In a study recently published by the journal Chinese Rare Earths, scientists from the Chinese Academy of Sciences (CAS) warned that China's estimated share of rare earths, 62%, could fall to just 28% by 2035 as new sources emerge.

A rare earths mining facility in Western Australia, which has 99% purity neodymium deposits. Photo: Australianresourcesandinvestment

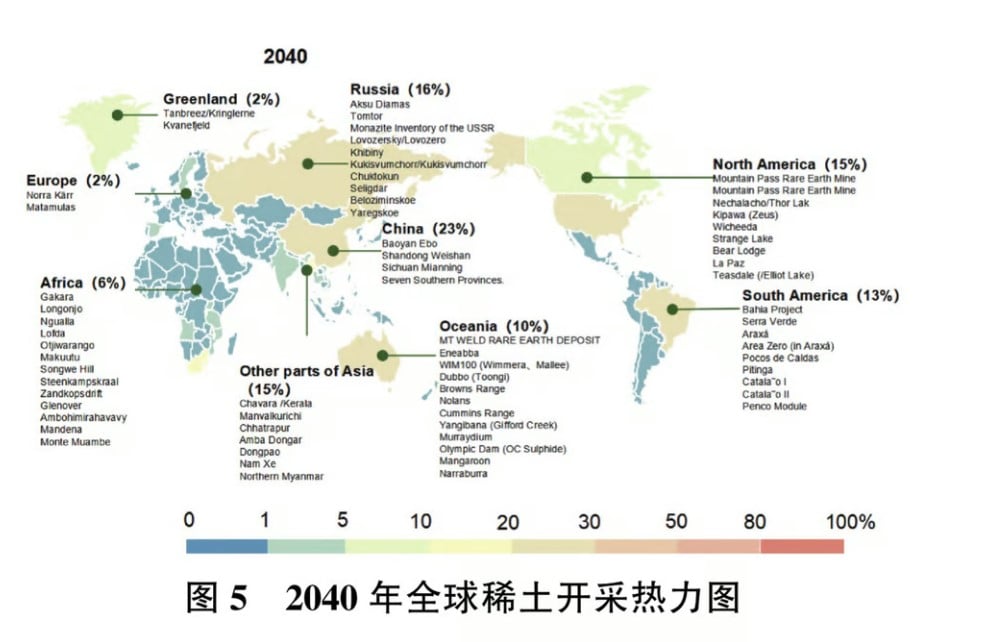

The researchers' model predicts a further decline would drag China's share of the global rare earths market down to 23% by 2040, leaving Beijing "completely losing its previous dominance" as expanding mining frontiers in Africa, South America and Australia potentially reshape the industry.

Even China's large rare earth deposits in the south - concentrated in ion-adsorbing clays - could be threatened by Greenland's Kvanefjeld mine and several projects in South America, experts say.

The rare earth report was prepared by researchers at the CAS Ganjiang Innovation Academy in Ganzhou, Jiangxi Province, eastern China. China has claimed to hold 60% of the world's rare earth reserves and account for 90% of global processing capacity.

Because of their crucial role in the production of high-tech products such as smartphones and electric cars, China's leverage over rare earth reserves gives its high-tech industries a competitive edge and is a geopolitical trump card for Beijing.

“By 2040, as global demand for rare earths continues to grow, Africa and Australia will develop additional high-potential rare earth deposits, respectively. Europe will also begin to participate in the global rare earth supply chain,” the researchers wrote.

Forecast of global rare earth deposits to 2040. Graphic: Chinese Academy of Sciences

The researchers used advanced “agent-based modeling” in the study to simulate global mining decisions and industrial demand from 2025 to 2040.

Brazil's Serra Verde and Amazon mines, rich in heavy rare earths like dysprosium, could supply up to 13% of global demand by 2040, the report said — although that estimate could be affected by looming clashes with indigenous groups and environmental regulations.

In Australia, the Mount Weld area – famous for its 99% purity neodymium deposits – and the Olympic Dam mines, which produce copper and uranium as by-products, are building refining networks in joint ventures with the US to bypass China.

Quang Anh (according to CAS, SCMP)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Explore the Great Wall of Water in the Suburbs of Beijing, China](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/5/c2e706533d824a329167c84669e581a0)

![[Photo] General Secretary To Lam receives leaders of typical Azerbaijani businesses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/998af6f177a044b4be0bfbc4858c7fd9)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)