The trend of increasing deposit interest rates in the remaining period of 2024 is unlikely to continue and there will be differentiation among banking groups.

Pressure to slightly increase deposit interest rates at small banks

Vietcombank Securities Company (VCBS) has just released a report on the banking industry in the third quarter of 2024, in which it gave its opinion on interest rate trends in the coming time.

Deposit interest rates continue to increase in the context of improved capital mobilization since the end of April 2024. As of August 15, the growth of mobilization from customer deposits (from residents and economic organizations) reached 2.74% (the first 6 months of 2024 recorded a growth rate of 1.5% over the same period).

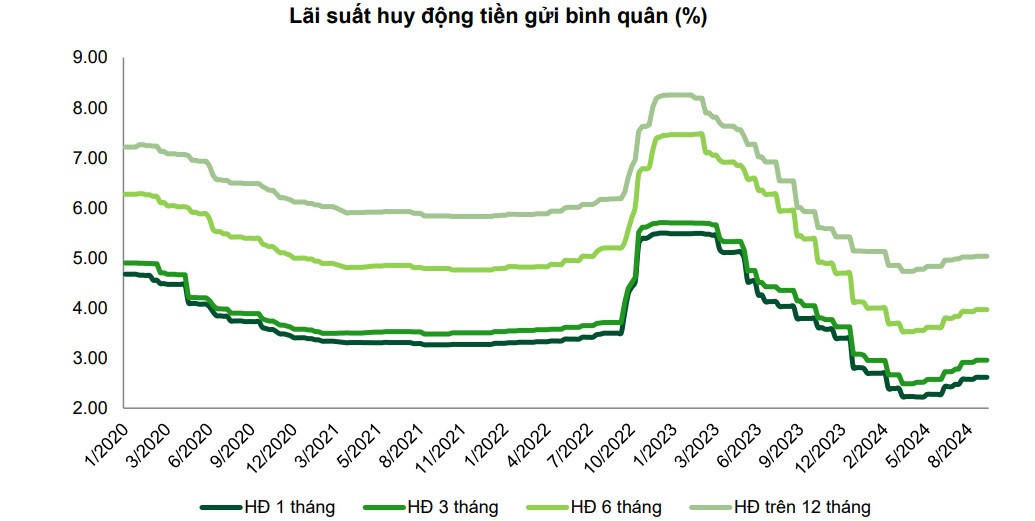

The average term deposit interest rate of the whole system as of mid-September 2024 continued to increase by 30-50 basis points for most terms, since the bottom at the end of April 2024, but still recorded a decrease of 10-30 basis points depending on the term compared to the beginning of 2024.

According to VCBS, the trend of increasing deposit interest rates in the remaining months of 2024 is unlikely to continue and there will be differentiation among banking groups.

For the state-owned banking group, deposit interest rates are expected to remain stable at the current level and may be adjusted slightly downward by the end of the year to support the economy, especially the impact of the recent storm No. 3.

For the group of private joint stock commercial banks, there is still pressure to slightly increase deposit interest rates to increase capital mobilization to promote credit growth, especially for banks with a high level of dependence on customer deposits and a less flexible capital mobilization structure.

However, VCBS also notes factors that may affect deposit interest rates in the last months of 2024 when considering factors such as:

The gap between deposit balance and credit balance of the whole system remains high, which may continue to put pressure on the mobilization interest rate level at some small-scale joint-stock commercial banks to increase the competitiveness of the savings deposit channel compared to the investment yield of other investment channels in the market.

The need to prepare capital to meet credit demand from production and business activities often tends to increase in the last months of the year.

Lending rates remain low

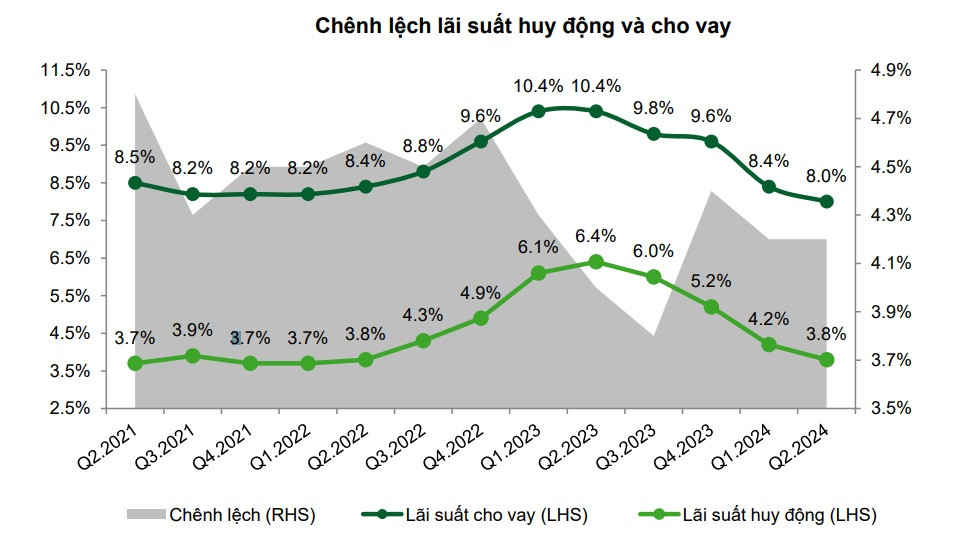

Synthesis from financial reports of listed banks shows that, from the end of the second quarter of 2024, average lending interest rates will decrease by about 0.4%/year compared to the first quarter of 2023 and decrease by 1.6%/year compared to the end of 2023.

Notably, the private commercial banking group recorded a stronger decrease in lending interest rates than the state-owned banking group due to lowering output interest rates to attract new customers in the context of weak credit demand, while simultaneously reducing interest rates/debt extension to support existing customers facing difficulties.

VCBS also assessed that lending interest rates will continue to be maintained at low levels to prioritize credit growth targets.

State-owned banks are continuing to reduce interest rates to support customers affected by Typhoon Yagi on existing and new loans until the end of this year.

Private banking groups, including some participating banks, have reduced lending rates to support customers affected by the storm. These banks are also facing competitive pressure on lending rates to boost credit and attract quality customers, especially small-scale banks.

The trend of increasing the proportion of loans to corporate customers - a group with lower lending interest rates than individual customers - in some banks in the context of loans to individual customers recovering more slowly than expected.

According to Ms. Phan My Hanh, Director of the Personal Customer Product Center, VPBank, since the beginning of the year, VPBank has reduced interest rates by more than 1%/year for individual customers borrowing for consumption and by 0.5-1%/year for business households, especially customers affected by recent storms and floods.

This bank also committed to disbursing at least VND2,500 billion for individual customers to borrow to buy social housing.

Source: https://vietnamnet.vn/tang-lai-suat-huy-dong-kho-tiep-dien-ap-luc-voi-ngan-hang-nho-2345809.html

Comment (0)