Passed the phase of increasing by times

If in the early stages of 2021, the real estate market in Hoc Mon and Cu Chi districts was quite "calm", then in early 2022, this place became the center of attention for investors. By early 2022, land in this area had appeared to close profits 2-3 times higher than the purchase price, becoming a highlight of the real estate market in Ho Chi Minh City.

Explaining the fever, many experts said that the real estate market in general was pushed up in price by quite shocking price increases in the central area of Ho Chi Minh City. From there, the market in the outlying districts also gained momentum, participating in the price increase race because there was still room for development.

In addition, the planning proposal to upgrade Cu Chi district to a city directly under Ho Chi Minh City is also a boost that makes the real estate market in the city increase rapidly. Immediately setting new prices, most of which increased 1.2 times to 1.5 times compared to more than half a year ago.

Among them, there are some "hot spots" of Cu Chi that are of particular interest to many investors, such as the area of Nguyen Thi Ranh Street (An Nhon Tay Commune) which has increased 2-3 times to 8.2 - 8.5 million VND/m2; land prices on Bui Thi Diet Street (Nhuan Duc Commune) have increased 4 times to 7.2 million VND/m2. According to some statistics, land in some areas with good infrastructure in Cu Chi District is even priced at about 17.5 million VND/m2.

The period when everyone invited each other to go see land in the suburbs of Ho Chi Minh City is over.

In Hoc Mon, land prices have been on the rise since 2020, when the news that the Ho Chi Minh City People's Committee proposed upgrading the three districts of Hoc Mon, Binh Chanh, and Nha Be to districts was widely spread. Many investors have bought a large number of land plots here at cheap prices and then pushed up prices through flash transactions. Since then, Hoc Mon has become one of the epicenters of the land fever. Hoc Mon land prices have been pushed up quite high along roads such as Pham Thi Giay, Dang Thuc Vinh, Trinh Thi Mieng, Nguyen Anh Thu, etc.

In 2020, the lowest land price in Hoc Mon on Le Thi Ha Street was 25 - 27 million VND/m2. The highest price was 45 million VND/m2 with a frontage land area of nearly 3000m2, this land plot was worth up to 13.5 billion VND. Other routes such as the parallel road of National Highway 22, Tran Van Muoi Street, Nguyen Thi Soc Street are the routes with the fastest increasing land prices in Hoc Mon. In particular, the parallel road of National Highway 22 had the lowest price increase from 13 - 14 million VND/m2 to 17 - 18 million VND/m2.

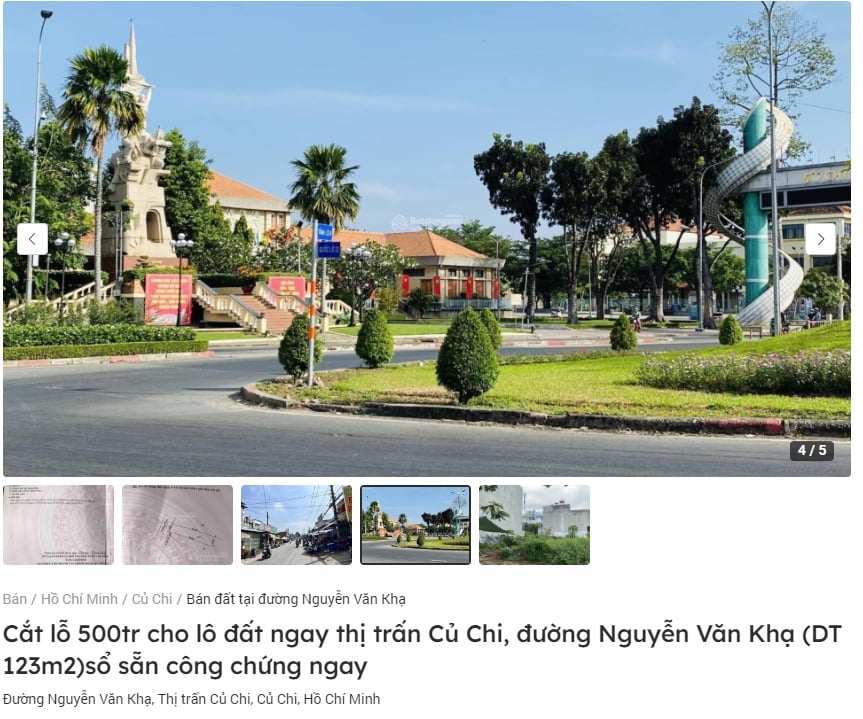

Corner lots in Cu Chi, an area with good traffic infrastructure, were once sought after and competed for by investors.

Along with that price increase, real estate listings in Cu Chi and Hoc Mon areas also topped the search results on online real estate markets. According to statistics from some search engines, after the Lunar New Year 2022, along with land in District 2 and District 9, Hoc Mon and Cu Chi are also keywords that are searched a lot on trading floors.

At that time, the overheating of the market raised many concerns about a predicted decline. Sharing with the press, Mr. Le Hoang Chau - Chairman of the Ho Chi Minh City Real Estate Association commented that some people took advantage of information from the meetings to make profits. According to Mr. Chau, speculators, land brokers, or dishonest businesses caused land prices in Cu Chi and Hoc Mon districts to "go crazy".

In addition, many experts also warned about the market's scam that could make investors holding land have to swallow bitter fruit, when the actual value of the land has been pushed too high. That warning seems to have become true when at present, many sources of information show that land in this area is being sold at a loss.

Cut losses for many reasons

Referring to some real estate markets as well as brokerage groups on social networks, many articles with the phrases "liquidation of goods at suffocating prices", "cutting losses quickly", "selling land to pay off bank loans" ... were widely posted. Many sellers are willing to cut losses from 30-40% of the value of the land to get money back for many different reasons such as paying off bank loans, paying money to other areas to avoid being fined, and being liquidated.

For example, on Nguyen Van Kha Street, a 123m2 plot of land is being sold by the owner at a price of 1.52 billion VND, equivalent to more than 12 million VND/m2. The owner said that this is a loss-cutting price of 500 million VND because this is a beautiful plot of land, close to the industrial park and other amenities. In addition, buyers can negotiate for a better price.

It is not uncommon to see such news of cutting losses in Cu Chi and Hoc Mon areas.

Or another corner lot on Provincial Road 8 (Cu Chi town) with an area of 90m2 is also being sold at a loss of 1 billion VND, this lot is also located in a new residential planning area with developed infrastructure and many amenities. The landowner said that because he needs money to pay the bank, he has to sell this lot cheaply, even willing to support high commission for brokers to quickly find buyers.

In Hoc Mon, some plots of land worth more than VND5 billion in the 2021-2022 period, have been advertised for sale by the landowner for VND4 billion for the past 2 months and have yet to receive any buyers. This is also the common situation of many other investors who have bought land during the hot period.

Through research, the land market in these areas decreased by 5-15% in the period from the end of 2022 to January 2023. Currently, the general decrease has reached 20-35% and shows signs of increasing in the coming time because many landowners are under pressure from banks. Although there have been some "bottom fishing" transactions with land lots that have decreased sharply, in some cases up to 50%. However, most of the market is illiquid, especially with large land lots.

Explaining this situation, experts said that it was partly due to the influence of the real estate market in general, when cash flow is flowing through other investment channels with high short-term profitability. In particular, many investors are still waiting to catch the bottom in the current period, thereby causing liquidity to not improve. The wave of cutting losses also spread from the center of Ho Chi Minh City to the outlying districts and neighboring provinces, thereby causing the market to have too many choices, so there are areas that even have no liquidity.

In addition, the market in Hoc Mon and Cu Chi was also severely affected because at the end of 2022, the Ho Chi Minh City People's Committee requested that suburban districts not apply for approval to become districts or cities. This has had a significant psychological impact on investment and trading decisions in this area, causing real estate market liquidity to decrease sharply.

However, according to the data, with the current cut-loss price, many investors holding goods from the 2019-2020 period still have large profits. Therefore, not 100% of the land lots advertised for sale at a loss are actually losing money, they are simply reducing profits to sell goods, preparing finances for another investment period with better profits.

Source

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] General Secretary To Lam receives leaders of typical Azerbaijani businesses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/998af6f177a044b4be0bfbc4858c7fd9)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)