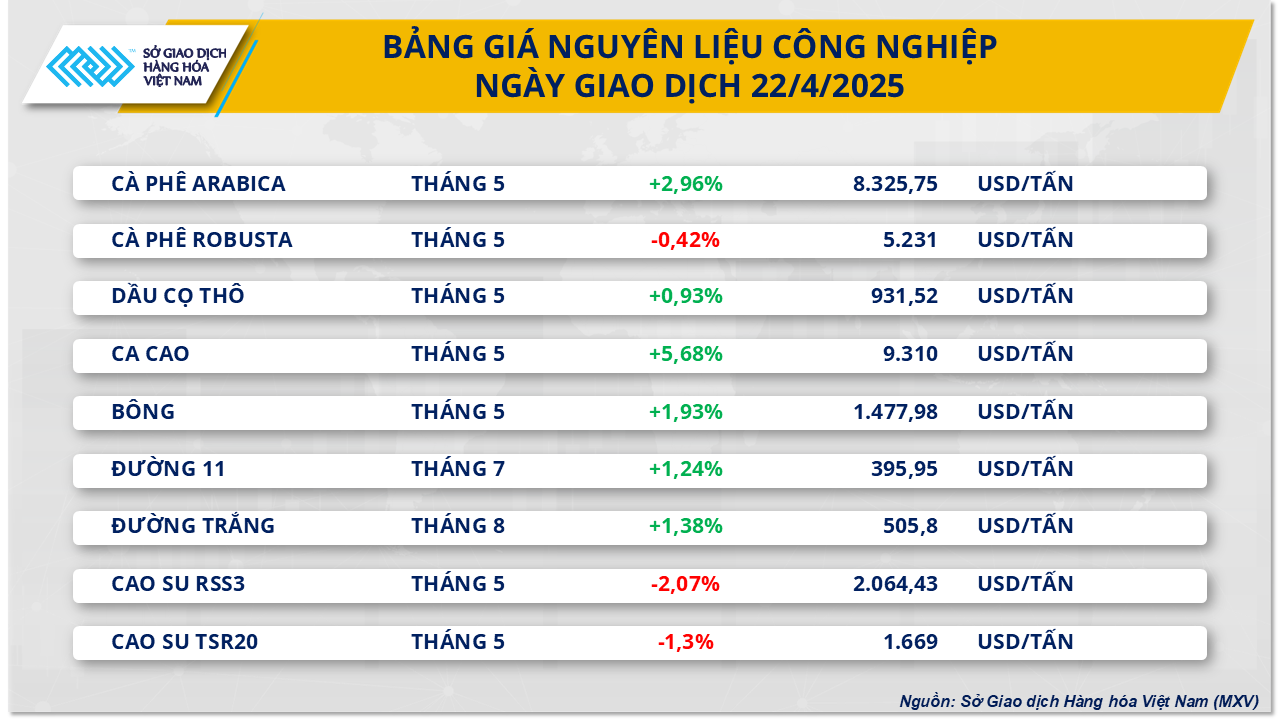

Regarding the industrial raw material group, according to MXV, the industrial raw material group played a leading role in the market in yesterday's trading session. Notably, cocoa. At the close, the price of this commodity continued to increase strongly by 5.68% to reach 9,310 USD/ton - the highest level in more than two weeks.

Cocoa exports from Ivory Coast are showing signs of slowing after a period of strong growth. Government data released on Tuesday showed that Ivorian farmers shipped 1.48 million tonnes of cocoa to ports between October 1 and April 20, up 11.3% from the same period in 2024, but down sharply from the 35% increase recorded in December last year.

Meanwhile, cocoa grinding in major markets also recorded a decline in the first quarter. In North America, grinding volume decreased by 2.5% compared to the same period last year, to nearly 110,280 tons, but was still better than the market forecast. Similarly, in Europe, cocoa grinding volume decreased by 3.7%, lower than the forecast of about 5%. Asia also witnessed a smaller-than-expected decline of 3.4% in the same period. In addition, on April 10, Barry Callebaut AG - one of the world's leading chocolate manufacturers - revised down its annual sales forecast due to the impact of high cocoa prices and complicated tariff situation, putting pressure on its business.

Source: MXV

In the coffee market, Arabica coffee prices recovered strongly with an increase of 2.96% to 8,325 USD/ton, while Robusta coffee opened down more than 1% but then recovered slightly, ending the session down slightly 0.42% to 5,231 USD/ton.

Supply continues to be the main factor driving price movements. According to Rabobank, Brazil's Arabica coffee output in the 2025-2026 crop year will decrease by 13.6% year-on-year to 38.1 million bags due to the impact of dry weather in major growing regions, which has slowed the flowering of coffee trees. In contrast, Brazil's Robusta coffee output is forecast to increase by 7.3% to a record 24.7 million bags, putting downward pressure on prices.

Positive news about a US-India trade deal also supported the dollar, but the Brazilian real continued to rise to a two-week high against the dollar, dampening the export momentum of Brazilian coffee producers.

In addition, inventories recorded on the ICE exchange on April 22 fluctuated slightly. While Arabica inventories increased slightly by 0.58% compared to April 21 at 806,180 bags, Robusta inventories decreased slightly by 0.28% compared to April 17, remaining at the lowest level since late March with 4,260 lots.

In the domestic market, this morning (April 23), the price of green coffee beans in the Central Highlands fluctuated between 128,500 - 129,200 VND/kg, stable compared to the previous day. Specifically, the price of coffee in Dak Lak was 129,200 VND/kg, Lam Dong 128,500 VND/kg, Gia Lai 129,000 VND/kg and Dak Nong 129,200 VND/kg, reflecting a temporary balance in the context of many fluctuations in the world market.

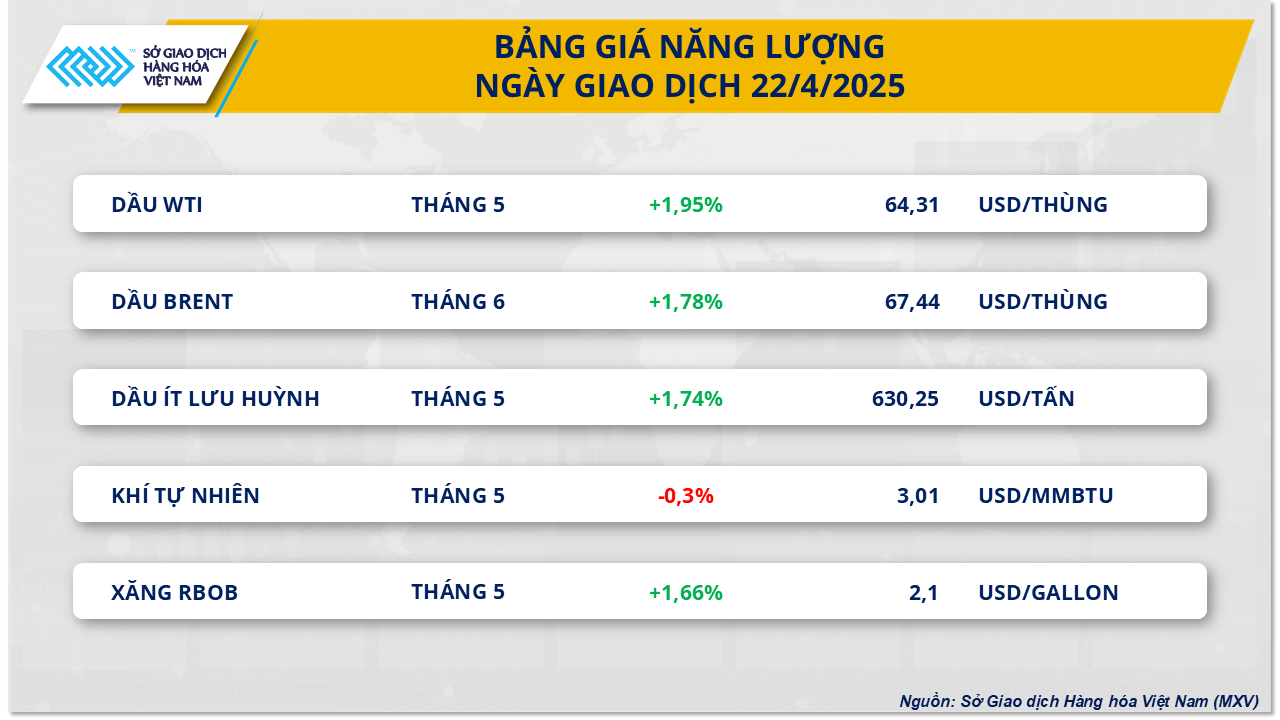

In the energy market, except for natural gas, all four remaining commodities in the group recorded significant increases after the US-Iran relationship showed signs of tension again.

Source: MXV

At the end of the trading session, Brent crude oil price increased by 1.78% to 67.44 USD/barrel. Meanwhile, WTI crude oil price for May contract also recorded an increase of 1.95% to 64.31 USD/barrel, in the last trading session before this contract expired.

Despite the progress in the above round of negotiations held in Italy last weekend and the first round of negotiations in Oman, the US unexpectedly continued to impose new sanctions on Iran. Specifically, the US Treasury Department announced new measures targeting Seyed Asadoollah Emamjomeh - Iran's liquefied petroleum gas (LPG) tycoon and related companies. According to US Treasury Secretary Scott Bessent, Emamjomeh and his network sought to export thousands of LPG shipments, including goods from the US, to evade sanctions and generate revenue for Iran.

The US also announced additional sanctions on Iran ahead of the second round of talks, including those outside Iran that the US believes are consuming and transporting crude oil from the Middle Eastern country. The move is part of the “maximum pressure” campaign initiated by the Trump administration, focusing on disputes related to Tehran’s nuclear program. The developments have raised concerns about the risk of a shortage of oil supplies from Iran, with attention focused on the third round of talks in Oman this week.

Also yesterday, the American Petroleum Institute (API) released its estimate of US crude oil inventories. Accordingly, US crude oil inventories fell by about 4.56 million barrels in the week ending April 18, in contrast to the estimate of an increase of about 2.4 million barrels in the previous week. Tonight, Vietnam time, the US Energy Information Administration (EIA) will release data on US crude oil reserves, with market predictions leaning towards a decrease of about 800,000 barrels last week.

The news, along with US sanctions on Venezuelan crude and OPEC+ plans to cut excess production, has raised the prospect of a global supply shortage, reinforcing the oil price recovery. However, the increase is also being held back by the unstable macroeconomic situation. The market is waiting for the release of the US PMI index tonight to have the latest assessment of the health of the world's largest economy.

Source: https://baodaknong.vn/thi-truong-hang-hoa-23-4-sac-xanh-chiem-uu-the-tren-bang-gia-250319.html

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

Comment (0)