ANTD.VN - As expected, after Vietcombank took the lead in lowering deposit interest rates, the remaining three state-owned commercial banks, VietinBank, BIDV and Agribank, also simultaneously reduced interest rates to the same level.

On October 11, the remaining 3 banks in the group of big 4 state-owned commercial banks simultaneously lowered their deposit interest rates. The reduction this time is 0.2%/year for many terms, bringing the interest rate level down to the same level as Vietcombank - the bank that had previously lowered its interest rate on October 3.

|

Bank interest rates have not stopped their downward trend. |

Accordingly, currently, the interest rate for non-term deposits and deposits with terms of less than 1 month at 4 banks remains at 0.1 - 0.2%/year; for terms of 1 - 2 months, it is 3%.

Meanwhile, the term from 3 months to under 6 months decreased by 0.2%/year to 3.3%/year; the term from 6 months to under 12 months decreased from 4.5% to 4.3%/year.

Similarly, for terms of 12 months or more, four banks simultaneously listed the mobilization interest rate at 5.3%/year. This is also the highest interest rate that these banks are applying to deposits at the counter.

Thus, the entire group of 4 state-owned banks, VietinBank, Vietcombank, BIDV and Agribank, have reduced their deposit interest rates to a historic low, lower than during the Covid-19 period. During the period from July 2021 to July 2022, these 4 banks kept the maximum interest rate at 5.5%/year.

Big4 are the banks with the largest operating network in Vietnam with transaction offices covering all localities across the country. These are also the banks with the largest customer deposits in the system, accounting for nearly half of the market share.

The Big 4's interest rate cut comes amid low credit growth. According to the State Bank of Vietnam, as of September 29, 2023, total credit in the economy reached about VND12,749 trillion, up 6.92%.

Although credit growth improved in September, it was still lower than the same period last year and only reached less than half of the annual plan (14%) after three quarters.

This also confirms that the banking system's liquidity is still abundant, despite the State Bank continuously withdrawing money through the issuance of credit notes.

Not only at Big 4, the interest rate level of private banks is also very low. Currently, the interest rate for 12-month term is mostly brought down to below 7%/year (except for some banks that apply it exclusively to VIP customers and large deposits).

Source link

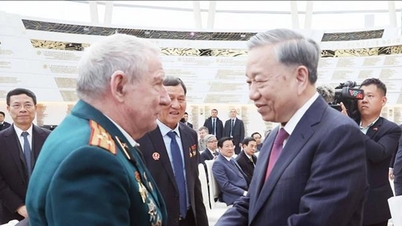

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)