Since August 16, the already hot stock market has become even hotter when VinFast shares were listed on the Nasdaq stock exchange in the US. On the day of its debut, VinFast's VFS shares made an impression by doubling, thereby putting Mr. Pham Nhat Vuong, Chairman of the Board of Directors of Vingroup Joint Stock Company, on the list of the richest people in the world.

Since then, VFS has had many strong fluctuations but with a mainly upward trend. Closing the last session of the week (August 25), VFS shares stopped at 68.77 USD/share, up 40.35%. During the session, there was a time when VFS reached 73 USD/share. Thanks to that, VinFast 's capitalization reached 160 billion USD.

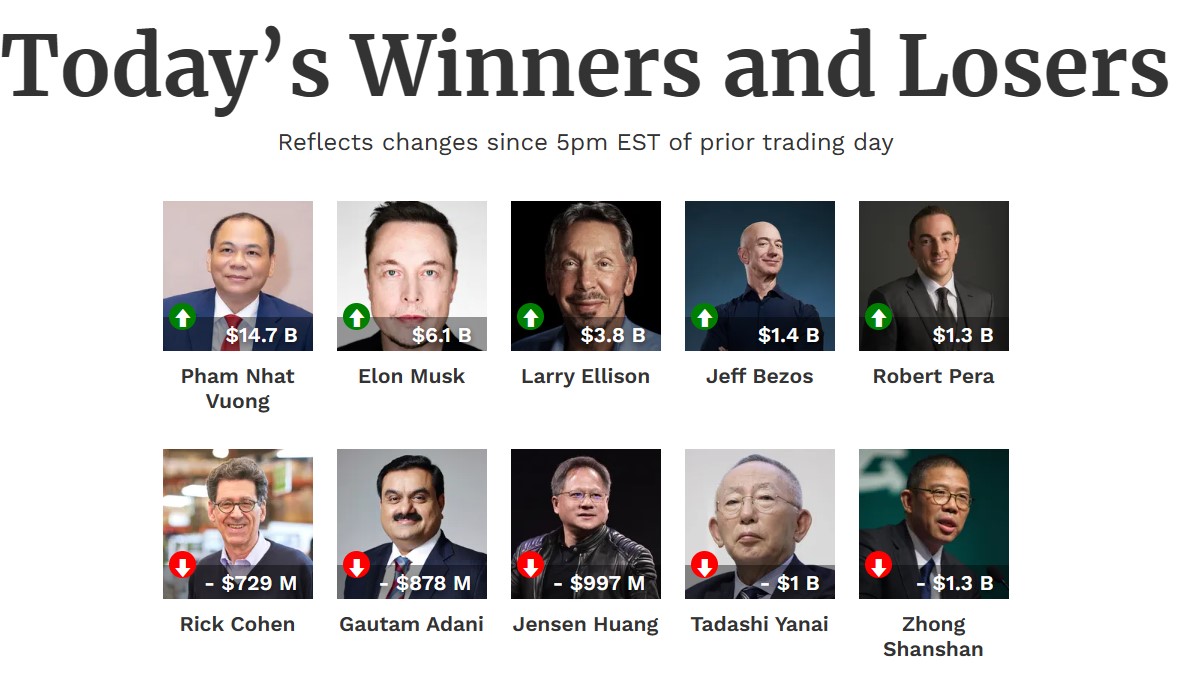

VinFast shares on the Nasdaq rose sharply, helping billionaire Pham Nhat Vuong's assets increase by 14.7 billion USD overnight, recording a stronger increase than Elon Musk. Photo: Source: Forbes

Currently, VinFast is firmly in the 3rd position in the list of companies with the largest market capitalization globally, just behind Tesla (757 billion USD) and Toyota (223 billion USD). VinFast's capitalization is superior to 2 members of the Top 5, Porsche (99 billion USD) and BYD (89 billion USD).

Not only did VinFast's market capitalization increase rapidly, Mr. Pham Nhat Vuong's assets also increased significantly. In the weekend session alone, Mr. Vuong's assets increased by 14.7 billion USD to 55.8 billion USD, recording the highest daily increase in the world .

The remaining billionaires have assets that increase at a much lower rate than billionaire Pham Nhat Vuong, such as Tesla boss Elon Musk (increased by 6.1 billion USD), Larry Ellison (increased by 3.8 billion USD), Jeff Bezos (increased by 1.4 billion USD) and Robert Pera (increased by 1.3 billion USD).

After his fortune increased sharply, Mr. Pham Nhat Vuong became the 23rd richest person in the world and the 3rd richest in Asia, just behind the richest person in India, Mukesh Ambani (95.9 billion USD) and Zhong Shanshan (60.3 billion USD). However, over the weekend, the two richest billionaires in the world lost 878 million USD and 1.3 billion USD.

Source

![[Photo] Closing ceremony of the 18th Congress of Hanoi Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/17/1760704850107_ndo_br_1-jpg.webp)

![[Photo] Nhan Dan Newspaper launches “Fatherland in the Heart: The Concert Film”](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760622132545_thiet-ke-chua-co-ten-36-png.webp)

Comment (0)