World coffee prices in the early morning of October 7, 2024, at 4:30 am, were updated on the Vietnam Commodity Exchange MXV (world coffee prices are continuously updated by MXV, matching world exchanges, the only channel in Vietnam that continuously updates and links to world exchanges).

Today's online coffee prices of the three main coffee futures exchanges ICE Futures Europe, ICE Futures US and B3 Brazil are continuously updated by Y5Cafe during the trading hours of the exchange, updated by www.giacaphe.com as follows:

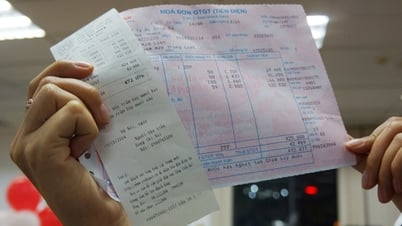

|

| Coffee price today October 7, 2024: Robusta coffee price on the London floor. (Photo: Screenshot giacaphe.com |

At the end of the trading session, the price of Robusta coffee on the London floor on October 7, 2024 at 4:30 a.m. was 4,533 - 5,067 tons. Specifically, the delivery period for November 2024 was 5,067 USD/ton, an increase of 146 USD/ton; the delivery period for January 2025 was 4,859 USD/ton, an increase of 139 USD/ton; the delivery period for March 2025 was 4,674 USD/ton, an increase of 126 USD/ton and the delivery period for May 2025 was 4,533 USD/ton, an increase of 110 USD/ton.

|

| Arabica coffee prices on the New York floor on October 7, 2024. (Photo: Screenshot of giacaphe.com) |

Arabica coffee prices on the New York floor on the morning of October 7, 2024, green dominated, at 4.95 - 5.30 cents/lb. Specifically, the December 2024 delivery period was 257.35 cents/lb, up 2.10%; the March 2025 delivery period was 255.65 cents/lb, up 2.06%); the May 2025 delivery period was 253.55 cents/lb (up 2.01%) and the July 2025 delivery period was 251.00, up 2.01%.

|

| Brazilian Arabica coffee price on October 7, 2024. (Photo: Screenshot of giacaphe.com) |

The price of Brazilian Arabica coffee on the morning of October 7, 2024 increased and decreased in opposite directions. Specifically, the delivery period for December 2024 was 308.05 USD/ton, down 0.95%; the delivery period for March 2025 was 310.30 USD/ton (up 1.72%); the delivery period for May 2025 was 311.20 USD/ton, up 2.17% and the delivery period for July 2025 was 307.75 USD/ton, up 2.17%.

Robusta coffee traded on the ICE Futures Europe (London exchange) opens at 16:00 and closes at 00:30 (next day), Vietnam time.

Arabica coffee on the ICE Futures US (New York floor) opens at 16:15 and closes at 01:30 (next day), Vietnam time.

For Arabica coffee traded on the B3 Brazil exchange, it will be open from 19:00 – 02:35 (next day), Vietnam time.

|

| Coffee price today October 7, 2024: The market decreased sharply compared to last week. |

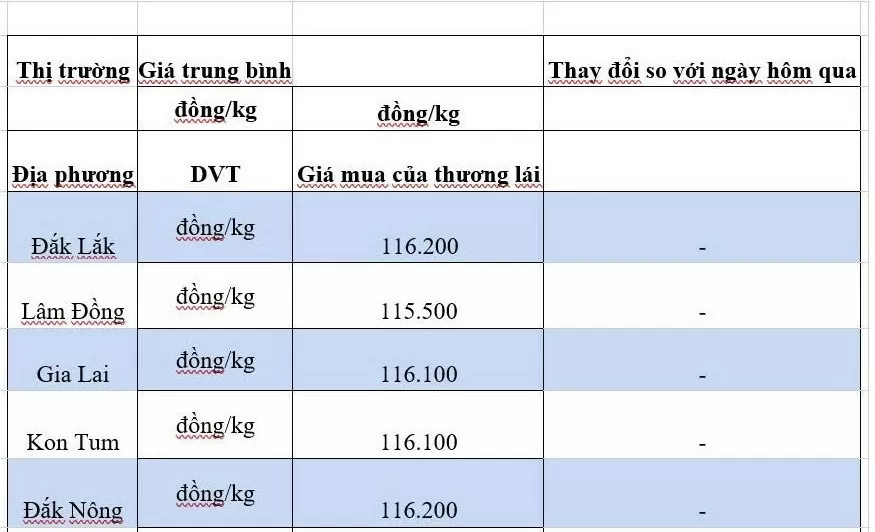

Domestic coffee prices were updated at 4:30 a.m. on October 7, 2024 as follows: The domestic coffee market today continues to maintain green, an average increase of 1,600 VND/kg, ranging from 115,500 - 116,200. Currently, the average purchase price in the Central Highlands provinces is 116,200 VND/kg, the highest purchase price in Dak Lak and Dak Nong provinces is 116,200 VND/kg.

Specifically, the coffee purchase price in Gia Lai province (Chu Prong) is 116,100, an increase of 1,600 VND/kg; in Pleiku and La Grai it is 116,000 VND/kg. In Kon Tum province, the price is 116,100 VND/kg, an increase of 1,600 VND/kg; In Dak Nong province, coffee is purchased at 116,200 VND/kg, an increase of 1,700 VND/kg.

The price of green coffee beans (coffee beans, fresh coffee beans) in Lam Dong province in districts such as Bao Loc, Di Linh, Lam Ha, coffee is purchased at 115,500 VND/kg, an increase of 1,700 VND/kg, unchanged from yesterday.

Coffee prices today (October 7) in Dak Lak province; in Cu M'gar district, coffee is purchased at about 116,200 VND/kg, an increase of 1,500 VND/kg, and in Ea H'leo district, Buon Ho town, it is purchased at 116,100 VND/kg.

In general, the domestic coffee price today, October 7, 2024, is at 115,500 - 116,200 VND/kg, and at the end of the week, the coffee price suddenly increased from 1,500 to 1,700 VND/kg in localities. At the end of the week, the coffee price decreased by an average of 4,900 - 5,600 VND/kg compared to the previous week.

According to the Import-Export Department, Vietnam could witness the lowest coffee output in 13 years in the 2024-2025 crop year, which will cause the global coffee market to face unprecedented challenges.

The recovery of the coffee market after the Northern Hemisphere summer break is boosting trading, especially ahead of the winter roasting season in Europe and the United States. Coffee demand is expected to increase sharply in the coming months, putting further pressure on prices. However, the main problem is supply. Although the USDA forecasts a possible increase in the upcoming harvest, many coffee industry experts are pessimistic, saying that production will fall by about 15% due to adverse weather and reduced coffee plantings.

The severe drought during the recent dry season has negatively affected the quality and size of coffee beans, especially during the rapid growing period. The depletion of stocks from the previous crop and the shortage of coffee since May have made the supply more limited than ever. This situation is expected to continue to develop in the coming months, putting further pressure on coffee prices.

In this context, the European Commission’s (EC) proposal to delay the implementation of a new regulation banning the import of deforestation-causing goods may have some impact. This delay may help reduce pressure on coffee exports to the EU and reduce demand from importers, leading to lower coffee prices on international and domestic markets. However, this impact is likely to be temporary, as demand for coffee remains high and scarce supply will be a determining factor in prices in the coming period.

Coffee production is expected to decline by 5-15% in the 2024-2025 crop year, mainly due to adverse weather and the El Nino phenomenon. This could lead to an increase in coffee prices due to insufficient supply. However, coffee prices have increased recently, which could reduce demand, thereby creating downward pressure on prices in the coming months. Current domestic coffee prices are higher than in 2023, and if consumers reduce their purchases, this will lead to a decrease in consumption and create further pressure on coffee prices.

Overall, the coffee market is facing many challenges in the coming time. Scarce supply, strong demand and the impact of climate change will create increasing pressure on prices. Adjusting production, managing supply and finding alternative solutions will be urgent issues that the Vietnamese coffee industry needs to address to adapt to complex market changes.

|

*Information is for reference only, prices may vary depending on region and locality.

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

Comment (0)