In late August, Singtel announced a partnership with Hitachi to develop data centers in Japan and possibly other Asian markets, leveraging the Japanese industrial giant's power and cooling technology.

The transaction is part of Singtel’s strategy to expand its Asian data center business following a restructuring last year that led to the creation of a new infrastructure division. Singtel has also partnered with Nvidia to deploy AI capabilities at the facilities, aiming to triple capacity to more than 200 megawatts in three years.

Singtel is also teaming up with global investors. In June, it announced a $1.3 billion investment in ST Telemedia Global Data Centres, a major Singaporean carrier, with private equity firm KKR.

The recent initiatives come after Singtel unveiled its “Singtel28” growth plan in May, which aims to improve financial performance over the next three years. It includes selling assets worth S$6 billion to fund new businesses, including costly data centers.

According to CEO Yuen Kuan Moon, they are seeing results from the tough decisions made over the past three years.

Over the past two decades, Singtel has grown to become Southeast Asia's largest carrier by investing in some of the region's leading players, including AIS (Thailand), Telkomsel (Indonesia), Globe Telecom (Philippines) and Bharti Airtel (India).

However, its core telecoms businesses in Singapore and Australia – which account for nearly 80% of total revenue – are starting to mature, forcing the company to pivot to new growth areas such as technology.

In the financial year ended March this year, Singtel's operating revenue in Singapore and Australia fell 2.4% and 5.8% respectively to S$3.89 billion and S$7.13 billion.

To improve operational efficiency, Singtel has simplified by merging its personal and business divisions at home and establishing a new infrastructure division – Digital InfraCo.

Carriers also divest from non-core assets and branches to invest in newer areas such as data centers and IT systems.

Singtel’s key growth drivers are showing results. Revenue from its data centre and other businesses reached S$413 million last financial year, the fastest growth (8%) among its units.

Revenue at its digital services division, NCS, rose 3.9% to S$2.83 billion, accounting for about 20% of total revenue and gradually narrowing the gap with the telecoms segment.

Not all of Singtel’s digital initiatives have been successful, however. In October 2023, the company announced the sale of its stake in Trustwave for $205 million after its cybersecurity unit posted a loss of $336 million in fiscal 2021. In 2022, it also sold its digital media and advertising unit, Amobee.

Da Baker, senior analyst at Morningstar, commented that Singtel's latest investments are at an early stage, and it is too early to say whether they can be successful in the long term.

(According to Nikkei)

Source: https://vietnamnet.vn/singtel-bien-cntt-trung-tam-du-lieu-thanh-tru-cot-tang-truong-2322708.html

![[Photo] Enjoy the Liuyang Fireworks Festival in Hunan, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761463428882_ndo_br_02-1-my-1-jpg.webp)

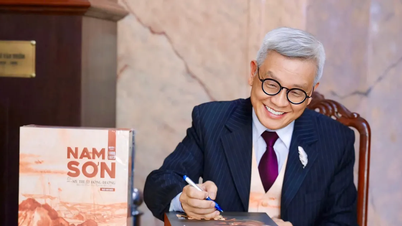

![[Photo] General Secretary To Lam received the delegation attending the international conference on Vietnam studies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761456527874_a1-bnd-5260-7947-jpg.webp)

![[Photo] Nhan Dan Newspaper displays and solicits comments on the Draft Documents of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761470328996_ndo_br_bao-long-171-8916-jpg.webp)

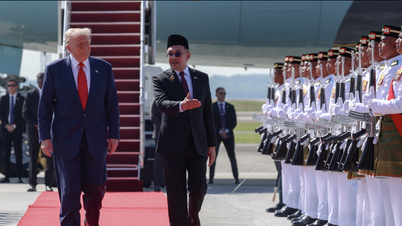

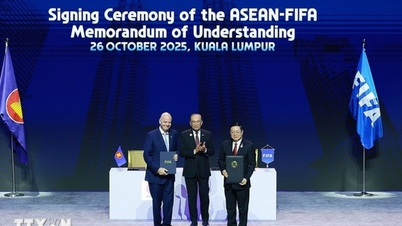

![[Photo] Prime Minister Pham Minh Chinh attends the opening of the 47th ASEAN Summit](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761452925332_c2a-jpg.webp)

Comment (0)