Depending on each company's business strategy, the items of prepayments from customers and unrealized revenue increase or decrease, but partly reflect the business's operating status in the past year.

Depending on each company's business strategy, the items of prepayments from customers and unrealized revenue increase or decrease, but partly reflect the business's operating status in the past year.

At the end of the fourth quarter of 2024 financial reporting season, many real estate businesses have had quite positive business results. In addition to recorded revenue and profit, the amount of prepayments from buyers or unrealized revenue of businesses is also colorful.

This is considered as “reserve” for the enterprise to record in revenue and profit after completing the product handover. At the same time, it also clearly reflects the business’s operating and sales status in the past year.

Leading in value in this category last year was still Vinhomes Joint Stock Company, with more than VND 46,300 billion, an increase of 32% compared to the end of 2023. Most of this amount came from progress payments from customers who signed real estate purchase contracts at projects of Vinhomes and its subsidiaries.

Vinhomes said that 2024 sales and unrecorded sales at the end of the fourth quarter of 2024 reached VND103,946 billion and VND94,182 billion, respectively, thanks to positive sales results at major projects, especially the Vinhomes Royal Island project.

Statistics from Vietcap Securities Company show that last year, Vinhomes and its subsidiaries were the units with the most project launches on the market. Currently, real estate brokers have begun to advertise and introduce the Wonder Park Project, 133 hectares (Hanoi) and Hau Nghia, 197 hectares ( Long An ), which are planned to launch in the first and second quarters of 2025. This preparation is consistent with the analysis team's expectation that Wonder Park and Hau Nghia will start selling in 2025, contributing 23% and 9%, respectively, to Vinhomes' 2025 sales contract value of VND83,000 billion.

Similarly, with Nam Long Investment Joint Stock Company, the amount of prepayments from buyers reached more than VND 3,000 billion, a decrease of nearly VND 800 billion compared to 2023. Nam Long said that in the fourth quarter of 2024, the company handed over many key projects such as Akari City (HCMC), projects in Can Tho , Southgate Project (Long An), Izumi Project (Dong Nai). Revenue from project handover reached VND 6,957 billion. Of which, revenue from Akari City accounted for the largest proportion, reaching 74%.

This year, Nam Long continues to develop residential real estate and commercial real estate in integrated urban area projects such as Waterpoint, Nam Long - Dai Phuoc, Izumi City, Nam Long - Can Tho... At the same time, it is preparing to expand to new potential markets in the North and invest in higher-end product segments, suitable for the needs of improving people's quality of life. The sales target is also higher than last year.

As for Khang Dien Housing Investment and Trading Joint Stock Company, the company's prepayments from buyers decreased by nearly VND500 billion, down to VND1,900 billion. Last year, Khang Phuc - a subsidiary of Khang Dien House, began handing over apartments to customers of The Privia Project (HCMC).

Khang Dien House Company also recorded more than VND 22,100 billion in inventory, mostly focused on large projects such as: Tan Tao Residential Area (VND 6,859 billion); Binh Trung Dong Project (VND 8,084 billion); Binh Hung Residential Area (VND 1,816 billion),...

Meanwhile, for No Va Real Estate Investment Group Joint Stock Company ( Novaland ), although the value of prepayments from buyers reached more than VND 18,900 billion, not much changed compared to the same period, it reflects that the business activities of the enterprise have not had much improvement in the past year.

Novaland said that in 2024, the progress of removing obstacles at the projects also achieved certain changes. Specifically, after the C4 subdivision planning is removed, it is expected that in July 2025, the project will complete the detailed planning 1/500 and sales licenses for subdivisions in accordance with the new planning. As for the NovaWorld Phan Thiet project, it is expected that in April 2024, decisions on land use fee payment will be completed, thereby continuing to implement construction activities, handover, and collection of product sales proceeds.

According to VisRating, in 2025, the creditworthiness of real estate businesses will continue to recover after a prolonged recession. This recovery is supported by a more favorable business environment, contributing to promoting new project development activities. New policies to remove legal barriers will accelerate project implementation this year.

Meanwhile, sales are expected to be boosted by investment demand and asset accumulation. Improved transport infrastructure will create a strong driving force, supporting housing projects, facilitating investors planning to launch projects.

Source: https://baodautu.vn/batdongsan/soi-cua-de-danh-cua-doanh-nghiep-dia-oc-d247470.html

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

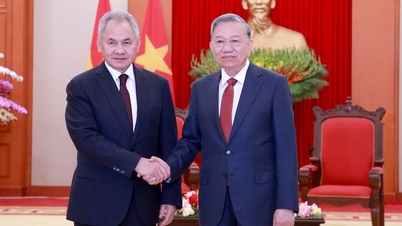

![[Photo] General Secretary To Lam works with the Standing Committees of the 14th Party Congress Subcommittees](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/09/1765265023554_image.jpeg)

Comment (0)