VN-Index rises amid fear.

The July 3rd stock market session kicked off the new month with investor caution. From the start of the session, a hesitant attitude was evident as the inflow of capital into the market was quite modest. However, selling pressure was not significant, so the VN-Index managed to maintain its positive momentum.

VCBS Securities commented that after two consecutive days of declines, the general sentiment of investors remains cautious and apprehensive about the short-term market correction, leading to increasing selling pressure and pulling the general index close to the reference level.

However, divergence remained evident as demand continued to gravitate towards specific sectors, most notably the chemical sector, which rose by over 2%. The positive trend continued into the afternoon session, but active buying activity slowed down and became somewhat sluggish as the overall index reached 1,125 points.

Ending their streak of net buying sessions, foreign investors returned to net buying throughout the session with a liquidity of 134 billion VND, focusing on buying HPG, SSI, and VHC.

Stocks rose on July 3rd, fueled by bullish sentiment in Asian markets. However, this wasn't a positive sign, as liquidity plummeted significantly. (Illustrative image)

At the close of trading on July 3rd, the VN Index rose 5.32 points, or 0.47%, to 1,125.50 points; the VN30-Index increased 0.24 points, or 0.02%, to 1,123.37 points. Across the entire exchange, 253 stocks gained, 59 remained unchanged, and 169 declined.

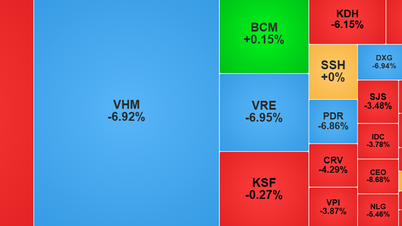

These data show that penny and mid-cap stocks were the main drivers of the stock market's price increase on July 3rd. Blue-chip stocks failed to play their role. The inflow of capital into large-cap stocks was very low, with only 156 million shares, equivalent to VND 3,998 billion, successfully traded in the VN30 group.

Notably, the highlight of the stock market on July 3rd was not the VN-Index regaining its positive momentum, but rather the sharp decline in liquidity. The index rising with low trading volume indicates that investors are full of fear. And this is not a good sign for the market.

On the Hanoi Stock Exchange, the HNX-Index even closed the July 3rd trading session in the red, falling 0.72 points, or 0.32%, to 226.60 points. Meanwhile, the HNX30-Index rose 2.77 points, or 0.65%, to 429.54 points.

Liquidity on the Hanoi Stock Exchange also plummeted during the July 3rd trading session. Only nearly 80 million shares, equivalent to 1,153 billion VND, were successfully traded.

Asian stocks surged.

Asian -Pacific markets rose as investors reacted to a series of manufacturing activity reports showing a slowdown in output across the region.

China's Caixin manufacturing purchasing managers' index for June reached 50.5, slightly higher than the 50.2 expected in a Reuters poll.

Hong Kong's Hang Seng index rose 2.2%, leading gains in the region, and the Hang Seng Tech index surged nearly 4%.

Mainland Chinese markets also moved higher: the Shanghai Composite rose 1.31%, closing at 3,243.98, and the Shenzhen Component gained 0.6%, ending the day at 11,091.56.

Japan's Nikkei 225 led gains in the region, rising more than 1.7% to close at a new 33-year high of 33,753.33, with the Topix also gaining 1.41% to finish at 2,320.81.

In South Korea, the Kospi rose 1.49% to close at 2,602.47, extending its recovery from Friday, and the Kosdaq gained 2.42% to close at 889.29.

In Australia, the S&P/ASX 200 rose 0.59%, closing at 7,246.1 as investors awaited the Reserve Bank of Australia's interest rate decision on Tuesday. Economists surveyed by Reuters expect the central bank to raise the cash rate by 25 basis points to 4.35%.

The S&P Global ASEAN Manufacturing Purchasing Managers' Index (PMI) showed a slight improvement in manufacturing conditions in June, reaching 51, down from 51.1 a month earlier.

Source

![[Photo] Prime Minister Pham Minh Chinh attends the Conference on the Implementation of Tasks for 2026 of the Industry and Trade Sector](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F19%2F1766159500458_ndo_br_shared31-jpg.webp&w=3840&q=75)

Comment (0)