|

| Nikkei 225 Index Performance |

Speaking at the Economic Club of Chicago on Wednesday (April 16), his first since Mr. Trump unexpectedly postponed reciprocal tariffs, Fed Chairman Jerome Powell said the Fed would wait for more data on the direction of the economy before making any changes to interest rates.

Commenting on these statements, Tom Graff, chief investment officer at Facet, said that the Fed Chairman is in a difficult position. “The Fed cannot act proactively to prevent any potential economic weakness, because tariffs are likely to cause inflation,” he said, adding: “They simply cannot cut rates while inflation is rising. This is doubly true when inflation is already high.”

Meanwhile, the US stock market saw a wave of tech stocks selling off after AI pioneer Nvidia announced a $5.5 billion quarterly charge due to the administration’s restrictions on AI chip exports. Dutch chip giant ASML warned that tariffs were increasing uncertainty around its outlook for 2025 and 2026.

The Nasdaq Composite closed down 3.07%, led by a 6.9% drop in Nvidia. The Dow Jones Industrial Average also lost 699.57 points, or 1.73%, to close at 39,669.39; the S&P 500 fell 2.24% to 5,275.70.

All of that kept investors cautious in Asian trading this morning. As a result, stock markets in the region were mixed. South Korea’s Kospi index rose 0.4%; while Taiwanese stocks fell 0.5%.

Notably, Japan's Nikkei 225 index rose nearly 1% after US President Donald Trump, who directly participated in negotiations with the Japanese delegation, said bilateral trade talks had made "great progress".

Chinese shares fell in early trading as concerns about the escalating US-China trade war mounted. The blue-chip index fell 0.5%, while Hong Kong's Hang Seng index rose 0.6%.

All eyes will now be on earnings forecasts from the world's largest contract chipmaker, Taiwan Semiconductor Manufacturing Co, to gauge the health of the chip industry.

“Chipmakers are very cyclical, so if we go into a recession for whatever reason, that’s not going to be good for chipmakers and we could see demand drop,” said Chris Zaccarelli, chief investment officer at Northlight Asset Management. “But there’s also the implication that if there are tariffs or if there are costs imposed in the short term, that could also lead to lower demand.”Source: https://thoibaonganhang.vn/thi-truong-co-phieu-chau-a-giao-dich-trong-than-trong-162920.html

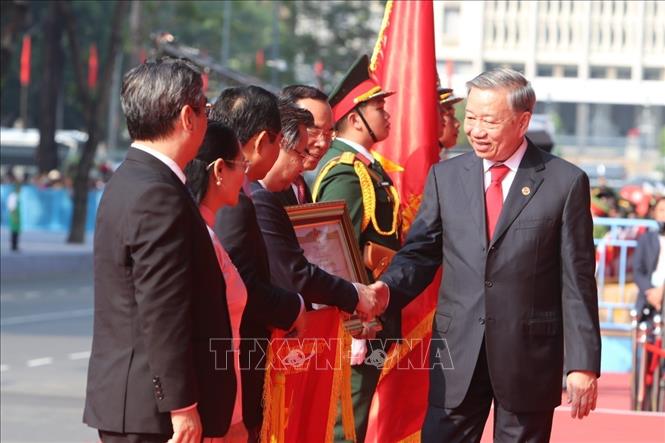

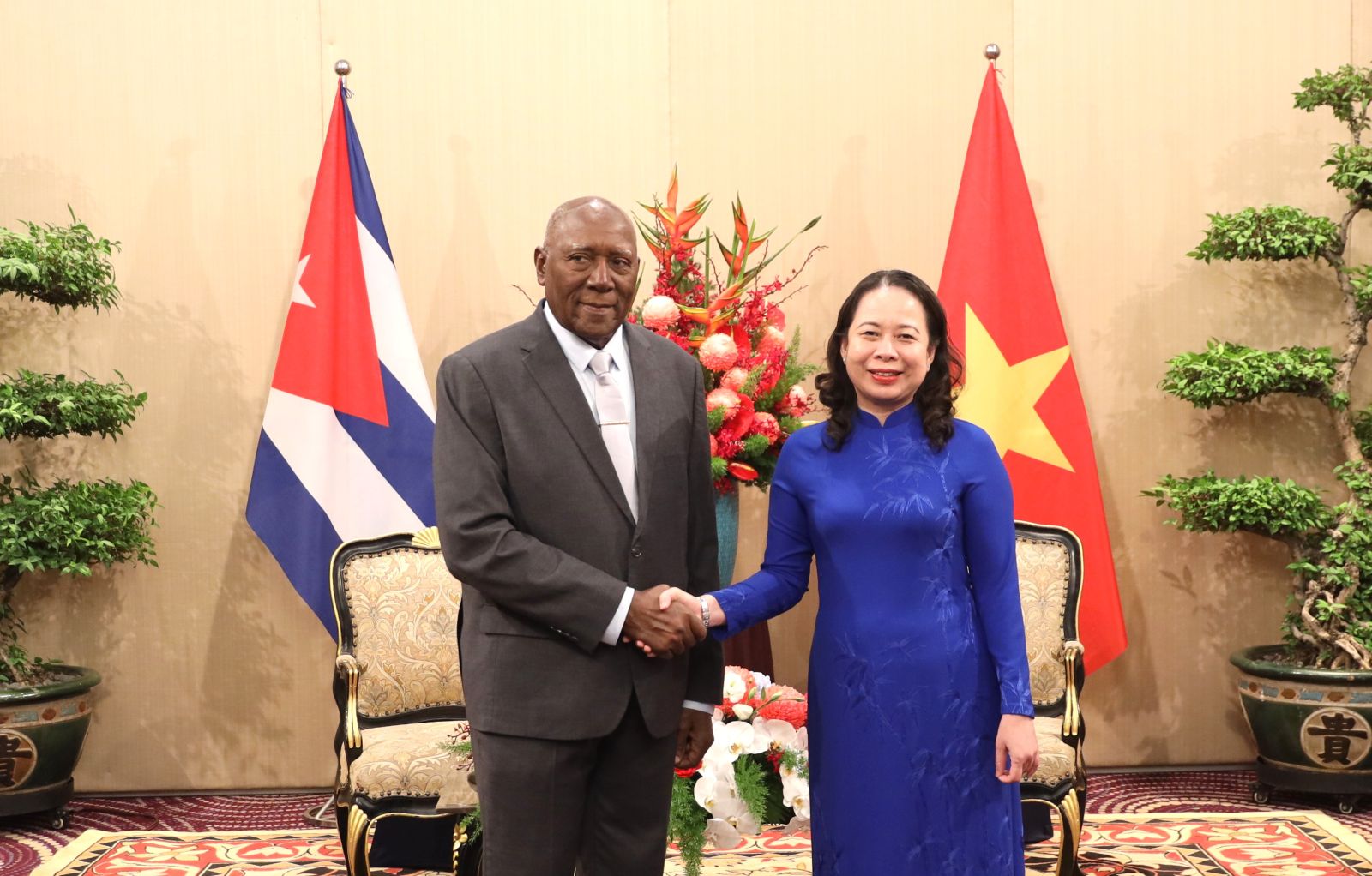

![[Photo] Performance of the Air Force Squadron at the 50th Anniversary of the Liberation of the South and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/cb781ed625fc4774bb82982d31bead1e)

![[Photo] Chinese, Lao, and Cambodian troops participate in the parade to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/30d2204b414549cfb5dc784544a72dee)

![[Photo] Cultural, sports and media bloc at the 50th Anniversary of Southern Liberation and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/8a22f876e8d24890be2ae3d88c9b201c)

Comment (0)