KBSV Securities Company has adjusted its 2025 GDP growth forecast down to 6% after assessing the risks of Tradewar 2.0 for the Vietnamese economy. In the face of external challenges, KBSV believes that the Government will strongly promote internal growth drivers such as public investment and credit growth.

The macroeconomic picture in the first quarter of 2025 maintained a positive trend. Gross domestic product (GDP) in the first quarter of 2025 is estimated to increase by 6.93%, reaching the highest growth rate compared to the first quarter of the years in the period 2020-2025. From the demand side, consumption and investment maintained a positive trend in the first quarter of 2025. From the supply side, the industrial, construction and service sectors continued to grow. However, this growth rate has not yet reached the target of 8.0% for 2025.

External growth drivers weaken

Vietnam's economic growth is closely linked to international trade activities. Therefore, facing the risks from Tradewar 2.0, KBSV has adjusted its GDP growth forecast for 2025 down to 6% (compared to the previous projection of 7%). In this context, KBSV expects the Government to focus on promoting domestic growth drivers, especially public investment and credit growth.

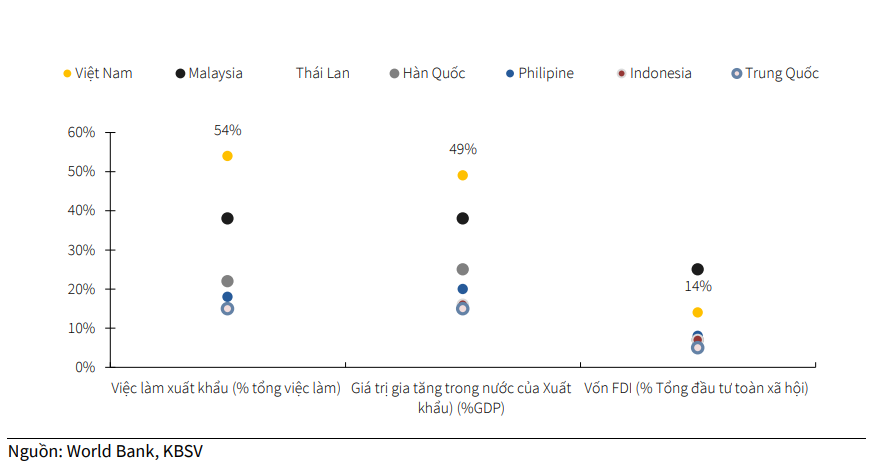

About 50% of Vietnam’s GDP growth and 54% of its labor market depend directly or indirectly on exports. At the same time, Vietnam is also the most trade-dependent economy in East Asia, except for Singapore, showing that Vietnam’s economy is highly open, and economic growth is closely linked to international trade. In the context of Trade War 2.0 under President Donald Trump, new policies are no longer as favorable for Vietnam as Trade War 1.0. This puts Vietnam at risk of declining export activities and foreign investment attraction, thereby directly affecting domestic economic growth and employment.

In the short term, KBSV maintains the view that FDI disbursement in Vietnam will decrease in the period of 2025 - 2026. The level of decrease will depend mainly on the reciprocal tax rate that Vietnam has to pay. In the most negative scenario, with a low probability of occurrence, Vietnam will be subject to an unchanged Reciprocal Tax of 46% (considered the ceiling after negotiations), disbursed FDI capital is forecast to decrease by 80 - 90% in 2025. Tariff risks will also increase the pressure to withdraw investment capital from FDI enterprises in 2025.

In fact, in 2024, Vietnam's financial account recorded a deficit of 8.03 billion USD, nearly 2.7 times higher than the deficit of 2.99 billion USD in 2023, mainly due to the tendency of FDI enterprises to transfer profits back home instead of reinvesting in Vietnam due to the interest rate difference.

In the long term, KBSV expects that disbursed FDI capital flows can gradually recover when the tensions of Tradewar 2.0 pass and be compensated by FDI enterprises with export markets outside the US, thanks to Vietnam still maintaining advantages in cheap labor force, favorable location for trade, signing many free trade agreements, and policies to attract FDI capital...

The Negative Effects of Tradewar 2.0

On April 10, the Trump administration announced its decision to temporarily suspend the application of reciprocal tariffs on all countries, except China. KBSV believes that this move will create short-term opportunities for businesses to boost export orders to the US market, especially in the second quarter of 2025, before the new tax policies officially take effect. However, in the second half of 2025, Vietnam's export activities may decline rapidly. The main reason is that US import businesses often place orders 3-6 months in advance. Therefore, the decrease in orders in the second quarter of 2025 will lead to the possibility that Vietnam's exports may decline sharply in the second half of 2025. KBSV expects that, with efforts to negotiate and bargain with the US, the reciprocal tariffs imposed on Vietnam will decrease.

Forecasting exports in the period of 2025, KBSV gives two main scenarios: Scenario 1: The reciprocal tax rate with Vietnam decreases to 30-40% Vietnam's exports may decrease by 10-15% in 2025. However, exports of items such as phones, laptops, semiconductor components, etc. can be maintained in the short term, thanks to being removed from the list of reciprocal taxes. Scenario 2: The reciprocal tax rate with Vietnam decreases to 2x%. This tax rate is similar or not too different from competitors such as Indonesia, Bangladesh, Malaysia. KBSV believes that although export activities are still negatively affected, the impact will be somewhat controlled. The export decline will be about 5-8%.

Vietnam’s labor market is also facing significant challenges due to the decline in FDI inflows and exports. FDI enterprises contribute up to 35% of employment, the actual figure may be even higher as production activities also spread to domestic enterprises. In addition, 54% of domestic employment depends on exports. Therefore, the decline in FDI inflows and exports will directly affect Vietnam’s labor market, especially key export industries to the US such as electrical machinery and equipment, textiles and wood, etc. This decline not only puts pressure on employment but also negatively impacts consumer confidence, which has not yet fully recovered.

However, KBSV still expects the negative impacts on domestic consumption to be partly mitigated by the Government's approval of economic stimulus measures such as maintaining low interest rates, promoting public investment, extending VAT reductions and promoting tourism (extending the length of stay for visitors from 12 visa-exempt countries).

Boosting domestic growth drivers

Faced with external challenges, KBSV believes that the Government will strongly promote internal growth drivers such as public investment and credit growth.

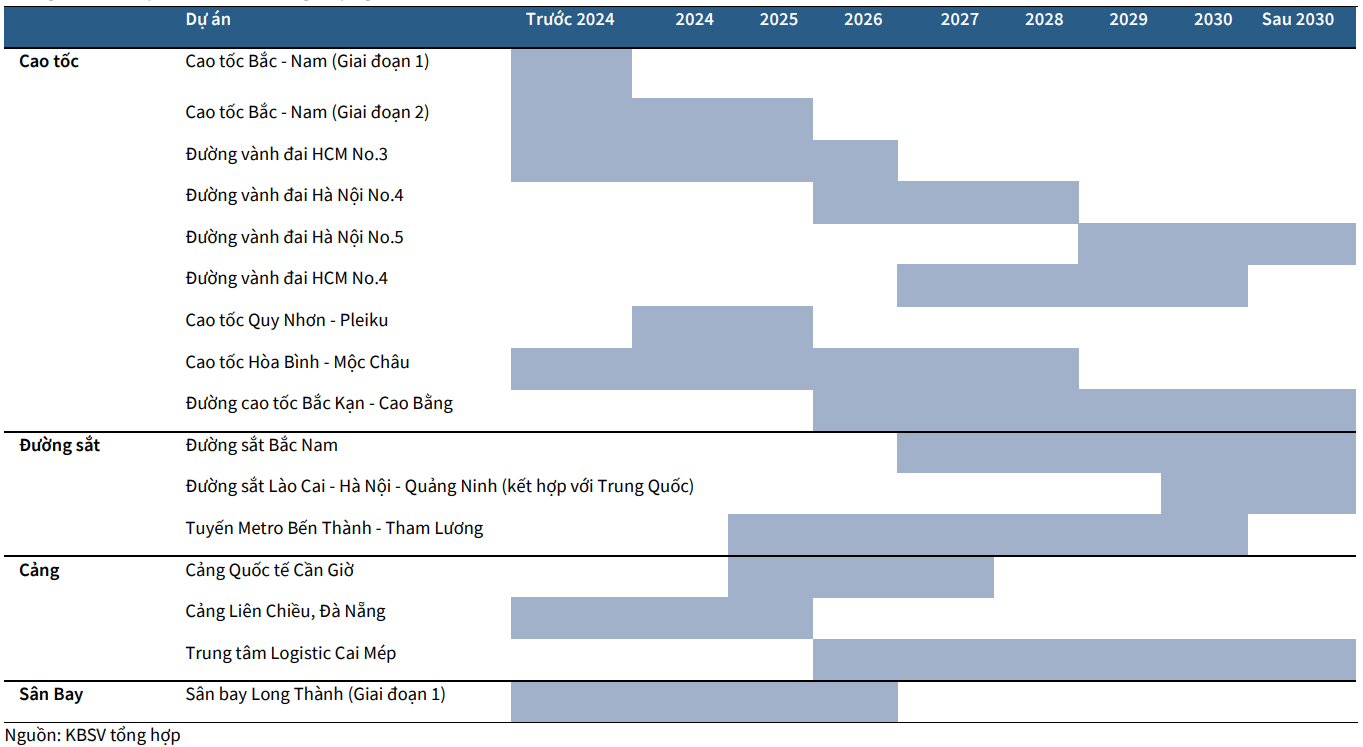

The work of streamlining and streamlining the state apparatus was basically completed in the first quarter of 2025, creating a foundation for more effective project management and implementation in the coming time. In addition, the National Assembly's approval of three new laws (Public Investment Law, Land Law, Real Estate Business Law) will help remove legal obstacles and speed up the implementation of public investment projects. With these favorable factors, KBSV expects public investment disbursement to accelerate in the following quarters and become the main driving force for economic growth in the context of weakening external drivers.

The Government's determination to promote public investment has also been clearly demonstrated since the beginning of 2025 with a series of plans being put forward such as: Supplementing public investment capital, Resolution No. 192/2025/QH15 supplementing about VND 84.3 trillion of public investment capital, raising the total disbursement plan to VND 875,707 billion, an increase of 40% compared to 2024, with a disbursement target of 95%; Approving important railway lines, including the North-South high-speed railway (67 billion USD) and the Lao Cai - Hanoi - Hai Phong railway (8 billion USD). The goal by 2030 is to double the length of expressways; The plan to strongly develop the power grid, the Power Development Plan VIII (PDP8) recently adjusted in March has set out specific plans to increase the installed capacity to more than 236 GW by 2030, an increase of about 3 times compared to the current level of 79 GW; The plan to develop the seaport system, the Government has approved the adjustment of the seaport system planning in the first quarter of 2025, adding the Can Gio port project, the goal is to increase the capacity of Vietnam's seaports to 50% in 2030.

In 2025, the State Bank of Vietnam (SBV) set a credit growth target of 16% to support the economic growth target of 8%. In the context of import-export activities and FDI capital flows being negatively affected by the trade war (Tradewar 2.0), KBSV believes that the credit growth target will be boosted by the Government's efforts to restore the real estate market and boost public investment - an important driving force contributing to supporting the economy in 2025.

KBSV expects the real estate market in 2025 to continue its recovery momentum, boosted by the Government's efforts to remove legal obstacles and the State Bank's loose monetary policy.

The Government's push to remove legal bottlenecks is creating favorable conditions for stalled real estate projects to be restarted. This has directly led to strong growth in supply in the first quarter of 2025. Specifically, the market has recorded about 27,000 new housing products, an increase of 33% over the same period in 2024. At the same time, other typical projects have also been restarted after a period of stagnation such as Dat Xanh Homes Riverside, New Galaxy, Bien Hoa Universe Complex, Metro Star, NovaWorld Ho Tram and NovaWorld Phan Thiet..., demonstrating the positive impact of efforts to clear legal procedures.

Regarding the SBV's loose monetary policy, the SBV's orientation to maintain low interest rates is expected to boost market demand. Initial signals show that this is working, with the absorption rate across the entire real estate market reaching about 45% in the first quarter of 2025, double that of the same period last year, however, this recovery does not reflect the risks in Tradewar 2.0.

KBSV believes that if the exchange rate increases below 4%, the State Bank still has room to continue its loose monetary policy, maintaining low interest rates to stimulate real estate purchases and investments in 2025, especially in the context that homebuyers' confidence may be affected by the poor labor market.

Source: https://baodaknong.vn/thach-thuc-tu-tradewar-2-0-ky-vong-chinh-phu-day-manh-nhung-dong-luc-tang-truong-tu-noi-dia-250024.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)