The story of family deductions when calculating personal income tax has heated up once again when 16 ministries and localities simultaneously proposed to increase the family deduction level by one and a half times compared to the current level, on the grounds that the family deduction level is too outdated.

Some provisions of the current Personal Income Tax Law, after many years of application, have revealed some shortcomings and are no longer suitable for the current situation - Photo: TTD

Speaking to Tuoi Tre , many experts said that the draft Law on Personal Income Tax replacement will be discussed by the National Assembly in the October 2025 session, approved in the May 2026 session, and can be applied from 2027, which is too long. Because from 2020 to the end of 2024, the consumer price index (CPI) has increased by nearly 16% and will reach 20% by the end of 2025. If we have to wait until 2027 to adjust, many salaried workers will have to pay taxes, even though their income is not enough to cover their living expenses.

Fed up with the "family deduction"

Ms. Nguyen (Go Vap District, Ho Chi Minh City) said that her family's monthly income is about 30 million VND but there is no extra money because prices have been continuously increasing recently. The deduction for her children is 4.4 million VND/month but the monthly tuition fee for each child is about 5 million VND, not including other expenses such as food, school supplies, and weekend entertainment.

Because there is no surplus, every time the school year begins, the family is under a lot of pressure, having to "make do" with a series of expenses such as buying uniforms, money for facilities at the beginning of the year, parent funds, class funds... Those expenses, although very legitimate, are not deductible, but the tax authority "contracts" them all into the amount of 4.4 million VND/month.

"Not to mention we still rent a house for 7 million VND per month but we can't declare it for deduction. Many months we don't have any money left, even having to borrow a few million VND to cover expenses but I still have to work hard to pay taxes," said Ms. Nguyen.

Many taxpayers are even more worried as the cost of living has recently become more expensive. Ms. Thuy (District 12) said that after returning to Ho Chi Minh City after Tet, she was quite surprised to see the prices of every item increase. A bowl of pho near her house went from 30,000 VND to 35,000 VND, a loaf of bread went from 20,000 VND to 22,000 VND, a package of sticky rice went from 12,000 VND to 15,000 VND...

"Not only in Ho Chi Minh City, but also during the recent Tet holiday when I went back to my husband's hometown in Binh Duong, I was also dizzy because prices had already established a new price level. While salaries have not increased for the past few years, they have even decreased, and the family deduction when calculating personal income tax remains the same, making salaried workers like me have a headache when calculating living expenses," Ms. Thuy was upset and suggested that the family deduction level should be adjusted soon as well as the tax bracket should be stretched to make it easier for salaried workers.

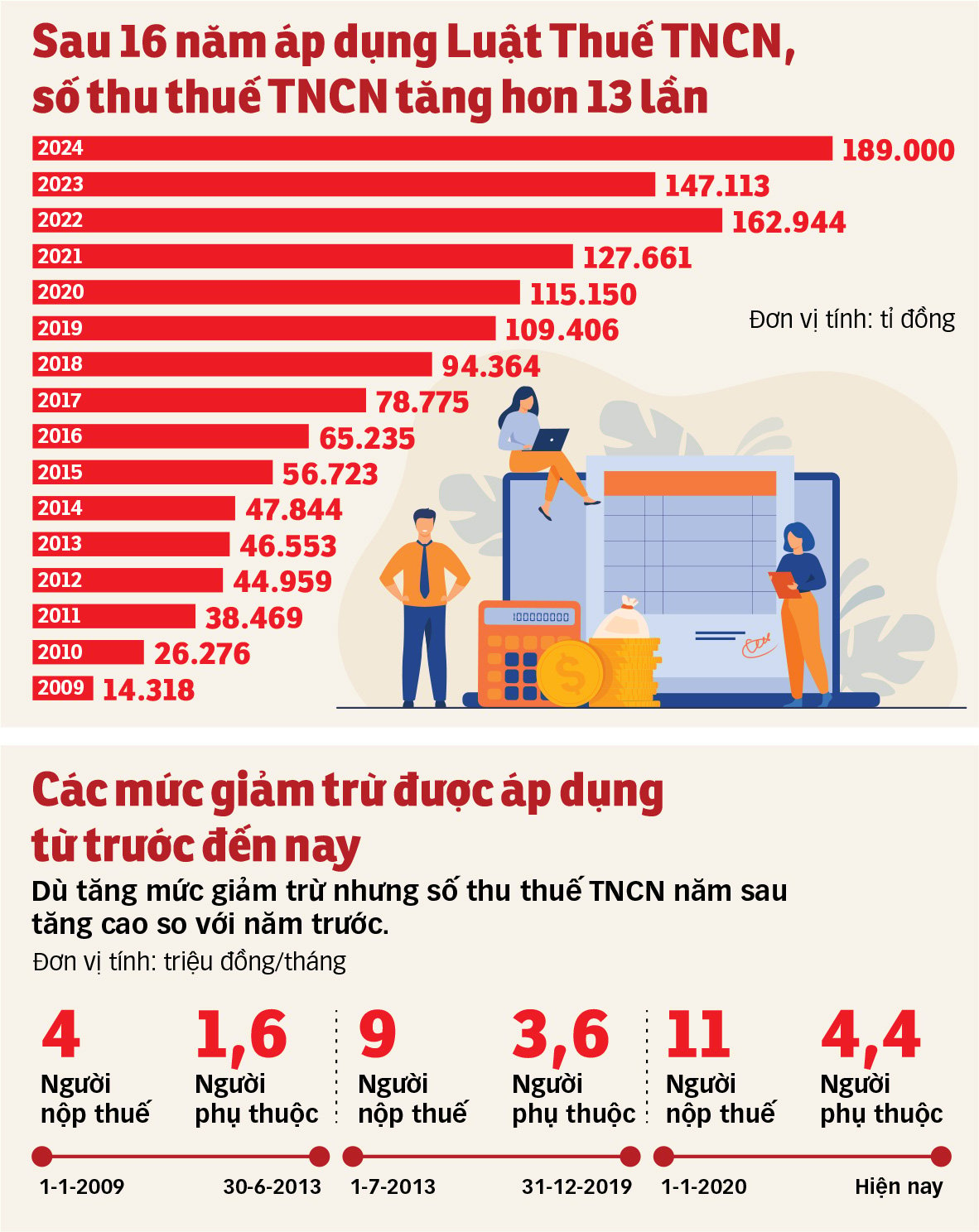

According to the summary report and assessment of 10 years of implementing the Personal Income Tax Law by the Ministry of Finance, the proportion of revenue from personal income tax in total budget revenue has continuously increased from 5.33% in 2011 to more than 9% in 2023, becoming the tax that generates the third largest source of revenue for the state budget in the tax system, after VAT and corporate income tax.

According to lawyer Tran Xoa - director of Minh Dang Quang Law Firm, revenue from wages and salaries accounts for 60 - 70% of total personal income tax revenue and this is the most important source of revenue among the 10 types of taxable income. "Therefore, it is understandable why salaried workers have complained a lot over the past time, but up to now, the Ministry of Finance has still used many reasons to delay adjusting the family deduction level to reduce the burden on taxpayers," said Mr. Xoa.

Rising prices make people's lives more and more difficult - Photo: QUANG DINH

Progressive tax schedules create a tax burden

An important content that the Ministry of Finance is orienting to amend is to reduce the number of tax brackets in the progressive tax schedule to less than seven compared to the current level in order to reduce the tax burden on people with income from wages and salaries. In fact, many countries have also reduced the number of tax brackets such as Indonesia and the Philippines, reducing them to five brackets with tax rates from 5-35%. Malaysia also reduced them from 11 brackets to nine brackets from 2024...

According to Ms. Huyen Nguyen - Deputy General Director of EY Vietnam Consulting JSC, many countries and territories in the world maintain a low number of tax brackets such as Hong Kong, Australia, Indonesia all have five brackets. Therefore, to reduce the burden on individual taxpayers with income from wages and salaries, in addition to increasing the family deduction level and reducing the number of tax brackets, the revised tax law needs to consider increasing the taxable income at each bracket.

"Because compared to countries with average income per capita similar to Vietnam and the same highest tax rate of 35%, the taxable income threshold at 35% in Vietnam is relatively low. The Philippines and Indonesia have the highest tax rate of 35%, but Indonesia applies it to an income of 5 billion rupiah/year (about 667 million VND/month), while the Philippines applies it to 8 million pesos/year (about 288 million VND/month).

"Meanwhile, in Vietnam, the taxable income subject to the 35% tax rate is over 80 million VND/month and has been applied for the past 15 years," said Ms. Huyen Nguyen, adding that according to information from the World Bank, Vietnam's average income in 2009 was about 1,120 USD. By 2023, Vietnam's average income will reach about 4,346 USD. Thus, from 2009-2023, Vietnam's average income has increased more than 3.73 times.

Average income has increased, the number of taxpayers as well as personal income tax has increased significantly. The evidence is that personal income tax revenue has increased very quickly. According to the Ministry of Finance, in 2011 it reached 38,469 billion VND, by 2024 it will increase to 189,000 billion VND.

Therefore, in its comments on the progressive tax schedule to amend this law, the Thai Nguyen Provincial Tax Department proposed to reduce the tax rate for the first three tax brackets to reduce the burden on taxpayers. In fact, taxpayers in tax brackets 1, 2 and 3 have incomes just enough to cover their living expenses, but over time, they still have to pay additional personal income tax.

Source: Ministry of Finance - Data: Le Thanh - Graphics: TAN DAT

Can't wait until 2027 to adjust family deductions

Talking to Tuoi Tre , many experts said that the draft Law on Personal Income Tax replacement will be discussed by the National Assembly in the October 2025 session, approved in the May 2026 session, and can be applied from 2027 is too long. According to Mr. Nguyen Ngoc Tu - a tax expert, with this roadmap from now until 2027, taxpayers will continue to wait wearily.

Meanwhile, from 2020 to the end of 2024, the consumer price index (CPI) has increased by nearly 16%. And with the expected CPI increase this year, the possibility of the CPI reaching 20% is entirely possible. "Therefore, taxpayers cannot wait any longer. The Ministry of Finance should promptly report to the Government to soon submit to the National Assembly Standing Committee a proposal to increase the family deduction level appropriately," Mr. Tu suggested.

Meanwhile, although she highly appreciates the Ministry of Finance's revised direction that will allow individuals to deduct some essential expenses such as education, medical treatment... before calculating personal income tax, Ms. Huyen Nguyen believes that the family deduction level should be reviewed and adjusted annually or at least every 2-3 years according to the increase in basic salary.

"In addition, it is also possible to consider adjusting the family deduction level according to the increase in the regional minimum wage or the increase in the CPI, instead of waiting until the CPI increases by more than 20% as currently regulated. For example, the increase in the regional minimum wage from July 1, 2024 is 6%, the increase in the family deduction level will also be 6%," Ms. Huyen Nguyen suggested.

Lawyer Tran Xoa also said that the two key issues in adjusting the Personal Income Tax Law for salaried employees are adjusting the family deduction level and the progressive tax schedule. According to Mr. Xoa, when the Personal Income Tax Law was developed in 2005-2006, the annual CPI growth rate was up to double digits. Therefore, many opinions suggested that a 20% CPI increase would increase the family deduction level because it was expected that after about two years, the CPI would reach that growth rate.

But in reality, in recent years, it took 5-6 years for the CPI to reach a 20% increase, and then another 1-2 years for the procedures to propose and adjust, so the family deduction level was outdated even before it was applied. Not to mention that the CPI basket includes more than 700 items, but only 20-30 of them are essential, so it is not suitable to be used as a basis for adjusting the family deduction level.

"Therefore, instead of setting a fixed level, we should study the calculation method as well as provide a basis for adjusting the family deduction level to make it suitable and easy to implement, avoiding disadvantages for taxpayers as well as avoiding falling into the current rut. The same is true when adjusting the progressive tax schedule," Mr. Xoa suggested.

Must deduct expenses for education, health care, housing...

In the proposal to develop a new Personal Income Tax Law recently submitted to the Government, the Ministry of Finance proposed adjusting the family deduction level, in particular, individuals can deduct some specific expenses such as education and medical treatment. In addition, to reduce the burden on taxpayers, the progressive tax rate for income from wages and salaries will also be reduced to seven levels lower.

Comments on this law have been received from 16 ministries and localities proposing to increase the family deduction level because the current level of VND11 million/month and VND4.4 million/month for taxpayers and dependents is no longer suitable. Meanwhile, Ha Tinh proposed to increase the family deduction level to VND18 million/month for taxpayers and VND8 million/month for dependents. The Ministry of National Defense also proposed to increase the family deduction level corresponding to the annual increase in the basic salary. In addition, localities also proposed that the family deduction level should be based on the regional minimum wage to ensure that it is suitable for the actual living conditions in each region and area of the country. Accordingly, the minimum wage is divided into four regions, corresponding to four family deduction levels.

Many localities also propose adding specific deductions such as education, health care, and housing expenses before calculating taxes...

Ms. Huyen Nguyen (Deputy General Director of EY Vietnam Consulting Joint Stock Company):

Personal income tax should be reduced immediately for those paying at level 1.

While waiting for the amendment of the Personal Income Tax Law to replace it, to reduce the disadvantages for taxpayers, the Government should submit to the National Assembly a tax reduction for taxpayers at level 1.

As in 2009, in order to prevent economic recession and ensure social security, the Government submitted to the National Assembly a resolution on personal income tax exemption for the first six months of 2009 for individuals with income from business, salary, wages, inheritance, gifts, etc.

In 2011, the economy faced many challenges and taxpayers' lives faced many difficulties. The Government reported to the National Assembly to exempt personal income tax for the last five months of 2011 for individuals and business households with taxable income from salaries, wages and business to the level of personal income tax at level 1.

After two years of the COVID-19 outbreak, and then the post-COVID-19 period from 2023 to present, workers' income has decreased while the cost of essential needs has increased. Therefore, the National Assembly can consider issuing support policies to share difficulties with personal income taxpayers.

Source: https://tuoitre.vn/sua-thue-thu-nhap-ca-nhan-bo-tai-chinh-can-lang-nghe-nhieu-hon-20250211075724534.htm

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

Comment (0)