(NLDO)- Last week, stocks of some banks such as Eximbank, ACB , and Techcombank attracted attention when they dropped sharply despite having just reported positive business results.

Last week of stock trading, the market continuously had sharp declines, VN-Index lost more than 32 points compared to the end of last week, down to 1,252 points.

In particular, banking stocks had the most negative impact on the general market, despite the banks' positive third-quarter and first-nine-month business results reports. The decline in banking stocks also "blew away" hundreds of billions of dong in assets of many giants in this industry.

Among them, the sharpest decrease was ACB stock of Asia Commercial Joint Stock Bank (ACB) when there was no increase last week, down 4.6% despite just reporting positive business situation in the first 9 months of the year, reaching 15,334 billion VND in pre-tax profit, up 2.1% compared to last year.

Accordingly, the value of 153 million ACB shares (equivalent to 3.4% of capital) of "handsome guy" Tran Hung Huy, Chairman of the Board of Directors of ACB bank, "evaporated" more than 184 billion VND, down to 3,809 billion VND.

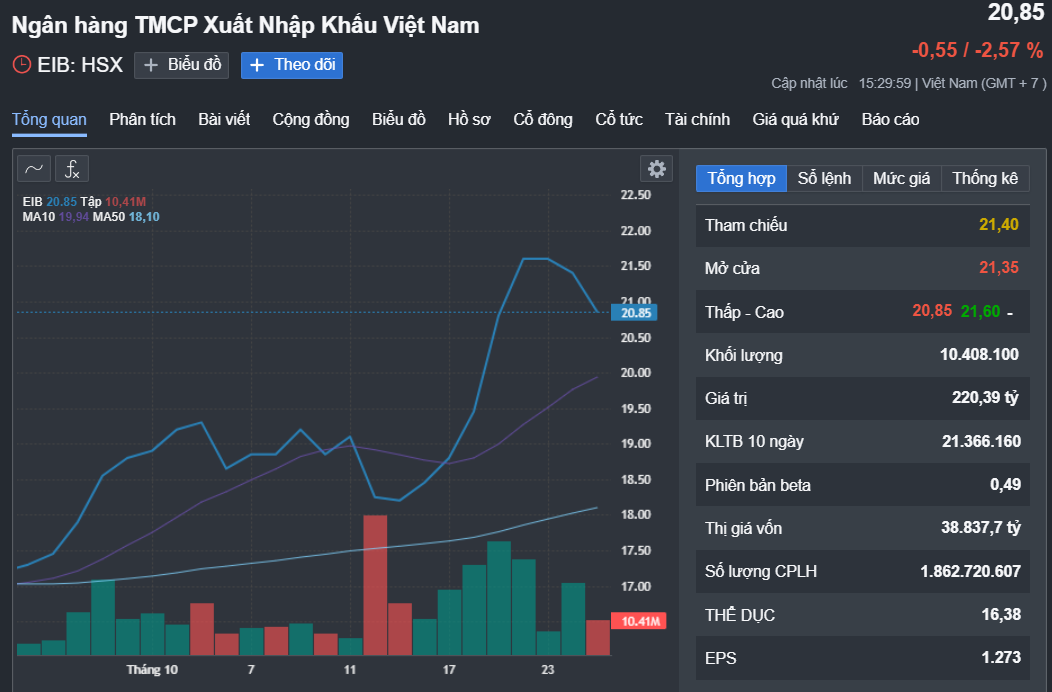

Eximbank's EIB shares suddenly plummeted in the last 2 sessions of the week despite just reporting a profit of thousands of billions of dong. Source: Fireant

Following behind is TCB shares of Vietnam Technological and Commercial Joint Stock Bank (Techcombank), which decreased nearly 4% compared to the trading session at the end of last week, down to VND23,500/share, despite reporting pre-tax profit of VND22,800 billion in the first 9 months of 2024, up 33% over the same period last year, nearly reaching the threshold of USD1 billion.

As a result, the value of more than 1 billion TCB shares held by Masan Group Corporation of billionaire Nguyen Dang Quang, the shareholder holding the largest amount of shares at this bank, decreased by more than VND950 billion, down to VND24,450 billion.

Meanwhile, despite increasing by 7.2% last week, EIB shares of the Export Import Commercial Joint Stock Bank (Eximbank) - the unit that just reported a profit in the first 9 months of 2024 increased by 39% compared to the same period last year, reaching 1,712 billion VND - attracted attention in the last session of the week when there were two consecutive sessions of decline, from 21,600 VND to 20,850 VND/share (equivalent to 3.47%).

Accordingly, the value of 187 million EIB shares (equivalent to more than 10% of capital) held by Eximbank's largest shareholder, Gelex Group Corporation, "evaporated" VND141 billion, down to nearly VND3,900 billion.

Source: https://nld.com.vn/tai-san-cac-dai-gia-ngan-hang-boc-hoi-tram-ti-du-ket-qua-kinh-doanh-tang-vot-196241027121101811.htm

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)