According to Savills' Q3/2024 report, serviced apartment rental prices and occupancy rates remained stable, and both increased compared to the same period last year. The occupancy rate was stable quarter-on-quarter at 83%, up slightly by 2 percentage points year-on-year. Serviced apartment rental prices in Hanoi as of Q3/2024 reached VND588,000/m2/month, down an average of 2% quarter-on-quarter, due to a 4% decrease in Grade A and a 2% decrease in Grade C, but still up slightly by 2% year-on-year.

Demand for serviced apartments from provinces neighboring Hanoi is increasing. (Illustration photo).

The supply of Grade A serviced apartments is still mainly concentrated in Tay Ho. Meanwhile, the supply in Hai Ba Trung, Gia Lam, and Long Bien is all Grade B.

Mr. Matthew Powell, Director, Savills Hanoi, explained: “The abundant foreign direct investment capital and the expansion of industrial zones attract many foreign experts to work in Vietnam. This helps create a stable demand for the serviced apartment segment.”

Currently, many businesses tend to diversify their supply chains or completely withdraw their production lines from China, because labor and production costs in this country are no longer as competitive as before.

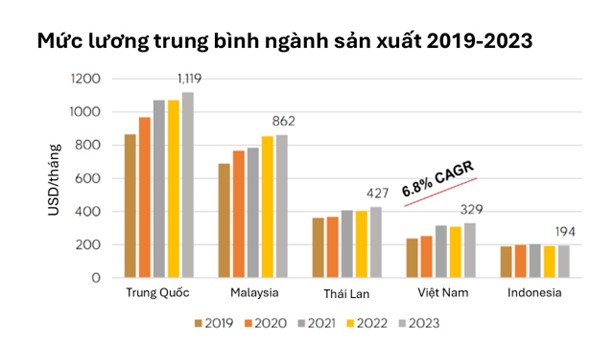

In this context, Vietnam has emerged as an attractive destination thanks to its strategic location in the heart of Southeast Asia. At the same time, Vietnam has an advantage in labor costs, with the average income of the manufacturing industry at 329 USD/month, among the lowest in the region. Compared to neighboring countries, this figure is only higher than Indonesia and about 3.4 times lower than China.

Average manufacturing income of Vietnam and neighboring countries.

In addition, the Vietnamese Government has also continuously introduced preferential corporate income tax policies to increase Vietnam's ability to attract foreign investment.

According to the General Statistics Office, as of August 2024, total FDI into Vietnam reached 20.5 billion USD, up 7% year-on-year. Realized FDI capital reached 14.2 billion USD, up 8% year-on-year, recording the highest level in the past 5 years. In Hanoi alone, FDI capital reached 1,476.3 million USD, up sharply by 71% compared to the previous year, with 178 new projects licensed.

Not only limited to the capital, the northern provinces surrounding Hanoi such as Bac Ninh, Phu Tho, Bac Giang and Thai Nguyen also have significant capital flows, increasing the demand for housing thanks to attracting more and more foreign experts. Typically, according to data from the Ministry of Planning and Investment, as of September 2024, Bac Ninh is leading with a total registered investment capital of more than 4.5 billion USD, accounting for 18.2% of the total investment capital of the country, 3.47 times higher than the same period.

Although housing demand from foreign experts is increasing, the supply of serviced apartments in these provinces is still limited. At the same time, the quality of housing products does not meet high standards. Therefore, "foreign experts still tend to choose Hanoi to live because of easy access to a diverse system of utilities and high-quality housing supply," Mr. Matthew explained.

The development of infrastructure connecting Hanoi and neighboring provinces also creates favorable conditions for foreign experts to access the city center as well as travel to neighboring provinces of the capital. Among them, we can mention some outstanding projects such as National Highway 1A, National Highway 18, Hanoi - Thai Nguyen Expressway...

Thanks to stable demand, serviced apartment occupancy in Q3/2024 continued to remain at 83%, up 2 percentage points year-on-year.

Le Trang

Source: https://www.congluan.vn/thi-truong-can-ho-dich-vu-tai-ha-noi-hoat-dong-tot-nho-fdi-tang-truong-doi-dao-post316388.html

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

Comment (0)