► Some stocks to watch on October 30

The index is likely to retreat to the support level around the 1,245 (+/-5) point area.

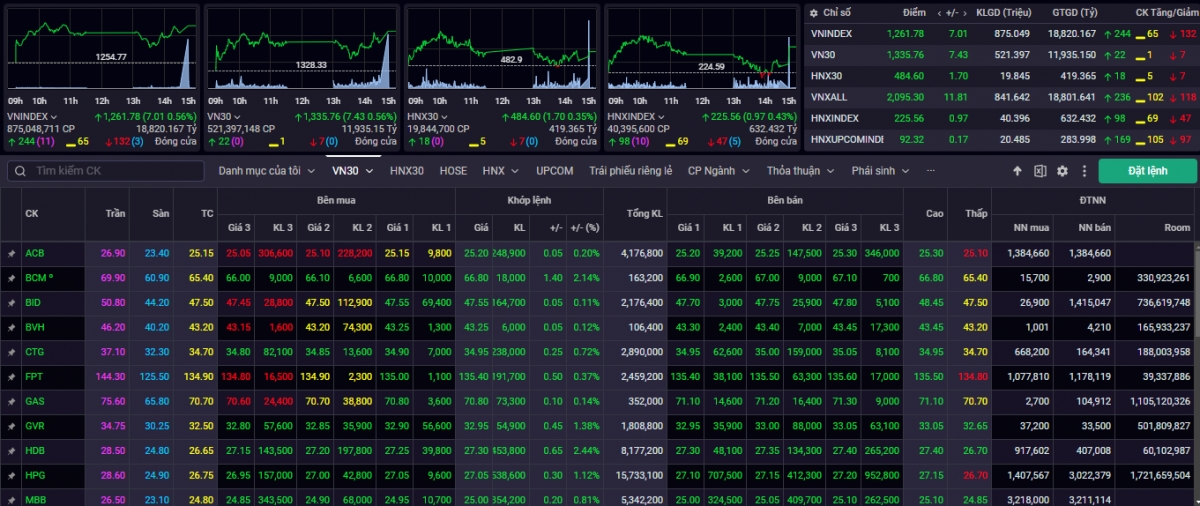

After a good recovery session at the strong support level of 1,250 points. VN-Index continued to recover well in the session of October 29 with a positive breadth when 196 stocks increased in price, 112 stocks decreased in price and 57 stocks maintained the reference price. The market was still quite differentiated with the demand for price increases increasing quite well in many groups of stocks such as fertilizers - chemicals, aviation, logistics, technology - telecommunications..., while real estate stocks were under pressure to adjust. At the end of the trading session on October 29, VN-Index increased by 7.01 points (+0.56%) to 1,261.78 points. Liquidity improved compared to the previous trading session when the matched volume increased by 22.50% at HOSE.

According to experts from Agribank Securities Company (Agriseco), on the technical chart, VN-Index recorded the second consecutive recovery session after reaching the long-term support level of MA200 days. However, demand is still quite reserved and mainly concentrated in the large-cap group, showing that investor sentiment is still relatively cautious. Agriseco believes that the recoveries in the first session of the week are more technical and the index is likely to retreat to the support level around the 1,245 (+/-5) point area to stimulate new demand to participate.

“Investors should not open new purchases during early market recoveries, keep a high cash ratio in the portfolio to ensure initiative in the scenario where the market experiences discounts to more attractive price ranges,” Agriseco experts noted.

The market is likely to continue to recover.

According to the analysis team of ASEAN Securities Company (ASEANSC), the market moved up when demand increased and green spread, helping to relieve the cautious sentiment in recent sessions. Cash flow improved compared to the previous session, but was still at the second lowest level in October, showing that cautious sentiment still existed. The general index tended to continue to shake off selling pressure, recovering slowly with narrow amplitude fluctuations around the threshold of 1,257 points. The strong cooling of oil prices helped world markets recover positively, while the upward force of exchange rates showed signs of slowing down in the last two sessions, which were factors that helped the general sentiment become more positive.

“The market may witness short-term recoveries in the coming sessions, however, investors should still be cautious, avoiding the psychology of chasing or dumping short-term transactions. We still have a good assessment of the medium and long-term market prospects, so investors should closely monitor the exchange rate, oil price and world markets to wait for clearer signals confirming the recovery trend, while focusing on holding long-term stocks and preparing cash to disburse when these stocks reach attractive valuations,” said ASEANSC experts.

Sharing the same view, experts from Yuanta Vietnam Securities Company (YSVN) said that the market may continue to recover in today's session, October 30, and the VN-Index may retest the resistance level of 1,270 points. At the same time, the market shows signs of entering a short-term accumulation phase, indicating that the market's decline has slowed down, meaning that short-term risks have slightly decreased. However, the market has not yet shown signs of forming a bottom and short-term risks remain high.

“The short-term trend of the general market remains bearish. Therefore, investors can continue to hold a low proportion of stocks at 30-40% of their short-term portfolio. At the same time, investors should only buy new stocks with a low proportion of stocks that have shown short-term buying points,” YSVN experts recommended.

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-3010-thi-truong-co-the-se-tiep-tuc-phuc-hoi-post1131897.vov

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

Comment (0)