This morning, May 25, under the chairmanship of National Assembly Chairman Tran Thanh Man , the National Assembly discussed in the hall the Report of the Supervisory Delegation and the draft Resolution of the National Assembly on the results of the thematic supervision of "the implementation of Resolution No. 43/2022/QH15 of the National Assembly on fiscal and monetary policies to support the socio-economic recovery and development program and the Resolutions of the National Assembly on a number of important national projects until the end of 2023".

Participating in the discussion, delegate Ha Sy Dong, member of the National Assembly's Finance and Budget Committee and Permanent Vice Chairman of the Quang Tri Provincial People's Committee, said that the macroeconomic policy to respond to COVID-19 is unprecedented and beyond economic research.

The general formula for macroeconomic policy is to loosen fiscal and monetary policies when the economy is in recession, and tighten them when inflation is high. When COVID struck, economic activity declined, unemployment increased, and most countries followed the same formula, which is to loosen fiscal and monetary policies.

Delegate Ha Sy Dong speaks at the National Assembly - Photo - NL

However, the economic crisis caused by COVID-19 is different from a normal economic crisis. A normal crisis comes because people had high expectations a while ago, so they invested too much. When the investments did not meet expectations, they stopped investing.

This decline in investment leads to unemployment and a fall in household income. As income falls, consumption falls. Thus, investment falls, income falls, leading to a fall in consumption, and the vicious cycle continues.

The COVID-19 crisis stems from fear of the pandemic, lockdowns, and a decline in consumption. The decline in consumption reduces the revenue of businesses, which discourages investment, leading to job losses and reduced incomes. The vicious cycle is the same, but the starting point is different. The COVID-19 crisis stems from consumption, not investment.

This difference leads to some countries implementing incorrect fiscal and monetary policies such as: lowering interest rates, increasing subsidies, reducing taxes during the COVID-19 period to stimulate spending, but due to the epidemic, people cannot spend money, this idle money falls into securities, banks, insurance, real estate, bonds... As a result, the economy forms an asset bubble.

Vietnam is no exception when in the period of 2020 - 2022, VNIndex increased to a record high, money in banks also reached a record high, insurance grew rapidly (20% per year), real estate fever, corporate bonds also had bubbles. State budget revenue in these years was very stable, not because of good economic growth but mainly from taxes from securities and real estate transfers.

Regarding the National Assembly's issuance of Resolution No. 43 in early 2022 and its expected implementation in 2022-2023 with the goal of economic recovery after COVID-19, delegates commented that if there was only COVID-19, these policy packages would not be necessary, because in 2022 the economy at that time had excess capital, interest rates were very low, and the support packages did not have the effect of stimulating growth, but in addition to COVID-19, the economy in the 2022 and 2023 periods had other problems (war, global economic fluctuations, asset bubble bursting), so in the end this support package was somewhat effective.

Furthermore, it is the slow implementation of Resolution 43 that makes it effective. Because if it were strongly implemented in early 2022 when it was first issued, Resolution 43 would have added to the already expanding asset bubble.

According to delegates, due to the slow implementation of Resolution 43, when the bubble had passed its peak and was beginning to land, this resolution was effective in helping Vietnam make a soft landing, instead of a hard landing like many other countries.

At the same time, the failure of the 2% interest rate cut package (only 3.05% disbursed) is also a blessing. If this package works well, it will certainly be much more difficult for Vietnam to deal with inflation in 2022 (like the 2009 stimulus package that caused inflation in 2011).

Because of those factors, which are more fortunate than clever, Vietnam did not fall into high inflation like many developed countries such as the US and EU. Vietnam still has a fairly good growth rate. Although lower than the target of the National Assembly, it is still considered stable and Resolution 43 proposed reasonable solutions at that time. Later, the Government had many other management solutions that brought good results such as reducing gasoline tax when world gasoline prices increased, which was a good solution.

Regarding some lessons learned after implementing Resolution No. 43, delegates' opinions highlighted:

Policies should prioritize feasibility, the 2% interest rate reduction package cannot be implemented because it is not feasible, while the VAT reduction packages are highly effective because this measure is based on existing tax procedures. The VAT reduction package itself also has problems when classifying which goods are reduced by 8% and which goods are reduced by 10%, it would be better if the VAT package was reduced to 8% across the board.

The Government's management is quite flexible, proactively proposing other solutions to cope with the situation. Reducing fuel tax is an extremely practical solution when global fuel prices increase, and helps the economic recovery process go more smoothly.

Extending tax payment until the end of the year is also a very practical solution, because businesses are like getting a short-term loan with 0% interest. This is very effective for businesses when interest rates are high and bank loan procedures are difficult.

Regarding fiscal policy in the area of tax exemption, reduction and deferral, it has been highly effective because it is easy to implement. Policies in the area of spending money from the budget such as public investment and interest rate support have been less effective. Vietnam has encountered legal bottlenecks and tightened discipline in the apparatus, so public investment has not been able to fully exert its effect.

Regarding monetary policy, looking back at this point, there are many things that have been done and some things that still exist. However, at that time, the management can be considered a temporary success. In the long term, it is necessary to move towards using interest rate tools to manage credit rather than tools on credit growth limits (credit room) and it is recommended that the State Bank soon summarize and evaluate the credit room policy and move towards legalizing this issue.

Focus on feasibility and timing. Macroeconomic policy is important in choosing the right time. A policy that is right in January may not be right in March, when inflation and growth trends are different.

Therefore, if in the future, we have programs and packages to support the macro economy, we must carefully consider the timing of putting the policy into practice, as Resolution 43 has a 2-year implementation period, during which time many things will have changed. The economic crisis caused by COVID-19 is very different from other crises. If we encounter a situation that requires support policies, the first thing to think about is tax reduction.

It is even possible to consider large and extremely focused tax cuts on a very specific industry. For example, at the beginning of the end of social distancing, restoring flight routes, it is necessary to consider reducing aviation VAT to 0% or reducing airport fees and charges. This could help the aviation industry recover faster.

During the implementation of Resolution 43, delegates pointed out some limitations such as: the reduction of gasoline tax, the policy of reducing VAT by 2% which could have been adjusted to reduce for all items from 10% to 8% was too rigid depending on Resolution 43; the policy of deferring tax payment until the end of the year, many opinions suggested deferring for a few more months to next year, because this is the lean season for businesses. However, this issue is under the authority of the National Assembly. The Government is afraid of adjusting the budget estimate so it has not submitted it.

Nguyen Thi Ly

Source

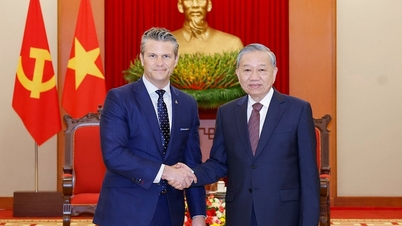

![[Photo] President Luong Cuong receives US Secretary of War Pete Hegseth](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/02/1762089839868_ndo_br_1-jpg.webp)

![[Photo] Lam Dong: Images of damage after a suspected lake burst in Tuy Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/02/1762078736805_8e7f5424f473782d2162-5118-jpg.webp)

Comment (0)