This morning, April 22, the Dong Ha - Cam Lo Regional Tax Department coordinated with service providers to support application solutions to organize a conference on solutions to enhance the management of electronic invoices (E-invoices) generated from cash registers in Dong Ha City and Cam Lo District. About 400 delegates representing economic organizations, enterprises and business households attended.

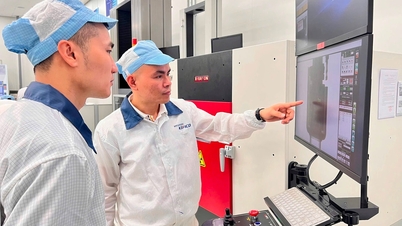

Delegates were introduced to solutions for using and managing electronic invoices initiated from cash registers - Photo: NT

The implementation of electronic invoices generated from cash registers according to the provisions of the Law on Tax Administration; Decree No. 123/2020/ND-CP and Circular No. 78/2021/TT-BTC has been implemented in 2 phases: Phase 1 from December 15, 2022 - February 31, 2023, focusing on restaurants, eateries, hotels, supermarkets, and gold and silver businesses; Phase 2 from April 1, 2023 is implemented nationwide for all subjects subject to the implementation of electronic invoices generated from cash registers.

In recent times, the Ministry of Finance and the General Department of Taxation have had many drastic solutions, along with the coordination of relevant departments and branches, to strengthen the management of electronic invoices generated from cash registers. The results achieved up to December 31, 2023 are basically quite good compared to the plan that the tax departments themselves built (94.36%).

This not only plays an important role in implementing the digital transformation goal of the tax sector, preventing tax losses in the retail sector, protecting consumer rights, but also brings many practical benefits to businesses and individual business households when deploying and converting to using electronic invoices generated from cash registers.

At the conference, delegates were introduced to solutions for using and managing electronic invoices generated from cash registers on invoice application software. Discussing and resolving difficulties of businesses, households, and individual businesses; handling difficulties and problems in implementing applications, conversion and usage costs; and problems with tax policies.

Through the conference, the aim is to accelerate the process of applying electronic invoices generated from cash registers for production and business establishments, contributing to creating an equal, transparent and favorable business environment for people and businesses and successfully implementing national digital transformation.

Ngoc Trang

Source

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)