VN-Index is under correction pressure, accumulating above the support zone around 1,260 points.

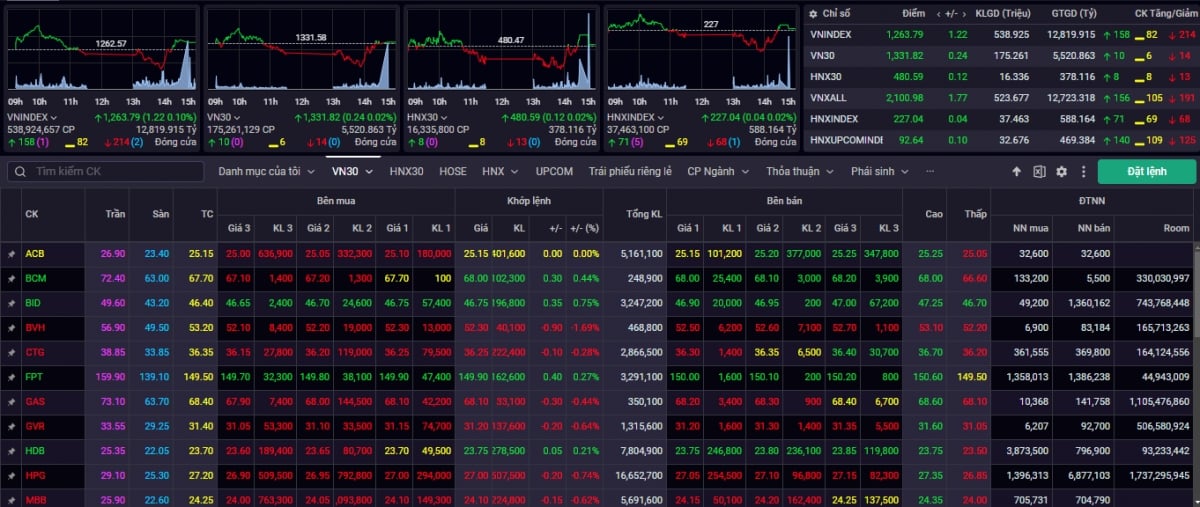

After 4 consecutive sessions of correction pressure, VN-Index recovered slightly in today's session, largely due to low supply pressure in the support zone around 1,260 points. At the end of the trading session on December 16, VN-Index increased slightly by 1.22 points +0.10%) to 1,263.79 points, maintaining above the 200-session average price line. Trading volume on HOSE decreased slightly by -2.37% compared to the previous session. Showing a strong level of differentiation, the accumulated correction pressure was still relatively normal in many codes, while many codes still recovered well, with quite extraordinary liquidity.

Market breadth remained negative with 165 stocks falling, 132 stocks rising and 64 stocks maintaining the reference price. The market is trying to create a balanced price zone above the highest price zone in 2023 and the average price of 200 sessions. Foreign investors continued to net sell on HOSE with a value of -197.6 billion VND in today's session.

According to experts from Saigon - Hanoi Securities Company (SHS), in the short term, VN-Index is still growing above the support level of around 1,260 points, corresponding to the average price of 200 sessions, and is facing a resistance zone of 1,280 points -1,300 points. This is a very strong resistance zone, the peak zone since the beginning of the year. To be able to overcome this very strong resistance zone, the market needs momentum, strong support from fundamental factors, and outstanding growth prospects. It depends heavily on two groups of stocks that account for a large proportion of market capitalization: banking and real estate.

In the short term, market quality is still improving, many stocks are at relatively attractive prices, opening up many good opportunities. However, VN-Index is under pressure to correct, accumulating above the support zone around 1,260 points, before waiting for new growth drivers such as expectations for growth in business results in the fourth quarter of 2024 and prospects for 2025.

“The market will overcome the accumulation trend that has lasted since the beginning of the year. Investors should maintain a reasonable proportion. Consider selectively disbursing stocks with good fundamentals, expecting continued growth. The investment target is towards leading stocks with good fundamentals,” said SHS experts.

The market may continue to fluctuate near 1,262 points.

According to the analysis team of Agribank Securities Company (Agriseco), on the technical chart, VN-Index formed a Spinning Top candlestick pattern right at the 1,260 point mark, corresponding to the 200-day MA line acting as an important support level to support the index in the short term, showing hesitation between the two sides of buyers and sellers at low prices and leaving open the possibility of a tug-of-war trend continuing in the coming sessions. Although the preservation of the 200-day MA support level is a positive signal showing that the supply force has somewhat eased, the active buying demand is still not strong enough to help the index immediately return to the uptrend.

“The VN-Index may continue to fluctuate around the 1,260-point mark with fluctuations in the next session before returning to the recovery trend. Investors should continue to hold their portfolios, prioritizing increasing the proportion of stocks in the banking, securities, and real estate groups when the index appears to break through the above support level,” Agriseco experts noted.

Sharing the same view, experts from Yuanta Vietnam Securities Company (YSVN) said that the market may continue to fluctuate near the 1,262-point level of the VN-Index in today's session, December 17. At the same time, if the VN-Index maintains the support level of 1,262 points in today's session, the scenario of the VN-Index moving towards 1,300 points may still occur. In addition, the sentiment indicator has decreased slightly and the market has shown signs of entering a short-term accumulation phase, so the market may continue to fluctuate narrowly with low liquidity in the coming trading sessions.

“The short-term trend of the general market remains at an upward level. Therefore, investors can continue to hold a high proportion of stocks in their portfolio and wait to observe further developments in the next session to be able to buy new ones,” YSVN experts recommended.

► Some stocks to watch on December 17

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-1712-thi-truong-co-the-se-giang-co-gan-muc-1262-diem-post1142524.vov

![[Photo] Ho Chi Minh City: Many people release flower lanterns to celebrate Buddha's Birthday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5d57dc648c0f46ffa3b22a3e6e3eac3e)

![[Photo] General Secretary To Lam meets with Chairman of the Federation Council, Parliament of the Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/2c37f1980bdc48c4a04ca24b5f544b33)

Comment (0)