The stock market on April 22 is forecasted by securities companies to continue to fluctuate and fluctuate in the short term, as the VN-Index is still in the accumulation phase, without any clear trend-setting signals. In the context of the first quarter of 2025 business results being announced one after another, cash flow tends to be strongly differentiated, focusing on promising industry groups.

VN-Index tests support zone, investors are cautious

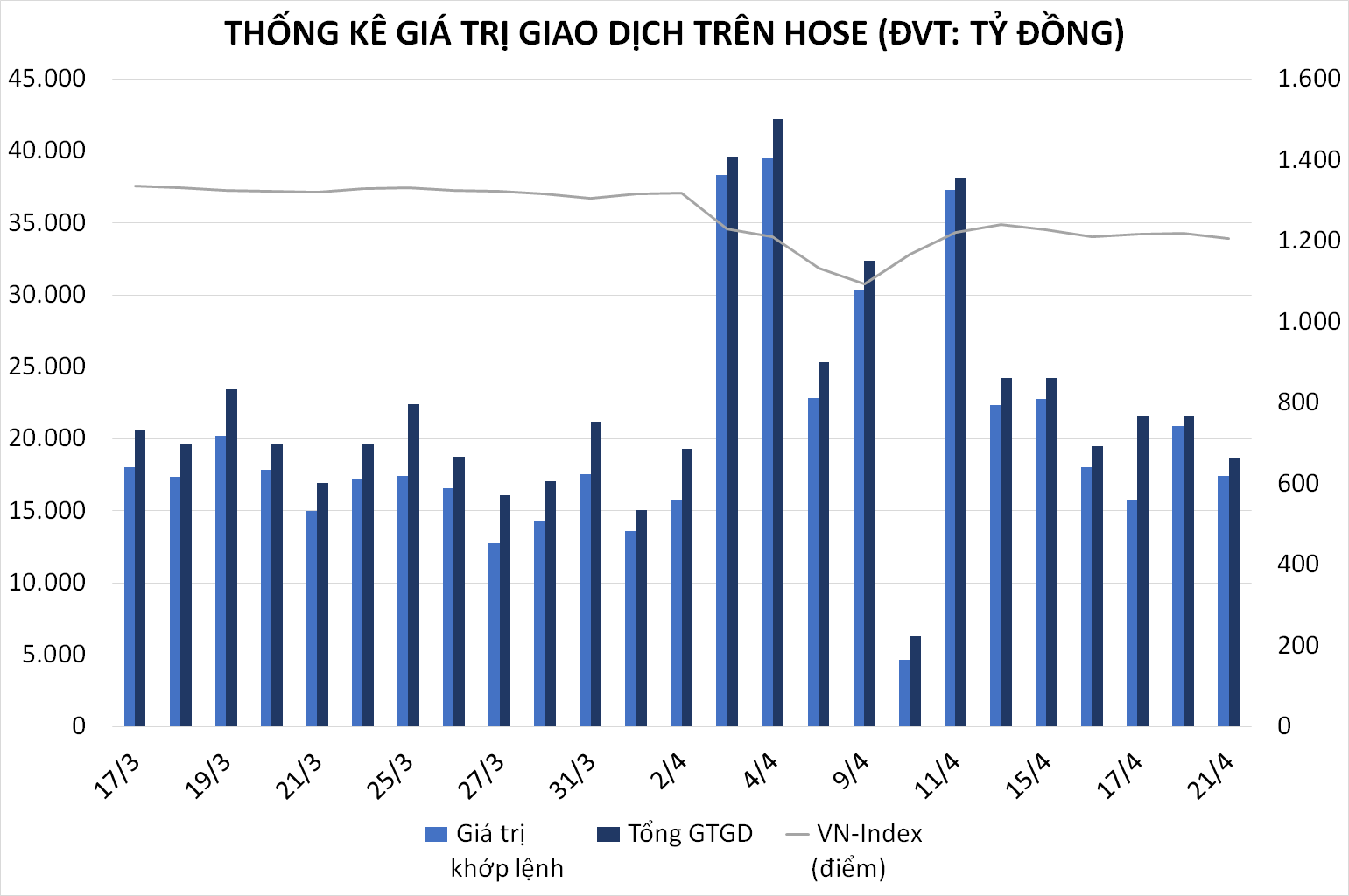

At the end of the session on April 21, VN-Index decreased by more than 12 points, closing at 1,207.07 points. The market trended negatively with 15/18 industry groups decreasing, notably the financial services group. However, foreign investors continued to maintain net buying momentum on both HOSE and HNX, which helped to keep market sentiment from being too negative.

Securities companies such as Yuanta, SSI and BSC all believe that the market will fluctuate in the range of 1,200 - 1,220 points in the short term. Demand is weakening, while cautious sentiment has prevented the index from breaking through the resistance zone of 1,240 - 1,250 points. However, strong support zones around the 1,180 point mark are expected to act as a support for the market.

Opportunities from differentiation, prioritizing stocks with good price foundation

Many securities companies recommend that investors take advantage of this period to restructure their portfolios. VCBS and AIS believe that short-term profits should be realized with stocks showing signs of profit-taking and switching to stocks that are consolidating a solid price base. Meanwhile, CSI believes that the 1,180 point mark is a reasonable buying point, expecting the market to recover towards the 1,270 - 1,300 point range.

Sectors that are less affected by macroeconomic fluctuations or have positive business results in the first quarter of 2025 will be the focus of attracting cash flows. Banking, securities and public investment stocks continue to be positively evaluated thanks to low valuations and stable dividend yields.

Derivatives Market: Trading in Range, Flexible Strategy

In the derivatives market, VN30F2505 is forecasted to continue fluctuating in the range of 1,284 - 1,310 points. MBS recommends a short-term trading strategy in the range: open a buy position in the range of 1,280 - 1,285 points and sell in the range of 1,295 - 1,300 points. Meanwhile, Yuanta believes that the VN30F2505 contract is well supported at the 1,286 point mark and can recover to the range of 1,305 - 1,328 points.

Overall, the stock market on April 22 is forecasted to continue its tug-of-war and accumulation phase, with clear differentiation between stock groups. Investors should maintain a reasonable stock weight, take advantage of support zones to disburse cautiously, and target stocks with positive technical signals and solid fundamentals.

Source: https://baonghean.vn/thi-truong-chung-khoan-22-4-giang-co-tiep-dien-dong-tien-phan-hoa-theo-ket-qua-kinh-doanh-10295647.html

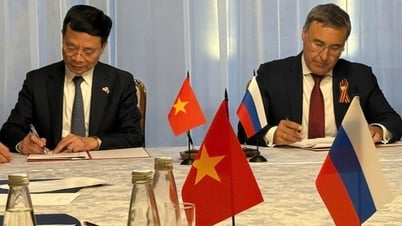

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

Comment (0)