMobil. Kazakhstan’s failure to meet its OPEC+ target of cutting excess production has further weighed on oil prices.

Also yesterday, the US Energy Information Administration (EIA) released a weekly report showing that commercial crude oil inventories increased by about 244,000 barrels in the week ending April 18, contrary to previous predictions of a decrease, thereby further strengthening the downward momentum of oil prices. The group of PMI indexes in the US announced on the day also failed to reassure the market about the health of the world's largest economy. Although the PMI index of the manufacturing sector unexpectedly increased, it was accompanied by a decrease in the remaining PMI indexes.

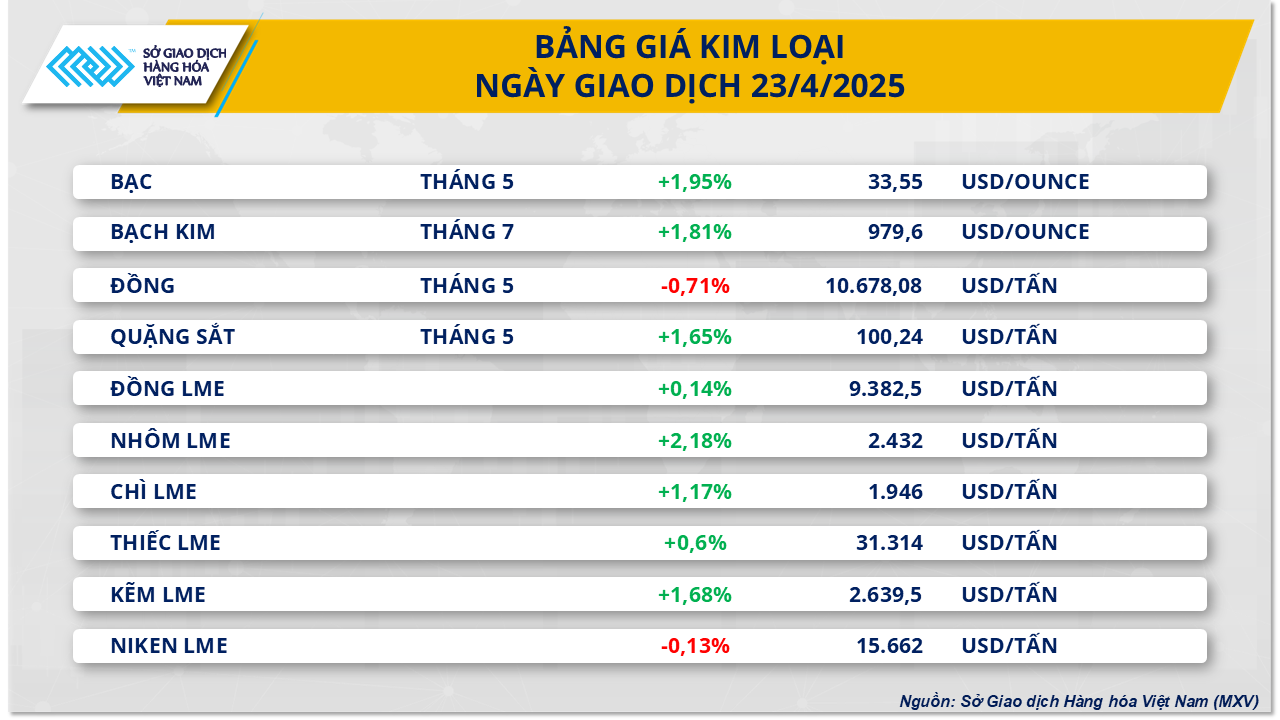

Regarding the metal market, according to MXV, the prices of two precious metals improved in yesterday's trading session thanks to hopes of easing US-China tensions.

At the end of the session, world silver prices extended their increase by 1.95% to 33.55 USD/ounce, while platinum recovered 1.81% to 979.6 USD/ounce.

Recently, the US media reported that the administration of US President Donald Trump is considering reducing tariffs on imported goods from China to about 50-60% while waiting for negotiations with Beijing. This is a positive move from the White House to ease tensions between the two countries in recent times. After this information was spread, positive sentiment in the market spread, concerns about economic recession, when the trade war causes high inflation and slows economic growth, can reduce the attractiveness of silver and platinum in the industry are significantly relieved, thereby pushing up the prices of precious metals - silver and platinum.

In the base metals group, COMEX copper prices unexpectedly reversed when concerns about a temporary supply shortage in the US were temporarily eased. Specifically, the price of COMEX copper contracts for May delivery decreased by 0.71% to $10,678/ton. According to data from Goldman Sachs bank, since the beginning of the year, the US has imported a total of 408,000 tons of cathode copper, far exceeding the initial forecast of 300,000 tons for the first half of 2025. This development shows that the US has actively increased its reserves, helping to reduce the pressure of short-term shortages and somewhat calm market sentiment.

Source: https://baodaknong.vn/thi-truong-hang-hoa-24-4-sac-do-bao-phu-thi-truong-nang-luong-kim-loai-tang-gia-250459.html

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

Comment (0)