Last week, the US Federal Reserve (Fed) revealed that last year, the median net worth of American families reached $1 million for the first time, up 42% from $749,000 in 2019.

Of course, that average is dominated by a small number of billionaires and millionaires. Inflation means that real wealth has not increased much. But it would be a mistake to conclude that the increase in wealth is a phenomenon of the top 1%, or that it is inflated by inflation and asset bubbles.

Many people in the American middle class have become millionaires.

One notable finding, according to the Fed’s latest Survey of Consumer Finances, which is conducted every three years, is the rise in millionaires. About 16 million American households—more than 12% of all households—will have assets exceeding $1 million by 2022, up from 9.8 million in 2019. Nearly 8 million households will have assets exceeding $2 million, up from 4.7 million in 2019.

According to The Wall Street Journal , these people are called "mini-millionaires," as opposed to the millionaires and billionaires in the 1% (ie the super-rich). "Mini-millionaires" typically earn between $150,000 and $250,000 a year. They are not considered wealthy, but rather upper middle class, by American standards.

Far from being left behind as the economy ’s gains went to billionaires, the “little millionaires” actually saw their wealth increase more than the top 10% of households over the past three years. The largest wealth gains from 2019 to 2022 were among the roughly 13 million households in the 80th to 90th percentiles of the income distribution. Their median wealth increased 69% from 2019 (adjusted for inflation), to $747,000 in 2022.

Certainly, for many American families, skyrocketing prices since the pandemic began mean that income is no longer worth what it used to be. But as these figures show, the growth in net worth for these families has far outpaced inflation.

More than 90% of these households said they owned stocks, either directly or through retirement accounts, and 87% owned homes. They benefited greatly from low interest rates, which saw the debt-service portion of their income fall from 19% in 2007 to 12.9% in 2022.

Instead of being dominated by the 1%, the US economy is creating an expanding middle class. Many people entered this group by earning college degrees, steadily building savings accounts, and buying homes. For the most part, they grew rich slowly, gaining a foothold in the economy as Covid-19 stimulus programs boosted asset values.

Source link

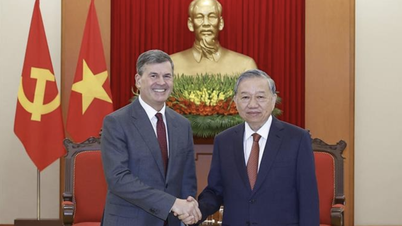

![[Photo] General Secretary To Lam receives the Director of the Academy of Public Administration and National Economy under the President of the Russian Federation](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F08%2F1765200203892_a1-bnd-0933-4198-jpg.webp&w=3840&q=75)

Comment (0)