On the morning of November 22, under the direction of Vice Chairman of the National Assembly Nguyen Duc Hai, the National Assembly listened to the report of the Government and the appraisal agency on the draft Law on Corporate Income Tax (amended).

Presenting the Government's Report, Deputy Prime Minister Le Thanh Long said that the promulgation of the Law on Corporate Income Tax (CIT) (amended) is necessary to implement the policy and guidelines on reforming the tax policy system in general, and CIT policy in particular, as stated in documents of the Party and State; meeting requirements from practice, from the new development situation of the economy as well as requirements of international integration.

The promulgation of the Law on Corporate Income Tax (amended) is to amend or abolish inappropriate contents; minimize the integration of social policies with tax exemption and reduction policies; ensure tax neutrality for stable and long-term application; attract the participation of economic sectors to invest in industries and areas that need investment incentives. Ensure transparency, ease of understanding, ease of implementation, promote administrative procedure reform, improve the investment and business environment. Implement standards on preventing and combating transfer pricing, tax evasion, tax losses, and revenue erosion according to international practices.

The draft Law consists of 4 Chapters and 20 Articles. The basic content of the draft Law closely follows the policy groups in the dossier proposing the development of the Corporate Income Tax Law (amended) which was approved by the National Assembly.

On behalf of the auditing body, Chairman of the Finance and Budget Committee (TCNS) Le Quang Manh expressed his agreement on the need to amend the Corporate Income Tax Law to overcome the difficulties and shortcomings of the current Law and to be consistent with the development of the domestic and world economy. In particular, focusing on a number of major goals including: Removing shortcomings and obstacles for the business sector to create a favorable environment for taxpayers to comply with tax laws; Institutionalizing the policies of the Party and State on encouraging and improving the investment environment, resolving limitations and shortcomings in tax incentives, promoting domestic enterprises to restructure the economy, attracting international investors in line with new trends...

Regarding taxpayers being foreign organizations conducting business activities on e-commerce platforms (Article 2), the draft Law supplements regulations on tax collection for taxpayers being foreign enterprises conducting e-commerce business, business on digital platforms paying tax on taxable income arising in Vietnam and supplements regulations on the type of "virtual" permanent establishment (no physical presence).

Head of the TCNS Le Quang Manh said that with these provisions of the draft Law, the Committee requested the drafting agency to clarify a number of issues: The ability to collect corporate income tax in practice for foreign enterprises without a presence in Vietnam supplying goods to Vietnam through transactions on e-commerce platforms. The suitability of the scope of Vietnam's taxing rights in the case of the above-mentioned foreign enterprises establishing permanent establishments in Vietnam compared with the provisions in the signed tax treaties...

In principle, the application of corporate income tax incentives (Article 12) and the consistency of the legal system, the draft Law is currently inconsistent in the scope of sectors and fields enjoying incentives compared to the provisions of the Investment Law, a number of current specialized laws and a number of laws being discussed by the National Assembly that will be promulgated in the near future. The majority of opinions in the TCNS Committee agree with the principle of prioritizing the application of the Corporate Income Tax Law in cases where there are different provisions between the Corporate Income Tax Law and other Laws as shown in the draft Law to ensure consistency in law enforcement, avoiding the provision of incentives spread across many different specialized Law documents...

Regarding the conditions for special investment incentives (Clause 2, Article 12), the TCNS Committee proposed to clarify the conditions for projects to enjoy special investment incentives currently stipulated in the draft Law based on the total investment capital. The draft Law only stipulates the time to ensure the disbursement of 1/3 of the total investment capital and has not stipulated the time to ensure the disbursement of the remaining 2/3 of the total investment capital. Therefore, there will be no legal basis for the tax authority to conduct post-audit and it will not ensure the comprehensiveness and strictness of the legal provisions.

Regarding the decision on the level of special investment incentives (Clause 6, Article 13, Clause 3, Article 14), the draft Law assigns the Prime Minister the authority to decide on the extension of the period of application of preferential tax rates, the period of tax exemption and reduction; the additional exemption and reduction levels, applicable to projects enjoying special investment incentives. These contents are stipulated in the Investment Law 2020 and are incorporated into the draft Law on Corporate Income Tax. These are large incentives to attract strategic investors, the rights and obligations of taxpayers, therefore, many opinions suggest that the Government should stipulate to ensure the implementation of the Law in a comprehensive and unified manner.

Regarding corporate income tax incentives for expansion investment (Article 14): The majority of opinions in the TCNS Committee agree with the amendments in the draft Law, in the direction of removing the requirement to separately account for the additional income from expansion investment, accordingly, the income from expansion investment will enjoy incentives according to the remaining time of the original main project. However, for cases where the initial project has expired its incentive period, the draft Law continues to stipulate that expansion investment must be separately accounted for to enjoy incentives as a new project. This provision does not resolve the current problem and may encourage enterprises to delay expansion investment to enjoy a larger incentive package as a new investment project.

The Draft Law on Corporate Income Tax (amended) consists of 4 Chapters and 20 Articles, including: Chapter I. General provisions (from Article 1 to Article 5); Chapter II. Tax basis and method (from Article 6 to Article 11); Chapter III. Corporate income tax incentives (from Article 12 to Article 18); Chapter IV. Implementation provisions (Articles 19 and 20).

Source: https://baotainguyenmoitruong.vn/sua-luat-thue-thu-nhap-doanh-nghiep-de-cai-thien-moi-truong-dau-tu-kinh-doanh-383513.html

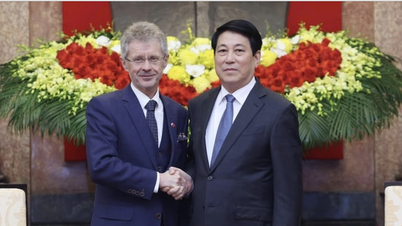

![[Photo] President Luong Cuong receives President of the Senate of the Czech Republic Milos Vystrcil](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F20%2F1763629737266_ndo_br_1-jpg.webp&w=3840&q=75)

![[Photo] Lam Dong: Panoramic view of Lien Khuong waterfall rolling like never before](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F20%2F1763633331783_lk7-jpg.webp&w=3840&q=75)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with South Korean National Assembly Chairman Woo Won Shik](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F20%2F1763629724919_hq-5175-jpg.webp&w=3840&q=75)

Comment (0)