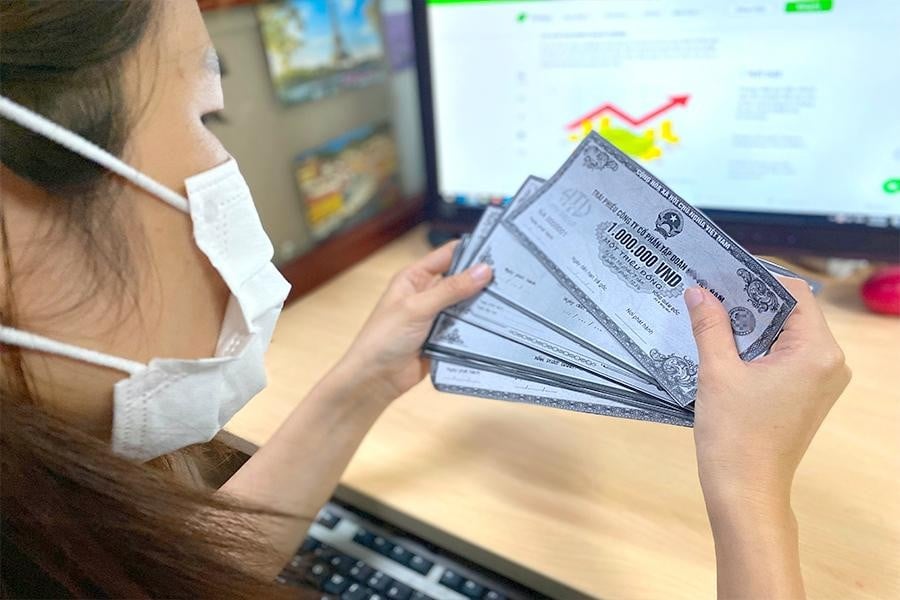

Concerns about tightening corporate bonds

The Ministry of Finance is seeking comments on the draft Law amending and supplementing a number of articles of the Securities Law; Accounting Law; Independent Audit Law; State Budget Law; Law on Management and Use of Public Assets; Tax Management Law; and Law on National Reserves.

In addition to legalizing stock manipulation with regulations restricting transactions with individual investors, to protect the market, the Draft Law on Securities (amended) also requires organizations issuing bonds to the public to have collateral or bank guarantees when applying for an issuance license (except in cases where credit institutions offer bonds as secondary debt that satisfy the conditions to be counted in tier 2 capital and have a representative of bondholders as prescribed).

With this regulation, in order to issue corporate bonds to the public, businesses must mortgage and register the bond security transaction before submitting the application for a license.

Lawyer Truong Thanh Duc, Director of ANVI Law Firm, affirmed that this contradicts the regulations on professional investors. Because, if there are collateral or bank guarantees when issuing bonds to the public, it is already very certain, minimizing risks for buyers, why is it necessary to set out conditions on professional investors?

Or adding regulations on conditions for professional securities investors is too strict, limiting the number of individual investors participating in this market.

Expressing agreement with lawyer Truong Thanh Duc's opinion, sharing with PV VietNamNet , lawyer Nguyen Duc Manh, Bizlink Law Firm LLC, also said: Lawmakers have not been able to explain why they have issued regulations requiring investors to participate in securities investment for a minimum period of 2 years, have a minimum transaction frequency of 10 times/quarter in the last 4 quarters, and have a minimum income of 1 billion VND/year in the last 2 years to be identified as professional securities investors.

"For example, in the past, stock investment had many risks, so investors were cautious and did not invest in many stock transactions, so they could not meet the above criteria, and therefore were not classified as professional stock investors. Thus, setting such criteria may not be really convincing and reasonable," Mr. Manh stated his opinion.

In addition, according to Mr. Manh, concerns about tightening corporate bond investment have caused the market to lack individual investors, not enough buyers, and as a result, businesses cannot successfully issue bonds to raise capital. This is an issue that lawmakers need to consider, and increasing the level/criteria for identifying professional investors also needs to have a roadmap in line with market development to both encourage market development and ensure market health and investor safety.

"But the important thing is to have scientific research and assessment to determine whether an investor is a professional, from which to come up with accurate and appropriate legal regulations," lawyer Manh noted.

Creating conditions for market development

Regarding the conditions for issuing corporate bonds to the public, the representative of the Vietnam Bond Market Association said that, in reality, enterprises with effective business operations and good financial status can make unsecured loans and issue unsecured bonds. The presence or absence of security belongs to the structure of the bond and is reflected in the issuance price, which is automatically balanced by the market based on supply and demand.

Therefore, according to this person, the regulation requiring bonds issued to the public to have collateral and bank guarantees will not solve the core problem of selecting and screening quality issuers to issue corporate bonds; at the same time, it will create a major barrier, directly reducing the supply of corporate bonds to the public, including bonds of leading enterprises, which can mobilize unsecured capital without guarantees.

The representative of the Vietnam Bond Market Association proposed that the drafting agency remove the regulation on the condition that bonds issued to the public must have collateral or payment guarantee; along with that, add regulations and instructions on organizations that can act as agents to receive and manage collateral for bonds with collateral and regulations allowing international financial institutions to participate in payment guarantee.

Speaking to VietNamNet reporter, legal expert Pham Van Hung said that in general, the draft tightens two knots related to corporate bonds. With the issuance of individual corporate bonds, the draft prohibits individual investors from participating in individual bond transactions. In addition, the draft raises conditions for institutional investors.

For bonds issued to the public, the draft tightens two conditions. First, the conditions for offering, the draft requires stricter conditions that must go to the General Meeting of Shareholders. Second , the draft requires collateral or bank guarantees. In addition, the draft also stipulates some additional responsibilities of the issuing consultancy organization, the auditing company, etc.

According to this expert, the drafting unit's thinking of amending the regulations on corporate bonds "is tightening both ends". Meanwhile, the capital market must ensure that businesses have a variety of options to mobilize capital in the market. Because if they cannot mobilize capital, businesses will face difficulties or cannot grow.

“When we feel that a certain market is risky for investors, we want to tighten it, but at the same time we have to untie another knot so that businesses can still mobilize capital through another channel, instead of tightening all the knots at the same time. That way, businesses will not know where to mobilize capital,” Mr. Hung noted.

Regarding the bond market, according to this expert, the rate of bonds issued to the public is very low compared to bonds issued individually. Because the conditions for issuing bonds to the public are too strict.

To ensure avoiding risks for investors, the State needs to have a transition roadmap, so that businesses have time to adapt.

This draft law should at least not impose strict conditions on public bond issuance, and there should be a roadmap to make public issuance conditions easier. Enterprises will have more channels to mobilize capital and investors will have more diverse financial products to invest in,” Mr. Hung suggested.

In addition, Mr. Hung recommended reconsidering the ban on individuals participating in the private bond market. It is true that the private bond market is not for the majority, those who participate need to have solid knowledge. Therefore, it is necessary to set conditions at a level suitable for professional investors to participate in this market. Once the conditions are set, there is no need to ban individual investors because they already have knowledge and accept that risk.

"At that time, if individual investors are banned, it will unintentionally reduce the diversification of financial products and push investors to put money into other riskier channels or channels that are not managed by the State," Mr. Pham Van Hung concluded.

Source: https://vietnamnet.vn/siet-manh-quy-dinh-dau-tu-trai-phieu-doanh-nghiep-thi-truong-cang-am-dam-2322461.html

Comment (0)