VN-Index accumulates above the support zone around 1,255 points

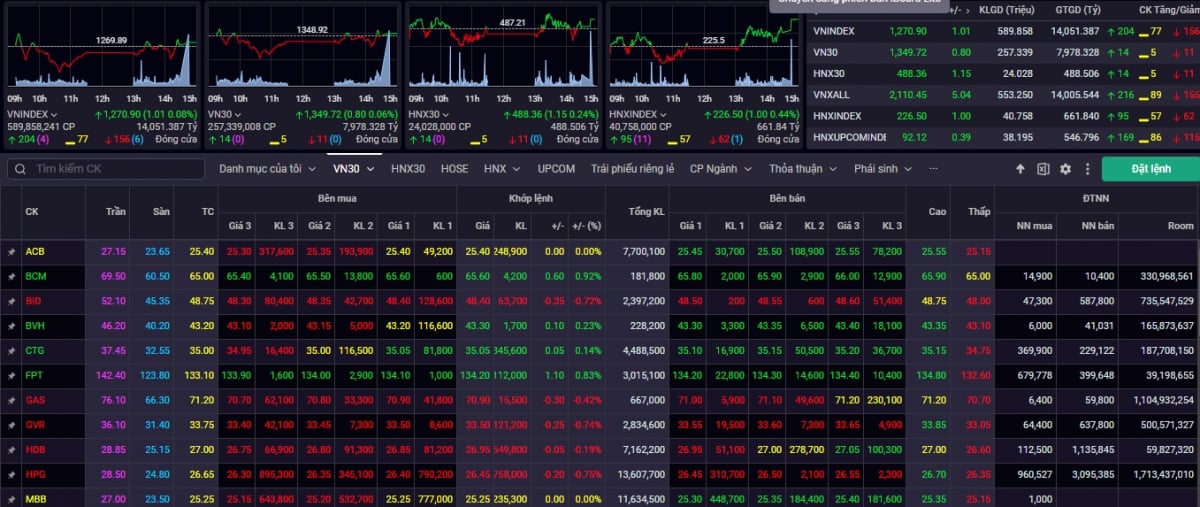

After a session under strong selling pressure at the end of the session, the VN-Index today mainly fluctuated within a narrow range, strongly diverging with short-term cash flow increasing mainly in the real estate group. The VN-Index recovered at a price range of around 1,263 points, ending the trading session on October 23, the VN-Index increased by 1.01 points (0.08%) to 1,270.90 points. The breadth of the HOSE was positive with 175 stocks increasing in price, 125 stocks increasing in price, and 62 stocks maintaining the reference price.

Liquidity decreased sharply compared to the previous trading session when the matched volume was -26.51% at HOSE. The trading session on October 23 of VN30F2410 successfully tested the support zone of 1,340, expected to continue fluctuating within the range of 1,340 - 1,370 points. The open OI volume was 56,544, an increase compared to the previous session of 53,811, showing an increasing trend of holding positions.

According to SHS experts, in the short term, VN-Index accumulates above the support zone around 1,255 points, the highest price zone in 2023, below the short-term resistance zone around 1,280 points corresponding to the average price of the current 20 sessions. In the medium term, VN-Index grows above the support zone around 1,250 points, towards the price zone of 1,300 points, expanding to 1,320 points. In which, the price zone of 1,300 points, a very strong resistance zone corresponding to the highest price zone since the beginning of 2024 and the peak price in June-August 2022. The market can only overcome these resistance zones when there are good macro support factors, outstanding business growth results. At the same time, uncertain factors such as geopolitical tensions such as the Russia-Ukraine war, the Middle East cool down.

“In the short term, investors should not chase the market. The short-term trend is accumulation, and the accumulation process may continue as the market is about to have no information after the third quarter of 2024 business results report, as well as uncertain information about the upcoming US election. The reasonable price range of VN-INDEX is 1,250 points - 1,260 points, corresponding to a total market capitalization of about 290 billion USD. Investors should maintain a reasonable proportion, and disbursement positions need to carefully select good quality codes. The investment target is towards leading stocks with good fundamentals and positive growth prospects for third quarter business results,” said the SHS expert.

The market may see a recovery.

According to the analysis team of ASEAN Securities Company (ASEANSC), the positive reaction of demand at the support zone with the dragonfly Doji candlestick pattern brings expectations for the index's ability to sustain and "eases" the risk of a short-term bearish pattern. The market tends to continue to consolidate the support zone and gradually create demand to help the index recover. However, the net withdrawal of the State Bank through the issuance of treasury bills and repo maturity sessions (the total net withdrawal has reached more than VND 100,000 billion) is still the main reason for the decline in market liquidity and the index's continuous negative developments in the last 3 sessions. Therefore, the market needs more time to rebalance.

“In the short term, investors should manage their portfolios carefully, closely monitor exchange rate developments and the SBV’s upcoming moves to determine how long the current adjustment trend may last. We maintain a positive view on the medium- and long-term market outlook. Investors should maintain an average and stable stock weight, focusing on stocks with good fundamentals and positive Q3 business results, and wait for disbursement when signs of balance appear and valuations return to attractive levels,” ASEANSC experts noted.

Meanwhile, experts from Yuanta Vietnam Securities Company (YSVN) said that the market may see a recovery in today's session, October 24, but the recovery is still weak and may quickly return to the downtrend. Liquidity remains low during the recovery, showing that demand is still weakening and investors are not ready to return to the market after a sharp decline. At the same time, the recovery is mainly concentrated in real estate stocks and many real estate stocks have shown new buying points, which is also a positive signal as cash flow is still looking for short-term investment opportunities, but investors need to observe this group of stocks in the next 1-2 sessions because investors will not have many safe options to buy real estate stocks during this period.

“The short-term trend of the general market remains neutral. Therefore, investors can continue to hold 40-45% of their short-term portfolio in stocks and should not buy new stocks,” YSVN experts recommended.

► Stocks to watch on October 24

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-2410-thi-truong-co-the-se-xuat-hien-nhip-hoi-post1130442.vov

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)