According to Nikkei Asia, Thailand's Department of Commerce (DFT) may conclude the investigation in June, after receiving an investigation request last year from Sahaviriya Steel, G Steel and GJ Steel, Thailand's largest hot-rolled coil producers.

Previously, the agency received a petition from some of the largest hot-rolled steel manufacturers in the country, in the context of businesses in the Land of Golden Pagodas struggling because they cannot sell their products.

The plaintiffs asked the DFT to investigate the case of 17 Chinese steelmakers who allegedly evaded anti-dumping duties by changing the ingredients in their steel products. According to the DFT, Thai authorities found evidence of such changes and dumping by Chinese steelmakers.

Southeast Asia, China’s top steel export destination, is facing widespread oversupply as China’s real estate, infrastructure and manufacturing sectors stagnate. China’s crude steel output was flat last year in 2022, even as consumption fell 3.5% year-on-year. Exports rose 39%.

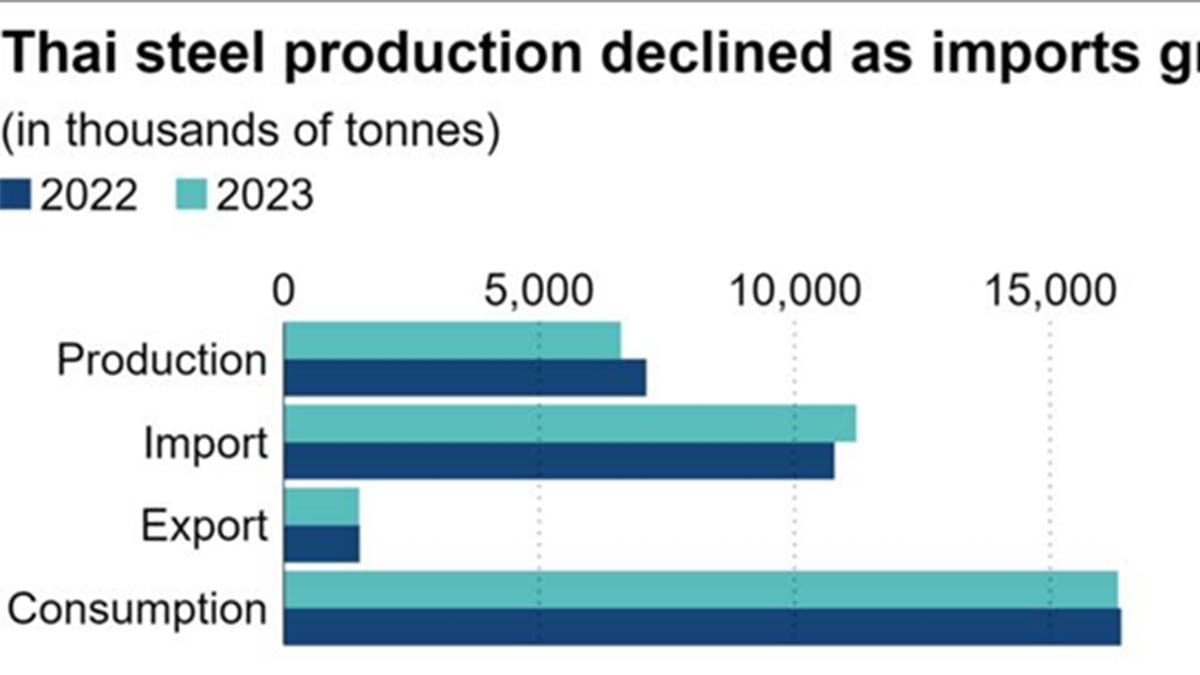

Meanwhile, Thailand’s steel imports are rising sharply, to 63% of total supply in 2023, up from 58% in 2014. Over the same period, domestic production has fallen from 42% to 37% of total supply. Thailand used a total of 16 million tonnes of steel in 2023. The country produced only 30% of its capacity, lower than the Southeast Asian average of 58% or the global average of 77%.

Letting the Thai steel industry wither would be a national security issue, Wirote Rotewatanachai, president of the Thai Iron and Steel Institute, told Nikkei Asia: “We should protect the domestic industry in case of problems such as supply chain disruptions, especially now that there are many geopolitical conflicts.”

Alloys mixed into steel products by Chinese producers to avoid anti-dumping measures are causing quality control problems for Thai steelmakers, who rely on scrap instead of iron ore, said Wirote, president of the Thai Iron and Steel Institute.

With abundant supply, Chinese producers offer Thai buyers cheaper prices than domestic steelmakers. In 2023, galvanized steel prices from China were 39% lower than Thai products. Chinese coils were sold at a 16% discount.

In a public hearing before the DFT, Chinese steel importers in Thailand opposed the proposal, saying that the investment decision was a mistake that had made the domestic steel industry lose its competitiveness.

“Thai steelmakers should focus on improving product quality and expanding sales channels to avoid price competition, otherwise they will lose to cheap imports despite the government’s protection measures,” Siam Commercial Bank’s Economic Intelligence Center warned in 2017, when Thailand imposed anti-dumping measures on a range of imported steel products.

Some Thai steel companies hope to take advantage of government incentives by supplying specialty steel to electric vehicle makers. But moving into higher-value products will require investment and knowledge sharing from companies like Japan’s Nippon Steel, which acquired G Steel and GJ Steel in 2022 for $722 million. Japanese automakers have imported steel since establishing supply chains in Thailand 30 years ago.

“The Thai government has asked EV manufacturers to use our local supply chain as much as possible,” said Mr. Wirote. “But we may see some Chinese steel manufacturers setting up shop in Thailand to supply Chinese automakers, which will compete with Japanese automakers.”

Source: https://vietnamnet.vn/thai-lan-muon-ap-dung-cac-bien-phap-chong-ban-pha-gia-moi-voi-thep-trung-quoc-2279939.html

![[Photo] Ho Chi Minh City residents stay up all night waiting to watch the parade rehearsal](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/0c555ae2078749f3825231e5b56b0a75)

![[Photo] Spreading passion for science and technology in educational environment](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/059521b98e3847368f5ff4120460a500)

![[Photo] Young people line up to receive the special supplement commemorating the 50th anniversary of the Liberation of the South of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/9e7e624ae81643eba5f3cdc232cd07a5)

Comment (0)