As we move past the first three quarters of 2024, the clearest sign of recovery is the market beginning to rebound with businesses continuously launching new projects. However, the market still faces many challenges in the fourth quarter.

|

| The real estate market in the South is expected to face many challenges in the fourth quarter. |

The market is starting to recover.

In the first eight months of 2024, the market showed significant signs of recovery compared to the 2022-2023 period, but this recovery was uneven across all segments.

Land plot segment

In the Ho Chi Minh City and surrounding areas market during the first eight months of 2024, the land plot segment recorded 14 projects launched (3 new projects, 11 projects in subsequent sales phases).

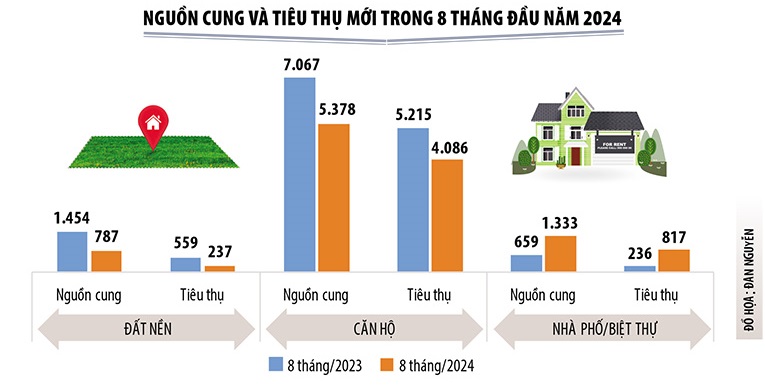

The supply to the market reached 787 products, a decrease of 46% compared to the same period in 2023 (1,454 plots).

The consumption rate of new supply reached approximately 30%, corresponding to 237 successful transactions, a decrease of 58% compared to the same period in 2023 (559 transactions).

Townhouse/Villa Segment

In August 2024, the townhouse and villa market in Ho Chi Minh City and its surrounding areas recorded 16 projects launched (3 new projects, 13 projects in subsequent sales phases).

The market supply reached 1,333 products, marking a twofold increase compared to the same period in 2023 (659 products).

The consumption rate of new supply reached 61%, corresponding to 817 products successfully transacted, a 3.5-fold increase compared to the same period in 2023.

|

Apartment segment

The apartment segment in Ho Chi Minh City and its surrounding areas recorded 30 projects launched in the first eight months, including 7 new projects, with the remainder being subsequent phases of previously launched projects.

New supply entering the market reached 5,378 units, a 24% decrease compared to the same period in 2023, mostly consisting of subsequent phases of projects, primarily concentrated in Ho Chi Minh City and Binh Duong .

The absorption rate reached 76% of the newly launched supply, with 4,086 successful transactions, a decrease of 22% compared to the same period last year.

Resort real estate

For the resort real estate segment, the market has not shown many signs of improvement in the short term. Although supply has increased in some segments (resort villas and condotels), consumption remains quite modest and is concentrated in only a few projects.

For the residential real estate segment, primary market selling prices have not fluctuated significantly compared to the beginning of the year. Secondary market liquidity shows signs of recovery, but this is largely concentrated in projects that have been handed over, have complete legal documentation, and are conveniently located near the city center. In the resort real estate segment, secondary market selling prices have fallen sharply, with many investors accepting losses of 20%, or even 30%, but liquidity remains very difficult.

Market challenges in Q4

Global economic growth in 2024 is projected to slow compared to 2023. The World Bank (WB) forecasts global economic growth in 2024 at 2.4%, the lowest in three consecutive years. The Organization for Economic Cooperation and Development (OECD) estimates global GDP growth in 2024 at 2.9%, lower than the 3.1% of 2023.

Regarding trade, the International Monetary Fund (IMF) projects world trade growth to reach 3.3% in 2024, lower than the average of 4.9% for the period 2000-2019. Increased trade tensions and geoeconomic fragmentation are expected to continue weighing on global trade growth in 2024, as countries imposed approximately 3,000 restrictions in 2023 (compared to 1,100 restrictions in 2019).

Meanwhile, by the end of 2023, total global debt reached $313 trillion, and the debt-to-GDP ratio was as high as 330%. This is a record high and alarming for the global economy.

Regarding the market, the supply-demand imbalance has been a persistent problem over the past decade. New supply is primarily in the high-end and luxury segments, lacking affordable housing and social housing to meet the real housing needs of the majority of the population. Furthermore, while market demand has increased, it remains low (both in the primary and secondary markets). Several factors have contributed to the slower-than-expected recovery of the real estate market, with the "wait-and-see" attitude of investors considered the main factor hindering the recovery process. This is clearly demonstrated by the fact that, despite low deposit interest rates, bank deposits in the first three months of the year reached a record high of 14 trillion VND.

Regarding legal policies, obstacles in project licensing continue to put pressure on businesses and the supply of new projects entering the market, particularly during the first three months of the year. Furthermore, significant progress has been made in resolving legal issues, especially for projects involving interspersed land. According to statistics, in Ho Chi Minh City alone, 126 projects are currently affected by legal and construction delays related to interspersed public land. Although this issue is regulated by Decree 148/2020/ND-CP and the current Land Law 2024, it has yet to be fully resolved. In addition, the calculation of land use fees remains problematic, accounting for 60-70% of legal project obstacles nationwide in recent times.

The Land Law, the Housing Law, and the Real Estate Business Law have been passed, but guiding circulars and decrees are still needed to ensure effective implementation in practice.

Regarding funding, many real estate businesses are facing difficulties, especially those with high bond debt. According to statistics, the amount of corporate bonds maturing in 2024 will reach over 300,000 billion VND, of which real estate bonds alone account for more than 130,000 billion VND.

This is a very large number given the current difficult liquidity situation in the real estate market. In addition, project legal procedures are stalled, and businesses are having difficulty accessing new loans from banks.

Market shifts

For the real estate market to recover, positive signals from the economy are indispensable. Accordingly, Vietnam's economic growth forecast for 2024 is 6-6.5%, striving to reach 7% as per Resolution No. 108/NQ-CP of the Government's regular meeting in June 2024 and the online Government-locality conference. This creates momentum for the economy in general and the real estate market in particular.

Furthermore, positive signals from import and export turnover are also noteworthy, with the total value of goods imported and exported nationwide in the first eight months of 2024 reaching US$511.11 billion, an increase of 16.7% compared to the same period in 2023. Of this, exports reached US$265.09 billion, imports US$246.02 billion, resulting in a trade surplus of US$19.07 billion. This created a trade surplus and increased foreign exchange reserves for the country.

Meanwhile, in the capital market, domestic lending interest rates, although showing a slight increase, remain low in line with the State Bank of Vietnam's guidelines.

From a market perspective, the recovery scenario for the real estate market can be observed more clearly in central city areas, existing new urban areas, densely populated areas with full amenities, or commercial real estate types that can generate rental income…

Observing the current market, transactions are primarily concentrated in affordable housing properties serving genuine housing needs, remaining high in major cities with convenient locations connecting to the city center, complete legal documentation, and clear construction progress. This is partly reflected in the outstanding transaction volume of B and C class apartments in Ho Chi Minh City and neighboring provinces, accounting for 62% of the total new supply consumed in the entire market during the first five months of this year.

This was achieved partly thanks to developers thoroughly implementing sales policies with many incentives beneficial to customers, flexible payment policies, support for grace periods on principal and interest payments from banks, opening day gifts, etc., in order to stimulate the market amidst the general difficulties.

Low demand is likely to persist until the end of this year. Accordingly, residential real estate in large, densely populated cities like Ho Chi Minh City and Hanoi will continue to attract market attention and spread to neighboring provinces. Within this segment, apartments will maintain their dominant position, leading both supply and consumption across the market. Land plots and townhouses/villas in existing, densely populated residential areas with integrated infrastructure are also expected to show promising signs in the coming period.

Although the tourism industry is showing positive signs, with 11.4 million international visitors in the first eight months of 2024, a 45.8% increase compared to the same period in 2023, the recovery of resort real estate has not been commensurate. These real estate segments will continue to face many challenges, with a slow recovery rate and little prospect of significant growth in the short term.

After undergoing an inevitable adjustment period from 2020 to early 2023, the real estate market has laid a solid foundation for sustainable long-term development. Accordingly, the market in the final months of 2024 is likely to continue showing some positive signs, but will still remain at a moderate level. More significant signs of improvement are expected to appear in mid-2025 - early 2026, when current outstanding issues are thoroughly resolved.

Source: https://baodautu.vn/batdongsan/bat-dong-san-phia-nam-su-dich-chuyen-cua-thi-truong-d225415.html

![[Photo] Reflections on "Building for Tet 2026" at the Sycamore High-Rise Project construction site.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2026/02/08/1770550642411_t4-jpg.webp)

Comment (0)